Find out more about our latest publications

Market Accessibility of Korean Capital Markets: Viewpoint of Foreign Institutions

Survey Papers 24-02 Jun. 28, 2024

- Research Topic Capital Markets

- Page 74

This paper introduces the perspective of foreign investors and intermediaries regarding the market accessibility of Korea’s capital markets. Korea’s capital markets, by quantitative measures, belongs alongside developed markets. However, in major market indices, mainly the MSCI stock market index and FTSE Russell bond market index, Korea is classified as an emerging market. The discrepancy between the quantitative and qualitative aspects of Korea’s capital markets comes from the market accessibility assessment, used by MSCI and FTSE Russell.

In both the MSCI and FTSE Russell market accessibility assessments, foreign financial institutions play an important role in providing feedback that is used as input for market classification. To better understand why Korea’s market accessibility is regarded as being below developed country standards, interviews were conducted with major financial firms that invest and intermediate investment in Korea. The group includes global asset managers, banks, custodians, boutique investment banks, hedge funds, market makers, system traders along with ASIFMA and GFMA. The results of the interview reveals that various issues related to market accessibility are interconnected. In particular, areas of market accessibility that Korea falls behind in are not just rules and regulation, but process and practice. Interview participants emphasize that in order to improve Korea’s market accessibility, rules and regulations need to be applied more transparently and consistently. In addition, the most effective measure suggested to enhance Korea’s market accessibility is to improve communication between Korea’s financial regulators and industry with the foreign investor community.

In both the MSCI and FTSE Russell market accessibility assessments, foreign financial institutions play an important role in providing feedback that is used as input for market classification. To better understand why Korea’s market accessibility is regarded as being below developed country standards, interviews were conducted with major financial firms that invest and intermediate investment in Korea. The group includes global asset managers, banks, custodians, boutique investment banks, hedge funds, market makers, system traders along with ASIFMA and GFMA. The results of the interview reveals that various issues related to market accessibility are interconnected. In particular, areas of market accessibility that Korea falls behind in are not just rules and regulation, but process and practice. Interview participants emphasize that in order to improve Korea’s market accessibility, rules and regulations need to be applied more transparently and consistently. In addition, the most effective measure suggested to enhance Korea’s market accessibility is to improve communication between Korea’s financial regulators and industry with the foreign investor community.

Ⅰ. 서론

한국 자본시장은 세계 상위권에 속하는 규모에 비해 걸맞지 않은 평가를 받고 있다. 2022년 기준 한국 주식시장 시가총액은 2.2조달러로 세계 11위, 상장기업 수는 2,318개로 세계 8위 자리를 차지하고 있다. 또한 2022년 한국 채권시장 발행잔액은 2.2조달러로 세계 11위 국가에 속하며, 아시아 지역에서는 중국, 일본 다음으로 큰 시장을 형성하고 있다. 그럼에도 불구하고 일부 글로벌 지수기관은 한국 자본시장을 신흥시장으로 분류하고 있다. 대표적으로 MSCI 및 FTSE Russell이 각각 한국 주식, 국채를 신흥시장지수에 포함하고 있다.

MSCI 및 FTSE Russell이 한국을 신흥시장으로 분류하는 이유는 시장접근성(market accessibility)에 있다. MSCI 및 FTSE Russell은 지수에 포함할 국가를 결정하기 위한 국가 분류 기준을 두고 있으며, 이는 양적 평가와 질적 평가로 구성되어 있다. 한국은 두 지수기관이 사용하는 양적 평가에서 선진시장 기준을 충분히 충족하고 있지만, 시장접근성으로 명칭되는 질적 평가에 있어서 선진시장 수준을 하회하고 있다. 따라서 한국 자본시장이 선진시장으로 분류되기 위해서는 MSCI 및 FTSE Russell이 정의하는 시장접근성의 제고가 필요하다.

한국 자본시장의 시장접근성을 논의하기에 앞서 MSCI 및 FTSE Russell이 말하는 선진시장이 무엇인지를 생각해볼 필요가 있다. 일반적으로 선진지장이라고 하면 시장의 발전도, 고도화, 성숙도 등 ‘선진성’을 의미하는 것으로 이해된다. 그러나 MSCI 및 FTSE Russell의 국가 분류 기준, 특히 시장접근성 기준은 기본적으로 외국인 투자자 및 해외 금융기관의 관점에서 특정 시장이 전체적 투자 과정의 편의성과 효율성을 갖추고 있는지를 평가하는 것이다. 이러한 부분들은 시장의 ‘선진성’과 일부 연계성을 지니고 있지만, 엄밀하게 보면 ‘선진성’과 일치하는 것은 아니다. 그럼에도 불구하고 한국 자본시장이 선진시장 지위를 확보하는 것은 중요하게 여겨지며, 한국 정부가 오랜 기간 추진해 온 정책과제에 포함된다. 우선 선진시장 격상은 상징적인 의미를 가지며, 대내외적으로 한국 자본시장의 위상을 높이는 계기가 될 수 있다. 나아가 MSCI 및 FTSE Russell의 선진시장지수 편입 시 이에 따른 경제적인 효과도 기대된다. MSCI 및 FTSE Russell 지수는 외국인의 글로벌 투자 포트폴리오 구성에 벤치마크로 활용되는 만큼 선진시장지수 편입은 한국 자본시장에 대한 투자 증가로 이어질 것으로 예상된다. 이와 더불어 선진시장지수 포함은 외국인 투자자 구성 측면에서도 긍정적 효과가 기대된다. 선진시장지수 편입으로 연기금, 국부펀드 등 장기투자 성향의 외국인 투자자 비중이 증가하면 시장 안정성도 높아질 수 있다.1)

실효성 있는 시장접근성 제고 방안을 마련하기 위해서는 해외 금융기관이 한국 자본시장을 바라보는 시각에 대한 이해가 필요하다. 그 이유는 MSCI 및 FTSE Russell이 특정 국가의 시장접근성을 자체적으로만 판단하는 것이 아니라 글로벌 자산운용사, 은행, 기관투자자 등 주요 해외 금융기관의 의견을 수렴하여 국가 분류 결정에 반영하기 때문이다. MSCI 및 FTSE Russell은 국가 분류 의사결정에 앞서 해당 시장에서 활동하는 해외 금융기관을 대상으로 설문조사 등을 실시하여 평가에 반영한다. 이는 시장접근성이 특정 국가의 제도나 규제만을 보는 것이 아니라 제도와 규제가 외국인 투자자 및 해외 금융회사의 입장에서 어떻게 작동하는지를 포괄적으로 검토하기 위한 것이다. 그러나 MSCI 및 FTSE Russell이 주기적으로 발간하는 자료만으로는 이러한 해외 금융기관의 시각을 파악하기 어렵다. 해당 자료는 해외 금융기관의 의견이 간략하게만 요약되고, 문제의 배경 등 자세한 내용이 생략되어 있기 때문이다.2)

본 보고서는 한국 자본시장의 시장접근성에 대한 해외 금융기관의 시각을 소개하는 데 목적을 두고 있다. 이를 위해 현재 한국 자본시장에 참여하고 있는 주요 해외 금융기관과의 인터뷰를 진행하였다. 인터뷰 대상은 글로벌 은행, 자산운용사, 커스터디은행, 증권회사, 시장조성자, 헤지펀드, 시스템트레이더 및 주요 금융협회 관계자를 포함한다. 인터뷰에 참여한 해외 금융기관 수는 15개, 참여 인원 수는 45명에 달한다. 유념할 점은 본 보고서의 목적이 해외 금융기관의 입장을 대변하거나 정당성을 부여하고자 하는 것이 아니라는 것이다. 해외 금융기관의 시각은 주관적인 측면이 있더라도 시장접근성 평가에 중요하게 작용하기 때문에 그 내용을 소개하고자 하는 것이다.

본 보고서의 구성은 다음과 같다. II장에서는 한국 자본시장의 양적 및 질적 위상을 살펴보며, 시장 규모 측면에서 한국 주식시장 및 채권시장의 위치와 MSCI 및 FTSE Russell의 국가 분류를 비교한다. III장에서는 한국 자본시장이 신흥시장으로 평가되는 이유를 MSCI 및 FTSE Russell의 시장접근성 기준 관점에서 살펴보며, 이와 함께 최근 정부가 발표한 시장접근성 개선 방안의 주요 내용을 정리한다. IV장에서는 인터뷰를 통해 파악된 한국 자본시장의 시장접근성에 대한 해외 금융기관의 시각을 소개한다. 이 장의 구성은 인터뷰 인용문 중심으로 구성되어 있다. 마지막으로 V장에서는 한국 자본시장의 시장접근성 제고 방안 마련에 고려해야 할 주요 사항을 제시한다.

II . 한국 자본시장의 위상

1. 한국 자본시장의 양적 위상

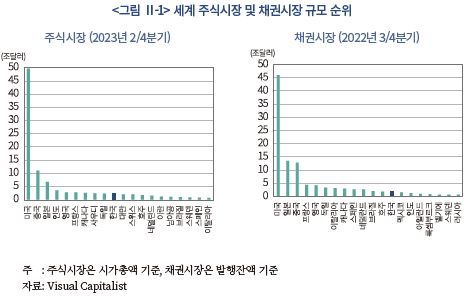

자본시장의 수준을 결정하는 절대적 기준은 없으나, 일반적으로 자본시장에 대한 평가는 양적 측면과 질적 측면을 함께 고려한다. 양적인 측면에서 한국 자본시장은 선진시장 반열에 포함될 충분한 자격을 지니고 있다.

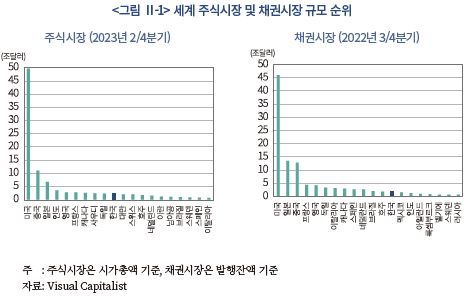

<그림 II-1>은 주식시장 및 채권시장 규모 상위 20개 국가 순위를 보여준다. 2023년 2/4분기 기준 한국 주식시장 시가총액은 2.2조달러로 세계 10위 국가 자리를 차지하며, 아시아에서는 중국, 일본 다음으로 큰 시장이다. 2022년 3/4분기 기준 한국 채권시장 발행잔액은 1.8조달러 수준으로 세계 13위 자리를 차지하며, 아시아에서는 일본, 중국, 호주 다음으로 큰 시장이다. 이와 더불어 한국 자본시장은 상장기업 수, 채권발행 기업 수, 주식 및 채권 거래량, 파생상품 시장 규모 등 다양한 양적 측면에서 세계 상위권에 속한다.

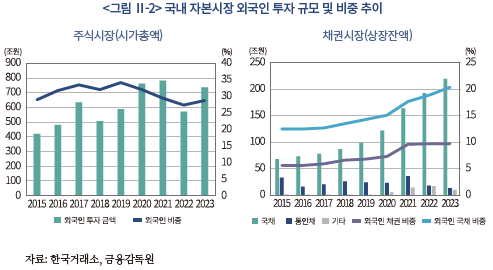

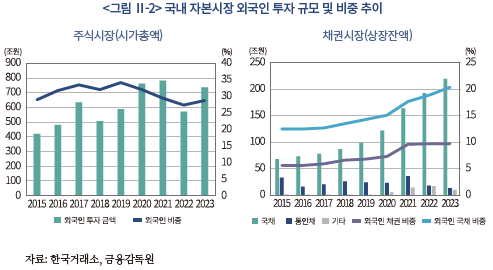

국내 주식 및 채권 시장의 외국인 투자 규모와 비중도 상당한 수준이다. <그림 II-2>는 2015년에서 2022년 사이 국내 주식시장 시가총액 기준 외국인 투자자 규모 및 비중 추이를 보여준다. 외국인 투자자의 국내 주식 투자금액은 2015년 420조원에서 2023년 737조원으로 증가하는 모습을 보인다. 시가총액 기준 국내 주식시장의 외국인 투자자 비중은 한때 40%에 달했으며, 최근에는 감소하는 모습을 보이지만, 2023년 기준 28.8% 수준으로 여전히 적지 않은 비중을 유지하고 있다.

2023년 상장잔액 기준 외국인 투자자의 국내 채권 보유 금액은 243조원에 달하며, 이는 국내 채권시장의 9.7% 수준이다. 외국인 투자자의 국내 채권 투자 상장잔액은 2015년 102조원에서 2023년 243조원으로 2배 이상 증가하였다. 외국인 투자자는 주로 국내 국채에 투자하며, 2023년 외국인의 국내 채권 보유금액은 국채 90.4%, 특수채 9.5% 및 회사채 0.1%로 구성되어 있다. 한국 국채의 외국인 투자자 비중은 상장잔액 기준 2015년 12.7%에서 2023년 20.4%로 증가하는 추세를 보이고 있다.

2. 한국 자본시장의 질적 위상

한국 자본시장은 규모적으로 세계 상위권에 속하지만, MSCI 및 FTSE Russell은 각각 한국 주식 및 채권 시장을 신흥시장으로 분류하고 있다. 다음으로는 MSCI 및 FTSE Russell의 국가 분류 현황을 살펴본다.

가. MSCI의 주식시장 분류

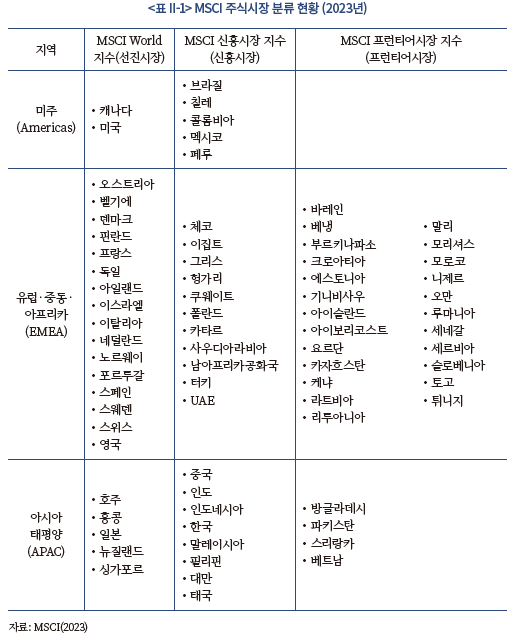

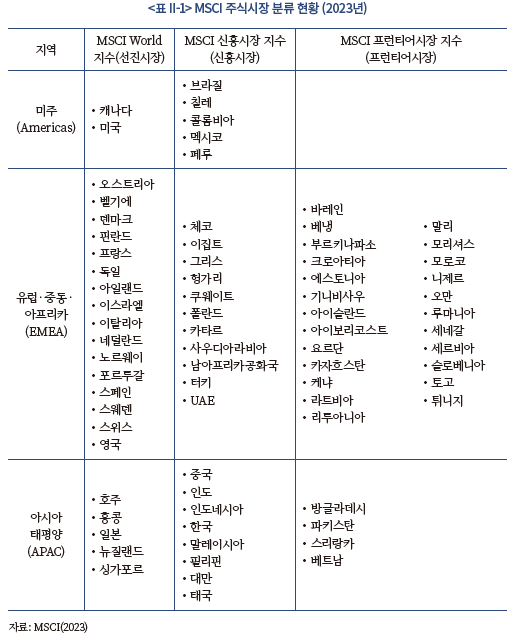

<표 II-1>은 2023년 현재 MSCI의 주식시장지수 국가 분류 현황을 보여준다. MSCI는 각국의 주식시장을 평가하여 선진시장, 신흥시장, 프런티어시장으로 분류하고, 이에 기반하여 선진시장지수(MSCI World Index), 신흥시장지수(MSCI Emerging Market Index), 프런티어시장지수(MSCI Frontier Market Index)에 포함한다. MSCI의 주식시장지수에 포함된 국가 수는 75개에 달하며, 이는 선진시장 23개, 신흥시장 24개, 프런티어시장 28개로 구성되어 있다.

2023년 현재 한국 주식시장은 MSCI에 따라 신흥시장으로 분류되며, 아시아 지역에서는 중국, 인도, 인도네시아, 말레이시아, 필리핀, 대만 및 태국이 같은 그룹에 속해있다. 앞서 살펴본 바와 같이 2023년 2/4분기 기준 한국 주식시장 시가총액은 세계 10위 자리를 차지하고 있으며, MSCI 주식시장 지수에 포함되는 75개 국가 중 65개 국가보다 규모가 크다. 한국 주식시장은 MSCI World Index에 포함된 23개 국가 중 14개 국가보다 높은 시가총액을 기록하고 있다. 또한, MSCI World Index의 아시아 지역 국가 중 일본을 제외한 나머지 5개 국가보다 한국의 시가총액이 높다.

나. FTSE Russell의 채권시장 분류

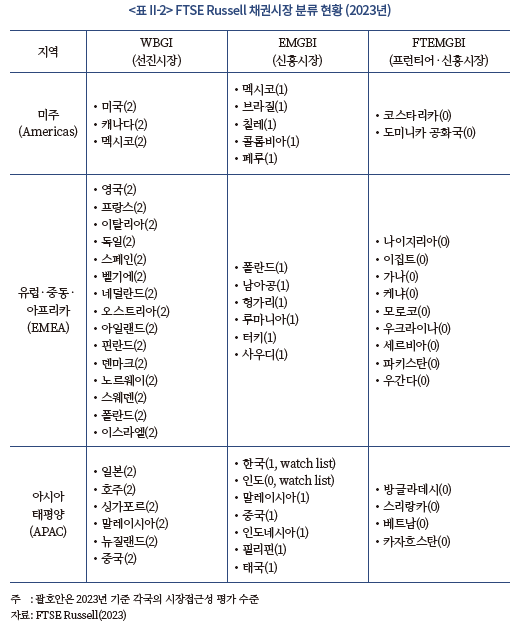

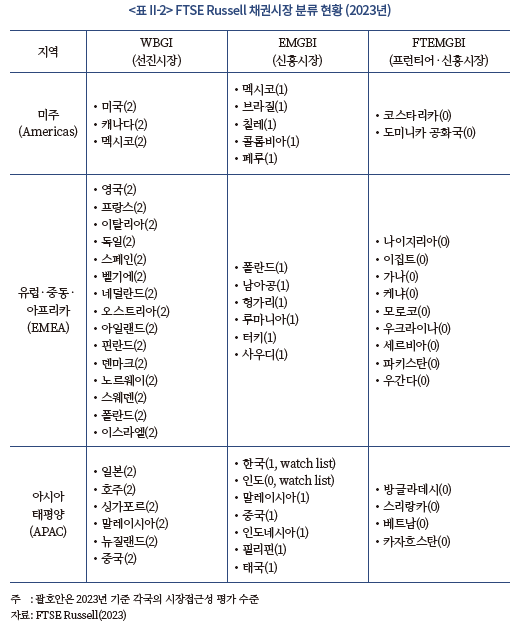

<표 II-2>는 2023년 현재 FTSE Russell의 국채지수 국가 분류 현황을 보여준다. FTSE Russell의 주요 국채지수에는 선진시장국채지수(World Government Bond Index: WGBI), 신흥시장국채지수(Emerging Market Government Bond Index: EMGBI) 및 프런티어신흥시장국채지수(Frontier Emerging Government Bond Index: FTEMGBI)가 있다. FTSE Russell의 국채지수에는 총 52개 국가가 포함되어 있으며, 이는 선진시장 24개, 신흥시장 18개, 프런티어신흥시장 15개 국가로 구성되어 있다. FTSE Russell의 국채지수는 포함하는 국가에 있어서 배타적이지 않기 때문에 하나의 국가가 복수의 지수에 포함될 수 있다. 중국, 말레이시아, 멕시코, 남아프리카 공화국 및 태국이 WGBI 및 EMGBI 지수에 동시 포함되어 있다. 이들 국가의 채권시장은 신흥시장의 성격을 지니면서 동시에 선진시장의 기준을 만족하는 ‘교차시장(crossover markets)’으로 정의되어 선진시장 및 신흥시장 국채지수에 동시 포함된다.

2023년 현재 한국 국채는 FTSE Russell의 신흥시장지수(EMGBI)에 포함되어 있으며, 아시아 지역에서는 중국, 말레이시아, 인도네시아, 필리핀, 인도 및 태국이 같은 그룹을 형성한다. 2023년 3/4분기 기준 한국 국채 발행잔액은 FTSE Russell 국채지수에 포함된 52개 국가 중 41개 국가, WGBI에 포함된 24개 국가 중 15개 국가보다 큰 수준이다. 또한, 한국 국채 발행잔액은 WGBI에 포함된 6개 아시아 국가 중 중국 및 일본을 제외한 4개 국가보다 큰 규모다. 2023년 3/4분기 기준 한국 국채 발행잔액은 WGBI에 포함된 호주의 1.6배, 인도네시아의 2.0배, 말레이시아의 3.5배, 싱가포르의 4.8배 수준이다.

앞서 살펴본 바와 같이 한국 자본시장의 양적 위상과 질적 위상은 불일치하는 측면이 있다. 한국은 경제적으로 선진국에 속하며, 한국 주식 및 채권 시장은 MSCI 및 FTSE Russell의 선진시장지수에 포함된 대부분 국가보다 큰 규모를 두고 있다. 그러나 MSCI 및 FTSE Russell은 질적 평가로 인해 한국 자본시장을 신흥시장으로 분류하고 있다. 특히 신흥국 경제로 분류되는 중국, 말레이시아, 멕시코, 남아프리카 공화국 및 태국의 국채가 WGBI에 포함되어 있다는 점에 비추어 볼 때 한국의 신흥시장 분류는 더욱 어울리지 않는 것으로 보인다.

III. 한국 자본시장의 시장접근성

1. MSCI 및 FTSE Russell 국가 분류 기준

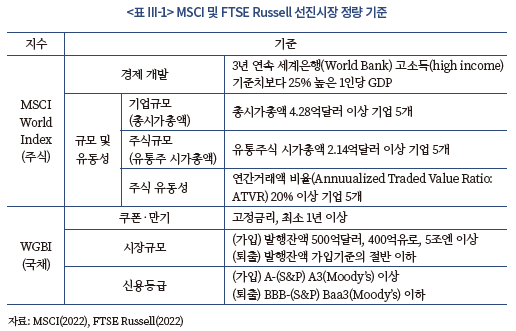

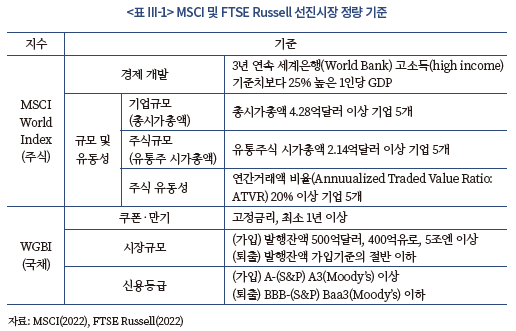

MSCI 및 FTSE Russell은 주요 지수에 포함될 국가를 결정하기 위한 국가 분류 기준을 두고 있다. 두 지수기관의 국가 분류 기준은 정량적 기준과 정성적 기준으로 구성되어 있으며, 정성적 기준은 시장접근성으로 명칭한다. <표 III-1>은 MSCI 및 FTSE Russell의 선진시장지수에 포함되기 위한 정량적 기준을 보여준다. 현재 한국 주식시장 및 국채시장은 두 지수기관의 정량적 기준을 모두 충족하고 있다.3)

정량적 기준의 충족에도 불구하고 한국 자본시장이 신흥시장으로 분류되는 이유는 MSCI 및 FTSE Russell의 정성적 기준인 시장접근성에 있어서 낮은 평가를 받고 있기 때문이다. 다음으로는 MSCI 및 FTSE Russell의 시장접근성 기준과 해당 기준에 따른 한국 자본시장의 평가를 살펴본다.

가. MSCI 주식시장 시장접근성 기준

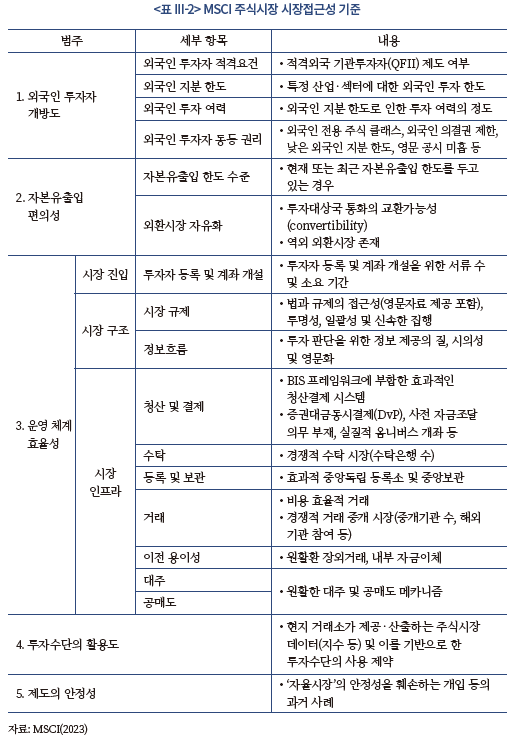

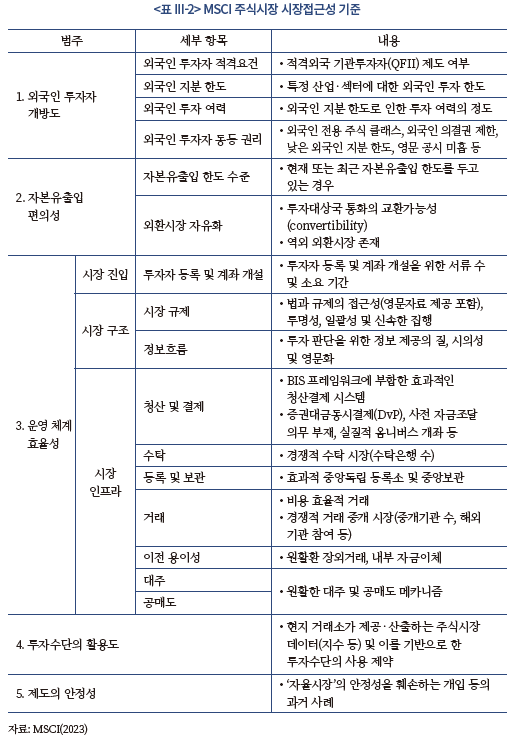

<표 III-2>는 MSCI가 사용하는 주식시장 시장접근성 기준을 보여준다. MSCI의 시장접근성 기준은 5개 범주 및 18개의 세부 항목으로 구성되어 있다. MSCI의 시장접근성 기준은 몇 가지 주요 특징을 지닌다. 첫째, 시장접근성은 기본적으로 외국인 투자자 관점에서의 평가다. 시장접근성의 일부 항목은 국내외 투자자 모두에게 적용되지만, 다수 항목은 외국인 투자자 전용 사항이다. 둘째, 시장접근성은 투자의 전체적 과정을 살펴보는 것이다. 여기에는 투자자 등록부터 청산결제까지 투자의 모든 단계를 포함한다. 셋째, 시장접근성은 정성적 평가라는 점이다. 시장접근성의 내용을 살펴보면 ‘효율성’, ‘투명성’, ‘일관성’, ‘시의성’ 등 주관적 판단의 여지가 상당히 많다.

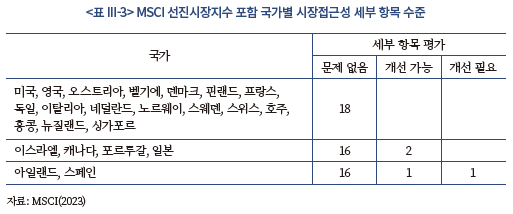

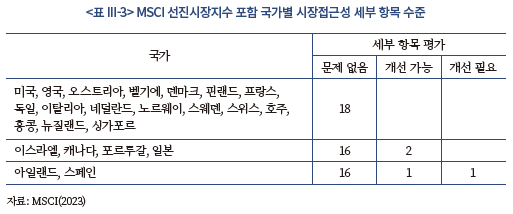

MSCI는 시장접근성의 18개 세부 항목에 대해 ‘문제 없음(++)’, ‘개선 가능(+)’, ‘개선 필요(-)’의 3개 등급 중 하나를 부여한다. MSCI는 선진시장지수에 포함되기 위한 구체적 기준은 제공하지 않지만, 현재 MSCI 선진시장지수에 포함된 국가의 세부 항목별 평가를 통해 그 기준을 유추해볼 수 있다. <표 III-3>은 2023년 현재 MSCI의 선진시장지수에 포함된 국가의 시장접근성 세부 항목별 평가 수준을 보여준다. MSCI 선진시장지수 포함 23개 국가 중 17개 국가는 모든 세부 항목에 ‘문제 없음’ 등급을 받고 있다. 이스라엘, 캐나다, 포르투갈 및 일본은 각각 2개의 ‘개선 가능’, 아일랜드 및 스페인은 1개의 ‘개선 가능’과 1개의 ‘개선 필요’ 세부 항목 등급을 받고 있다. 이러한 점들에 비추어 볼 때, MSCI의 선진시장지수에 포함되기 위해서는 시장접근성 세부 항목 평가에서 ‘문제 없음’ 이하의 등급은 2개 미만이어야 하는 것으로 추정된다.

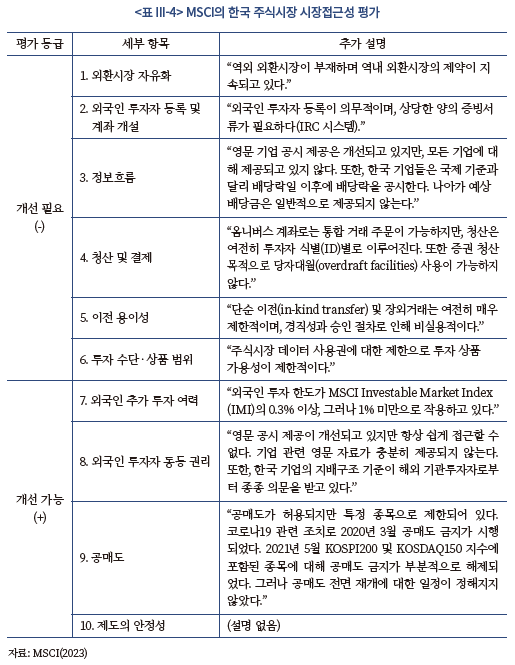

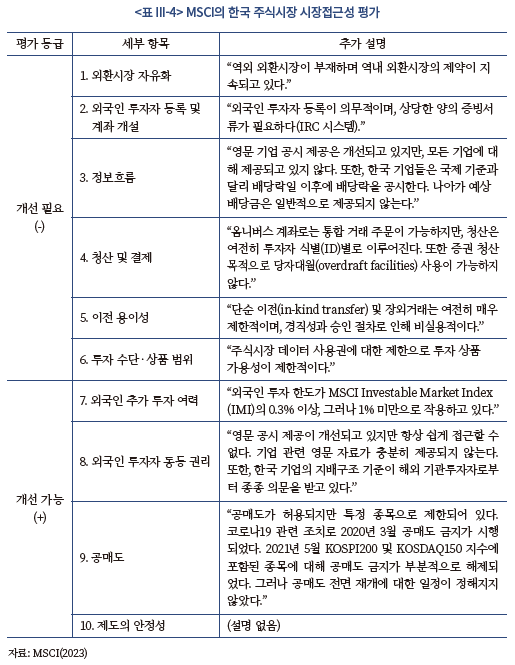

MSCI는 현재 한국 주식시장의 시장접근성 평가에 있어서 10개 세부 항목에 ‘문제 없음’ 이하 등급을 부여하고 있다. 이는 6개의 ‘개선 필요’와 4개의 ‘개선 가능’으로 구분된다. <표 III-4>는 MSCI가 지적하는 한국 주식시장의 주요 개선 사항을 보여준다.

다음은 한국 주식시장에 대해 MSCI가 지적하는 주요 개선 사항을 살펴본다.

1) 외환시장 자유화

MSCI가 한국 외환시장에 대해 지적하는 사항은 역외 외환시장의 부재와 역내 외환시장의 제약이다. 이와 관련하여 MSCI가 추가적인 설명을 제공하지는 않지만, 주요 문제점은 다음으로 파악된다. 첫째, 역외 외환시장의 부재는 외국인의 한국 주식투자를 위한 자금조달 및 환율 리스크관리를 어렵게 만든다. 이 부분은 외국인의 국내 채권 투자에도 동일하게 적용되는 사항이다.4) 원화 역외 외환거래시장은 차액결제선물환(Non-deliverable Forward: NDF) 시장이며, NDF 시장의 경우 환율 헤지의 기능을 일부 제공하지만, 증권 투자나 결제를 위한 자금조달의 수단으로 기능하기는 어렵다.5) 따라서 외국인은 투자 및 결제 자금조달을 위해 역내 외환시장을 활용해야 한다.

역내 외환시장의 경우 MSCI가 구체적으로 언급하지는 않으나, 외환거래 시간의 제약과 외환거래시장의 경쟁도를 문제 삼고 있는 것으로 파악된다. 우선 역내 외환거래 시간은 증시 마감과 겹쳐서 외국인 투자자는 결제 자금을 전날 또는 익일 조달해야 하며, 이로 인해 환율 변동의 오버나이트(overnight) 리스크를 부담해야 한다. 또한, 역내 외환거래시장은 외환당국으로부터 외국환은행 허가를 받은 국내 금융기관만 참여할 수 있는 규제를 두고 있다. 이로 인해 외국인 투자자의 관점에서는 원화 거래 선택지가 제한되고 환전 비용이 증가한다.

2) 외국인 투자자 등록 및 개좌 개설

MSCI는 외국인 투자자 등록 및 계좌 개설에는 ‘상당한(significant)’ 양의 증빙서류와 기간이 소요되는 점을 개선이 필요한 사항으로 지적한다. 외국인 투자자는 한국 상장증권에 투자하기에 앞서 금융감독원에 외국인 투자자로 등록하고 승인을 받도록 되어 있다. 금융감독원의 승인을 받은 외국인 투자자에게는 외국인투자등록증(Investment Registration Certificate: IRC)이 부여되고 계좌 관리는 IRC 단위로 이루어진다. 우선 이러한 외국인 투자자 등록 의무화는 선진시장에는 없는 제도로, 이에 수반되는 비용과 절차가 문제점으로 추정된다. 이와 더불어 IRC 발급 및 계좌 개설을 위한 증빙서류, 기간 등 절차적인 부분이 선진시장에 비해 과도하다고 평가하는 것으로 해석할 수 있다.

3) 정보흐름 및 외국인 투자자 동등 권리

MSCI는 ‘정보흐름’ 세부 항목에서 한국 기업의 영문 공시 부족 및 배당절차를 문제점으로 지적한다. 영문 공시를 제공하는 기업 수와 공시의 범위가 늘어나고 있지만, 선진시장에 비해서는 여전히 부족한 것으로 평가하는 것으로 볼 수 있다. 기업 영문 공시 부족은 시장접근성의 ‘외국인 투자자 동등 권리’ 세부 항목에서도 지적되는 사항이다. 이는 기업 영문 공시가 외국인 투자자 입장에서 정보 제공의 측면과 더불어 외국인에 대한 차별로 보고 있음을 시사한다. 국내 기업 배당절차와 관련해서는 선진시장의 표준과 달리 국내에서는 배당기준일 이후 배당금이 공시되며, 예상 배당금 정보가 미제공되는 부분을 문제점으로 삼고 있는 것으로 파악된다. 또한, 외국인 투자자 동등 권리와 관련해서 MSCI는 국내 기업의 지배구조가 해외 기관투자자로부터 “종종 의문을 받고 있다(often questioned)”라고 설명하지만, 구체적으로 지배구조와 관련된 어떠한 부분들이 주요 문제점인지는 언급하지 않는다.

4) 청산 및 결제

청산결제에 대한 MSCI의 지적 사항은 외국인 통합계좌, 즉 옴니버스 계좌(omnibus account)와 관련되어 있다. 옴니버스 계좌는 여러 고객의 자산을 하나의 계좌로 통합하여 관리하는 수단으로, 금융기관은 중개인으로서 다수의 고객을 대신하여 증권을 보유하고 거래할 수 있다. 한국 정부는 2017년 외국인의 국내 증권 투자 편의성을 제고하기 위해 옴니버스 계좌 제도를 도입했다. 그러나 한국의 옴니버스 계좌는 일괄 매매주문이 가능하지만, 청산결제에 있어서는 통합계좌의 이점을 가지지 못한다. 이는 옴니버스 계좌를 사용하는 경우에도 최종투자자 단위로 거래내역을 결제 후 즉시(T+2) 금융감독원(Financial Investment Integrated System: FIMS)에 의무적으로 보고해야 하는 규정을 두었기 때문이다. 이러한 보고의무는 시세조작, 불법거래 등을 방지하기 위한 목적을 두고 있지만, 외국인 투자자의 입장에서는 옴니버스 계좌의 실효성을 떨어트리는 부작용을 지니며 이로 인해 한국의 옴니버스 계좌를 사용하는 해외 금융회사가 없는 상황이다. MSCI의 청산결제 관련 또 다른 지적 사항은 증권거래의 결제를 위한 원화차입기구(overdraft facility)의 부재다. 현재 국내 외환법규는 위기 시 외국인의 원화 투매 방지를 위해 원화 차입을 원칙적으로 금지하고 있다.

5) 공매도

MSCI는 한국의 공매도 재개 일정 불확실성을 시장접근성 문제로 지적한다. 한국 금융당국은 코로나19 위기 당시 2020년 3월 공매도를 한시적으로 금지하였다가 2021년 5월 코스피200 및 코스닥150 종목에 한해서 공매도를 재개하였다. MSCI는 공매도 전면 재개에 대한 일정이 공개되지 않고 있는 점을 문제로 지적하고 있다.6)

6) 제도의 안정성

MSCI는 한국 ‘제도의 안정성’을 개선 가능 수준으로 평가하고 있으나 이와 관련해서는 별도의 설명을 제공하지 않는다. 제도의 안정성에 대한 MSCI의 일반적인 설명은 “정부 개입의 실적과 현재의 외국인 투자 제한 수준”이다. MSCI는 정부 개입은 주로 과거 이력에 초점을 두고 있으며, 특히 위기 상황 시 외국인 투자자에 대한 차별 가능성을 염두에 두고 있다고 설명한다. 단정하기 어렵지만, 과거 한국의 공매도 금지 사례 등이 지적되는 것으로 추정해볼 수 있다.

7) 기타 시장접근성 개선 사항

MSCI는 앞서 소개된 내용 외에 추가적인 시장접근성 개선 사항을 지적한다. 첫째, 외국인 투자자가 활용할 수 있는 단순 이전(in-kind transfer) 및 장외거래가 제한적인 점이 문제로 제기된다. 국내에서 외국인 투자자의 상장증권 거래는 장내거래를 원칙으로 하고 있으며, 장외거래의 경우 금융감독원의 사전심사가 필요하다. 둘째, 주식시장 데이터 사용권에 대한 제한이 투자 수단 및 상품 범위를 제한한다고 주장한다. 해당 사항은 한국거래소가 산출하는 코스피200 등 지수사용권 제한과 관련된 것으로 파악된다.7) 셋째, 외국인 추가 투자 여력이 언급된다. 한국은 여타 국가와 마찬가지로 경제적, 안보적 보호를 위해 방송, 통신, 항공, 금융, 에너지 등 특정 산업에 속하는 일부 기업에 대한 외국인 투자자 지분한도를 두고 있다. MSCI는 외국인의 투자가능 지수(Investable Market Index: IMI)에 있어서 외국인 지분한도로 인해 포트폴리오의 1.0% 이상이 영향을 받을 경우 문제점으로 본다.

나. FTSE Russell 채권시장 시장접근성 기준

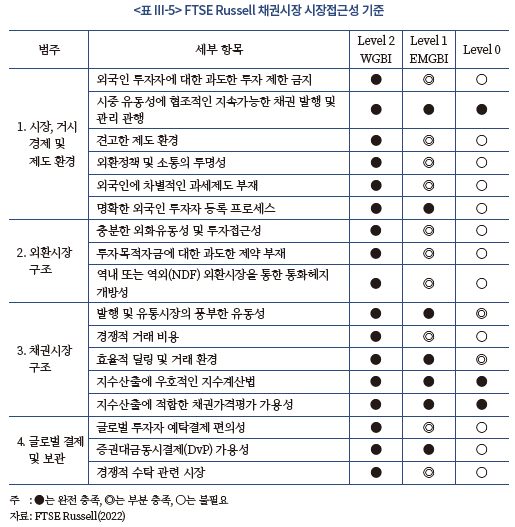

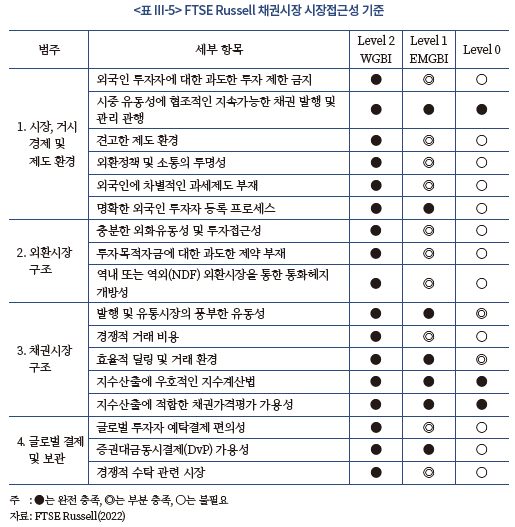

<표 III-5>는 FTSE Russell의 채권시장 시장접근성 기준을 보여준다. FTSE Russell의 채권시장 시장접근성 기준은 5개의 범주와 17개의 세부 항목으로 구성되어 있다. FTSE Russell은 시장접근성의 17개 세부 항목을 평가하여 종합적으로 개별 시장에 대해 Level 2(선진시장), Level 1(신흥시장), Level 0(프런티어시장)의 3개 등급을 부여한다. <표 III-5>는 채권시장 시장접근성에 대한 전반적인 기준이며, 국채시장에만 국한되지 않는다.

<표 III-5>에서 볼 수 있듯이, Level 2 등급을 받기 위해서는 17개 세부 항목 전체에 있어서 ‘완전 충족’ 수준의 평가를 받아야 한다. 개별 국가 국채가 WGBI에 포함되기 위해서는 정량적 기준을 충족하고 정성적 기준인 시장접근성 평가에서 Level 2 등급을 받아야 하며, 이와 더불어 IMF 또는 World Bank에 의해 신흥국 또는 선진국으로 분류되어야 한다. 경제개발 수준이 신흥국으로 평가되는 국가인 경우에도 국채가 WGBI에 포함될 수 있으며, 2023년 현재 중국 및 말레이시아가 그 경우에 속한다.8)

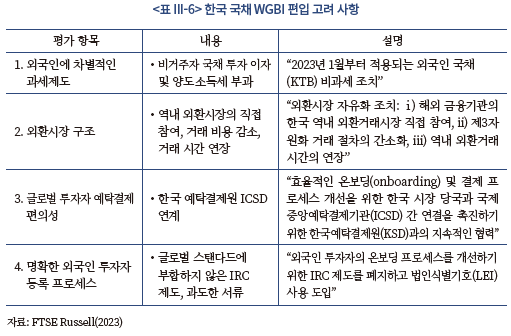

2023년 현재 한국은 IMF 및 World Bank에 의해 선진국으로 분류되지만, 채권시장은 FTSE Russell의 시장접근성 기준에 따라 Level 1 등급을 부여받고 있어서 신흥시장으로 분류된다. FTSE Russell은 국가 분류 조정 대상의 경우 ‘관찰대상국(watch-list)’으로 지정하며, 한국은 2022년 9월부터 WGBI 편입 대상인 관찰대상국에 포함되어 있다.

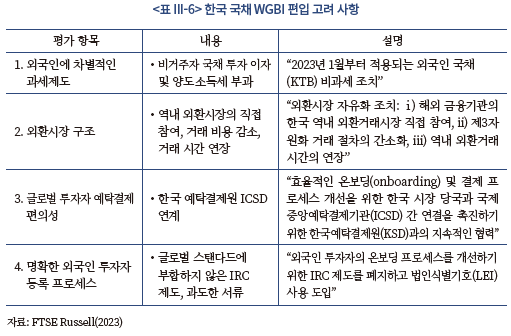

FTSE Russell은 개별 국가의 시장접근성에 대해 종합적인 등급만 제공하고, 세부 항목별 등급은 공개하지 않는다. 다만, 관찰대상국에 올라와 있는 국가에 대해서는 격상 여부를 위해 고려하는 주요 사항을 설명해준다. <표 III-6>은 FTSE Russell이 한국 국채의 WGBI 편입을 위해 주시하고 있는 주요 사항을 보여준다.

FTSE Russell이 한국 국채의 WGBI 편입을 위해 검토하고 있는 사항은 4개가 있으며, 이중 ‘외환시장 구조’ 및 ‘명확한 외국인 투자자 등록 프로세스(IRC 제도)’는 앞선 MSCI의 한국 주식시장 개선 사항과 내용이 동일하다. 나머지 2개 사항의 내용은 다음과 같다.

1) 외국인 차별적 과세제도

FTSE Russell은 주요 선진시장의 표준으로 자리 잡고 있는 외국인 국채 투자 비과세를 WGBI 편입의 명시적 조건으로 제시하고 있다.9) 한국의 경우 2009년 비거주자 채권 투자에 대한 비과세 조치를 시행한 후 WGBI 관찰대상국으로 지정되었으나, 2011년 1월 비과세 조치를 철회하였고 관찰대상국에서 제외되었다. 2022년 3분기 한국 정부는 외국인 국채 투자 비과세 세법개정안을 국회에 제출하였고, 2022년 12월 30일 국무회의에서 의결되어 2023년 1월 1일부터 적용되었다. 이에 따라 ‘외국인에 대한 차별적 과세 제도’ 이슈는 해소된 것으로 볼 수 있으며, FTSE Russell은 이러한 한국 정부의 시장접근성 개선 노력을 한국 국채의 WGBI 편입 의사결정에 고려할 것으로 설명하고 있다.

2) 글로벌 투자자 예탁결제 편의성

FTSE Russell은 외국인 투자자의 가입(onboarding) 절차의 효율화를 위해 국제예탁결제기구(International Central Securities Depository: ICSD) 연계를 요구한다.10) ICSD는 외국인 투자자들이 단일 플랫폼을 통해 여러 국가의 국채를 매입하고 보유할 수 있게 하여 투자과정의 편의성과 효율성을 높여준다. ICSD를 사용하는 경우 각 국가에 별도로 계좌를 개설할 필요가 없어진다. 주요 ICSD로는 유로클리어(Euroclear)와 클리어스트림(Clearstream)이 있다. 최근 정부는 외국인 국채 투자의 비과세, 외국인 투자자 등록 의무 폐지, 적격외국금융기관(Qualified Foreign Intermediary: QFI) 도입 등 ICSD 연계를 위한 여러 가지 방안들을 발표했다. 이에 따라 2023년 한국예탁결제원은 유로클리어와 ICSD 구축을 위한 계약을 체결하고, 2024년 6월부터 시스템이 운영될 계획이다. FTSE Russell은 이와 같은 ICSD 연계 추진 상황을 주시하고 한국 국채의 WGBI 편입 결정에 이를 고려할 것으로 설명한다.

2. 최근 정부의 시장접근성 개선 방안

가. 시장접근성 개선 방안의 주요 내용

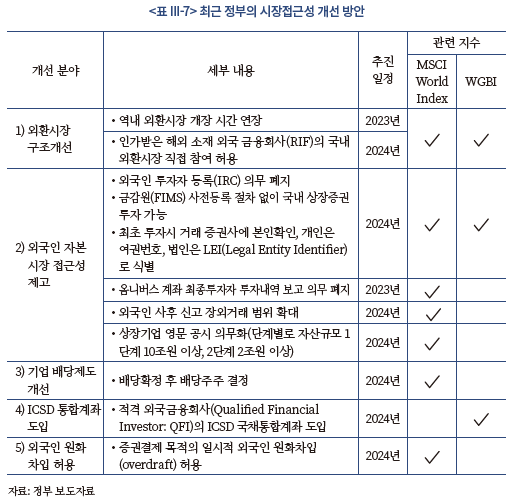

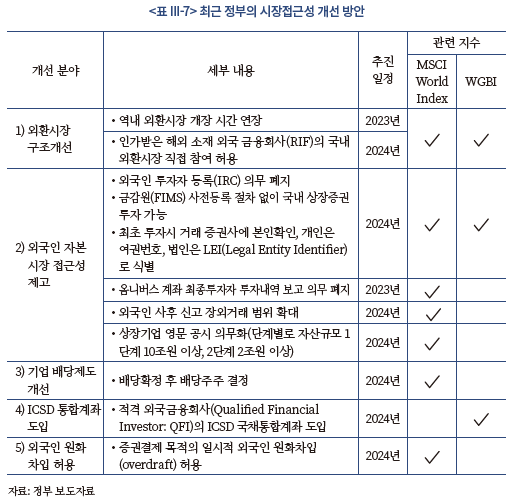

한국 자본시장의 선진시장 격상은 정부11)가 오랜 기간 추진해온 정책과제에 속한다. 2023년에 들어 정부는 MSCI 및 FTSE Russell의 다수 지적 사항에 대응하는 시장접근성 개선 방안을 발표했다. <표 III-7>은 최근 정부가 발표한 주요 시장접근성 개선 방안 및 추진 일정을 보여준다. 발표된 개선 방안은 MSCI 및 FTSE Russell 시장접근성에 공통적으로 적용되는 사항과 개별적으로 적용되는 사항을 포함한다. 일부 개선 방안은 2023년에 이미 시행되었으며, 대부분의 개선 방안은 2024년부터 본격적으로 추진하는 일정을 두고 있다.

다음으로는 정부의 시장접근성 개선 방안의 주요 내용을 살펴본다.

1) 외환시장 구조개선

2023년 2월 정부는 ‘글로벌 수준의 시장접근성 제고를 위한 외환시장 구조 개선방안’을 발표했다.12) 외환시장 구조개선에는 3가지 방안들이 포함되어 있다. 첫째, 역내 외환시장의 개장시간 연장이다. 앞선 MSCI의 ‘개선 필요’ 사항에서 살펴봤듯이, 한국 역내 외환시장 개장시간은 증시와 동시에 마감되어 외국인 투자자의 여러 불편함과 오버나이트 리스크의 원인으로 작용해왔다. 금번 개선 방안은 역내 외환거래 마감을 익일 2시까지 대폭 연장하며, 시범운영 기간을 거쳐 2023년 7월부터 정식 적용하는 것으로 발표되었다. 둘째, 인가받은 해외 소재 금융회사(Registered Foreign Institution: RFI)의 역내 외환시장 직접 참여 허용이다. RFI의 외환 취급 범위는 현물환과 더불어 FX 스왑거래도 포함한다. RFI의 역내 외환시장 참여를 통해 외환거래시장 경쟁도가 높아지고 비용 절감과 더불어 상품 및 서비스의 향상이 기대된다. 셋째, 외환거래 업무의 전자거래 고도화다. 여기에는 국내 외국환중개회사 API(Application Programming Interface)를 RFI에게도 제공하고, 전자중개업무(aggregator) 제도를 도입하는 계획이 포함되어 있다. 이러한 시장 인프라 개선 방안들은 외환거래 업무의 편의성과 비용을 낮춰주는 효과를 가져올 것으로 기대된다.

2) 외국인 자본시장 접근성 제고

2023년 1월 정부는 ‘외국인 투자자의 자본시장 접근성 제고방안’을 발표했다.13) 해당 개선 방안에는 4가지 주요 내용이 포함되어 있다. 첫째, 외국인 투자자 등록 의무의 폐지다. 개선 방안에는 IRC를 폐지하고, 금융당국의 등록 의무 없이 외국인 투자자가 거래 증권사에 개인의 경우 여권번호, 법인의 경우 Legal Entity Identifier(LEI)를 부여받고 계좌를 관리할 수 있게 되었다. 다만, 기존에 IRC를 부여받은 투자자는 이를 계속 사용해야 하며, LEI를 새롭게 부여받을 수 없다.

둘째, 외국인 통합계좌, 즉 옴니버스 계좌의 활용도를 높이는 방안이 포함된다. 기존 외국인 투자자 거래내역의 실시간 보고의무를 폐지하고, 대신 국세청이나 금융당국이 필요시 요청하면 최종투자자별로 거래내역을 보고하는 방식으로 완화되었다.

셋째, 외국인 장외거래 범위를 확대하는 내용이 포함되어 있다. 기존 제도하에서는 외국인의 상장증권 거래는 원칙적으로 장내시장에서만 가능하며, 사전심사 후 승인받은 예외적인 경우에만 장외거래가 허용되었다. 발표된 개선 방안에는 사후신고가 가능한 장외거래 범위를 확대하고 신고 부담도 완화하는 조치를 포함하고 있다.

넷째, 상장기업 영문 공시 제공의 활성화 내용이 담겨 있다. 기업 영문 공시 활성화는 2단계로 나누어 추진되며, 우선 1단계는 2024년부터 자산규모 10조원 이상 또는 외국인 지분율 30% 이상의 코스피 상장사가 대상이다. 2단계는 2026년부터 자산규모 2조원 이상 코스피 상장사로 확대된다.

3) 기업 배당제도 개선

2023년 1월 정부는 ‘글로벌 스탠더드에 부합하는 배당절차 개선방안’을 발표했다. 국내 기업의 배당절차가 글로벌 스탠더드에 부합하지 않다는 지적은 MSCI의 개선 필요 사항에 포함된다. 현재 국내 기업들의 배당제도는 일반적으로 연말에 배당받을 주주를 먼저 확정하고, 이후 주주총회에서 배당금을 확정하고 있으며, 이는 선진시장과 비교해 순서가 뒤바뀌어져 있다. 발표된 제도 개선 방안은 배당액을 선 결정하고, 이후 배당기준일 주주를 확정하는 절차를 도입한다. 다만, 배당절차의 개선은 의무적인 것은 아니며, 기업이 자발적으로 시행할 수 있도록 금융당국이 유권해석을 제공하는 것이다.

4) ICSD 통합계좌 연계

2023년 정부가 도입한 일련의 방안들은 외국인의 국채 투자를 위한 ICSD 연계의 걸림돌을 대부분 제거하였다. 우선 외국인 투자자의 투자 등록 의무가 폐지되었다. 또한, 2023년 시행된 ‘외국인 국채투자 비과세 규정’은 비거주자외국법인이 적격외국금융회사(Qualified Foreign Intermediary: QFI) 등을 통해 취득·보유·양도하는 국채 등으로부터의 이자 및 양도소득을 비과세하는 조치를 포함한다. 이러한 QFI에는 ICSD가 포함되며, 2023년 유로클리어가 한국예탁결제원과 ICSD 연계 시스템 도입을 위한 계약을 체결하고 2024년 6월부터 시스템을 운영할 계획이다.

5) 외국인 원화차입 허용

2024년 정부 발표14)에는 증권결제 목적의 일시적 외국인 원화차입(overdraft)을 허용하는 내용이 포함되어 있다. 외국인 투자자가 주거래은행이 아닌 다른 금융기관과 증권 결제를 위한 환전에서 일시적 원화부족 발생시 실제 원화 거래계약이 있으면 증권 매매 결제 대금을 차입할 수 있도록 하는 방침을 마련하였다.

나. 시장접근성 개선 방안의 기대효과

최근 정부가 발표한 시장접근성 개선 방안은 한국 주식의 MSCI World Index 및 국채의 WGBI 편입을 목적으로 두고 있는 것으로 볼 수 있다. 대부분 개선 방안이 MSCI 및 FTSE Russell의 시장접근성 지적 사항에 대한 직접적인 대응이기 때문이다. 그러나 실제로 이러한 시장접근성 개선 방안이 MSCI 및 FTSE Russell에 의한 한국 자본시장의 선진시장 격상으로 이어질지는 불확실하다. 단정하기는 어렵지만 현재 나와 있는 내용만을 두고 판단할 경우 한국 국채의 WGBI 편입 가능성은 높아 보이며, 한국 주식의 MSCI World Index 편입은 시간이 더 걸릴 수 있을 것으로 예상된다.

최근 정부의 개선 방안은 한국 국채의 WGBI 편입 가능성을 상당히 높여줄 것으로 판단된다. FTSE Russell은 현재 한국을 관찰대상국에 두고 있으며, 선진시장 격상을 위해 검토하고 있는 4개 시장접근성 개선 사항 중 외국인 국채투자 비과세는 이미 실행하고 있다. 또한 예탁결제 편의성과 관련해서도 유로클리어와의 ICSD 연계가 예정되어 있으며, 외국인 투자자 등록 프로세스의 문제점도 ICSD를 활용할 수 있게 되면 해소될 것으로 보인다. 남아 있는 사항은 외환시장 구조이며, 최근 정부의 외환시장 개선 방안이 FTSE Russell의 기준을 얼마나 충족하는가에 따라 WGBI 편입이 결정될 것으로 보인다. 이와 관련하여 한국과 유사하게 부분 교환 통화를 두고 있는 중국 및 말레이시아 국채가 WGBI에 포함되어 있다는 점은 고무적이다.

반면, 한국 주식의 MSCI World Index 편입 가능성은 불확실성이 상대적으로 높아 보인다. MSCI는 선진시장으로 분류되기 위한 구체적 기준은 제공하지 않지만, 현재 선진시장지수에 편입된 국가를 보면 시장접근성의 18개 세부 항목 중 개선 필요 또는 개선 가능으로 평가되는 경우는 합해서 2개 미만이다. 반면, 현재 한국은 MSCI의 관찰대상국에 포함되어 있지 않으며, 시장접근성의 10개 세부 항목에 있어서 개선 필요 또는 개선 가능 등급을 부여받고 있다. 특히 MSCI가 지적하는 시장접근성 사항의 상당수는 제도나 규제적 접근만으로는 개선이 어렵고 절차와 관행 변화가 수반되어야 한다. 이러한 절차와 관행은 단기간에 바꾸기 어려울 수 있으며 보다 장기적인 일정이 필요할 수 있다.

IV . 해외 금융기관의 시각

1. 해외 금융기관 시각의 중요성

한국 자본시장의 선진시장 격상을 위해서는 해외 금융기관의 시각에 대한 이해가 필요하다. 이는 무엇보다 MSCI 및 FTSE Russell의 국가 분류 또는 재분류에 있어서 해외 금융기관의 의견을 의사결정에 반영하는 절차를 두고 있기 때문이다. MSCI는 “시장접근성은 특정 시장에서의 해외 기관투자자(international institutional investor)의 경험(experience)을 반영하는 것을 목표로 한다.”고 설명한다. 또한 국가 재분류에 관해서는 “분류 변경이 되돌릴 수 없는(irreversible) 것으로 간주될 경우에만 시장 업그레이드를 고려한다.”는 기준을 두고 있다.15) FTSE Russell은 “국가 재분류는 새로운 규제의 제정이 아닌 해외 투자자(international investors)의 실질 경험(practical experiences)을 기준으로 평가된다. 따라서 국가 재분류의 변경 시기는 규제 개선이 완전히 실행되고 해외 투자자가 예상하는 혜택을 실현하기 위해 필요한 기간에 따라 결정된다.”고 설명한다.16)

이러한 MSCI 및 FTSE Russell의 국가 분류 기준에는 중요한 공통점이 있다. 첫째, 국가 분류의 근거가 되는 시장접근성 평가는 해외 금융기관의 ‘경험’에 기반한 의견을 중요하게 여긴다는 점이다. 둘째, 국가 분류는 규제 변경 자체에 중점을 두는 것이 아니라 해당 규제 변경이 실행되고 나서 해외 투자자에게 어떠한 영향을 미치는지를 확인한 이후 이루어진다는 점이다. 이는 시장접근성 제고를 단순히 규제 변경으로만 접근해서는 안 되고, 규제 변경에 대한 해외 금융기관의 의견을 함께 고려해야 함을 시사한다.

이처럼 해외 금융기관이 한국 자본시장에 대해 가지고 있는 시각은 시장접근성 제고에 중요한 요인으로 작용한다. 문제는 MSCI나 FTSE Russell이 제공하는 자료만을 두고는 해외 금융기관의 의중을 충분히 파악하기 어렵다는 점이다. MSCI 및 FTSE Russell은 각 시장에 대한 해외 금융기관의 의견을 수렴하지만, 그 내용은 핵심 사항 위주로 매우 간략하게만 제공하기 때문이다. MSCI 및 FTSE Russell이 지적하는 한국 시장접근성의 문제점을 자세하게 이해하고, 이에 기반하여 시장접근성 개선 방안의 실효성을 제고하기 위해서는 해외 금융기관의 상세한 설명을 들어볼 필요가 있다.

본 보고서는 해외 금융기관의 시각과 경험을 파악하기 위해 다수 해외 금융기관 관계자와의 인터뷰를 진행하였다. 인터뷰 대상 금융기관은 금융회사 및 금융협회로 구분된다. 인터뷰에 참여한 금융회사에는 글로벌 자산운용사, 상업‧투자은행, 커스터디은행, 증권사, 헤지펀드, 시장조성자 및 시스템트레이더가 포함된다. 인터뷰 대상 금융협회에는 아시아증권산업시장협회(Asian Securities Industry and Financial Markets Association: ASIFMA)17) 및 글로벌금융시장협회(Global Financial Market Association: GFMA)가 포함된다. 인터뷰는 2023년 1월에서 9월 사이에 온라인 및 오프라인 방식으로 이루어졌다. 오프라인 인터뷰는 한국 및 홍콩에서 진행되었다. 인터뷰에 참여한 해외 금융기관 수는 15개에 달하며, 인터뷰 횟수는 온라인 10회 및 오프라인 8회, 인터뷰 참여 관계자 인원수는 45명에 달한다. 다수 글로벌 금융회사는 내부 컴플라이언스 규정에 따라 인터뷰를 익명으로 하는 조건을 두었으며, 이에 따라 본 보고서에서는 인터뷰에 참여한 금융회사명 및 참가자 이름을 제공하지 않는다.

2. 주요 인터뷰 내용

가. 인터뷰 주제

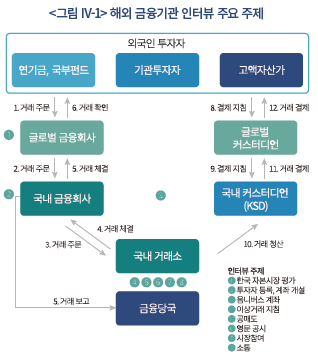

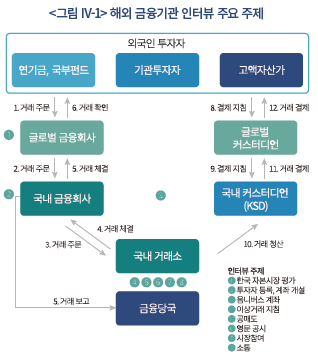

해외 금융기관 인터뷰는 시장접근성에 중점을 두었다. 인터뷰에서는 MSCI 및 FTSE Russell이 지적하는 한국의 시장접근성 사항과 더불어 참가자가 한국 시장에서 활동하면서 경험한 여러 이슈를 포괄적으로 다루었다. 이와 함께 최근 정부가 발표한 각종 시장접근성 개선 방안에 대한 의견도 논의되었다. 인터뷰 이후 내용을 종합해봤을 때 8개의 주요 주제가 도출된다. <그림 IV-1>은 인터뷰에서 다루어졌던 주요 주제를 외국인 투자자의 투자과정에 도표화(mapping)하여 보여준다.

나. 인터뷰 내용

다음으로는 해외 금융기관 인터뷰에서 도출된 8개 주제의 주요 내용을 소개한다.18) 인터뷰의 내용을 살펴보기에 앞서 유의해야 할 점이 있다. 첫째, 소개되는 내용은 인터뷰 당시 참가자가 중요하게 여기는 사항들이다. 이러한 사항 중 일부는 인터뷰 시점에 상황, 특정 이벤트 등이 영향을 미쳤을 가능성이 존재한다. 둘째, 본 보고서의 목적은 해외 금융기관의 입장을 대변하거나 정당성을 부여하는 것이 아니다. 해외 금융기관의 시각을 소개하는 이유는 이러한 의견들이 주관적인 측면이 있을지라도 시장접근성 평가에 중요하게 작용하기 때문이다. 인터뷰 참가자의 의견을 가치판단 없이 있는 그대로 전달하기 위해 본 절의 내용은 인용문 중심으로 구성되어 있다.

1) 한국 자본시장 평가

인터뷰에서는 외국인 투자자의 관점에서 한국 자본시장에 대한 종합적인 시각을 질문하였다. 한국 자본시장이 지니는 매력과 그럼에도 불구하고 신흥시장으로 평가받고 있는 이유에 대해 물어보았다. 대부분 인터뷰 참가자는 한국 자본시장을 실제로는 선진시장으로 봐야 하지만 기대하는 수준의 효율성을 제공하지 못하고 있다고 설명한다.

한국은 사실상 선진시장이다. 한국이 MSCI나 FTSE Russell의 선진시장지수에 편입되는 것이 이득인지 아닌지는 무의미한 질문인 것 같다. 장기적으로 봐야 한다. 이는 큰 파이의 작은 비중과 작은 파이의 큰 비중 중 어느 것이 더 나은지로 생각할 수 있지만, 한국이 신흥시장에서 차지하는 비중은 점차 줄어들 수밖에 없다. 인도, 베트남 등의 경제와 자본시장은 한국보다 빠르게 커지고 있으며, 이에 따라 한국이 신흥시장지수에 머물러 있다면 한국의 비중 감소는 불가피하기 때문이다. (금융협회)

한국 자본시장은 왜 신흥시장으로 간주되는가? 한국의 산업기반, 경상수지, 무역수지 등을 보면 더 이상 신흥국이 아니라 선진국이다. 한국의 자본시장도 선진시장으로 봐야 한다고 생각한다. 일반적으로 선진시장은 안정성이 높고, 신흥시장은 위험성이 높은 시장으로 인식된다. 한국의 주식시장과 채권시장은 선진시장 못지 않은 안정성을 지니고 있다. 다만, 외국인 투자자 입장에서 한국에 투자하는 과정은 편의성과 효율성 측면에서 선진시장에 뒤떨어진다. 외국인 투자자는 현지 투자로 노출된 위험을 헤지 할 수 있어야 하고, 투자자금을 효율적으로 회수할 수 있어야 한다. 그러나 한국은 외환시장 구조, 시장 관행 등의 측면에서 외국인들이 바라는 효율성을 가지지 못하는 것으로 평가되고 있다. 이러한 부분들을 한국의 시장접근성이 떨어지는 것으로 표현한다. (글로벌 증권사)

한국은 외국인 투자자의 관점에서 매우 매력적인 시장이 될 수 있다. 한국은 다양한 산업군을 두고 있으며, IT, 바이오 등 성장성이 높은 산업에 투자할 수 있는 많은 기업들이 있다. 한국 기업들은 적절한 성장성과 안정성을 지니고 있기 때문에 더욱 매력적이다. 외국인의 글로벌 투자 포트폴리오 관점에서 보면 한국은 다른 시장에서 제공하지 못하는 분산의 기회를 제공해준다. 그러나 한국이 홍콩, 싱가포르, 일본, 호주 등의 시장과 같은 수준에서 경쟁하려면 일부 영역에 있어서 선진시장 수준의 관행(best-in-class practices)을 도입해야 한다. (글로벌 헤지펀드)

시장접근성이 얼마나 중요한지는 의견의 차이가 있을 수 있다. 가장 중요한 것은 시장 자체의 매력도다. 이미 한국 시장에 투자를 결정한 투자자는 편의성 때문에 결정을 번복하지는 않는다. 우리와 같은 금융회사의 역할이 고객의 투자 과정을 원활하게 해주는 것이다. 다만, 불편함과 비용이 증가하면 투자가 가능한 수준보다 낮아질 수 있다. 보다 영향을 받는 것은 한국 시장에 대한 투자를 결정하지 않은 고객이다. 이러한 고객은 세계 각국의 자산에 투자하며, 하나의 플랫폼을 사용하고자 한다. 한국에 투자하는 과정에 있어서 별도의 절차나 비용이 발생하면 투자를 하지 않을 수 있다. 어떠한 경우든 한국의 시장접근성이 낮다는 것은 외국인 투자자로부터 받을 수 있는 잠재적 투자의 100%를 얻지 못하고 있음을 의미한다. (글로벌 은행)

최근 미국과 중국 간의 갈등으로 인해 많은 자금이 중국에서 빠져나와 투자처를 찾고 있다. 이중 상당 부분은 아시아 지역 내에서 재투자를 원한다. 한국이 당연히 이러한 투자의 목적지가 되어야 한다. 그러나 한국보다 일본으로 투자가 많이 흘러 들어가고 있다. 이러한 상황은 한국의 시장접근성과 무관하지 않으며, 매우 안타까운 상황이다. (금융협회)

선진시장의 공통적인 특징은 개방된 경쟁과 동등하고 공정하게 적용되는 규칙과 규제다. 홍콩, 싱가포르, 호주, 일본 모두 각각의 방식에는 차이가 있으며 개선할 부분이 있지만, 해외와 국내 금융회사 간 차별을 두지 않는다는 공통점이 있다. 다양한 플레이어들이 참여하고 경쟁하면서 시장의 효율성과 혁신이 증진된다. 그러나 한국 시장은 경쟁이 제한되어 있고, 해외 금융회사에 대한 시장 참여 기회나 규칙의 적용이 동등하지 않게 느껴지는 부분이 있다. (시장조성자)

2) 외국인 투자자 등록 및 계좌 개설

인터뷰에서는 최근 정부의 외국인 투자자 등록 의무 폐지와 IRC를 대체하는 LEI에 대해서도 논의하였다. 인터뷰 참가자 대다수는 외국인 투자자 등록 의무의 폐지를 환영하고, 정부의 노력을 긍정적으로 평가하는 것으로 나타난다. 그러나 IRC 폐지가 시장접근성 향상에 미치는 영향은 예상보다 적을 수 있다고 설명한다. 그 이유는 그간 IRC의 불편함이 투자자 등록 의무화에 있다기 보다 IRC 발급 절차의 일관성 부족과 과도한 증빙서류에 있었기 때문인 것으로 파악된다. 다수 인터뷰 참가자는 근본적인 문제는 투자자 등록 이후의 절차에 있는 것으로 지적하며, 이 부분에 개선의 여지가 많이 남아 있어서 IRC 폐지 자체만의 효과는 크지 않을 수 있다고 설명한다.

외국인 투자자 등록 의무 폐지는 전반적으로 환영받을 결정이다. 이는 무엇보다 한국 정부가 외국인 투자자의 목소리에 귀를 기울이고 있음을 보여준다. 한국의 외국인 투자자 등록 의무는 주요 선진시장에는 없는 제도로 외국인 투자자가 한국 시장을 접근하는 데 있어서 불필요한 복잡함과 비용을 발생시키는 하나의 요인으로 작용해왔다. IRC를 대체하는 LEI는 훌륭한 기준으로 보인다. 다만 새롭게 도입되는 외국인 투자자 등록 시스템의 실제 효과와 편의성은 세부 내용을 봐야 판단을 할 수 있을 것으로 보인다. 이전에 한국에서 옴니버스 계좌를 도입한다는 발표가 있었을 때, 해외 금융회사는 큰 기대를 하였다. 그러나 세부 내용을 보고는 크게 실망했다. 너무 많은 제약 사항이 있었기 때문이다. 이런 경험으로 인해 외국인 투자자와 해외 금융회사는 현재 보수적인 입장을 취하고 있다. (글로벌 자산운용사)

그동안 IRC의 불편함은 투자자 등록 자체에도 있었지만, 그 과정에 따른 불확실성이 어쩌면 더 큰 문제가 되어 왔다. 예를 들어 두 건의 IRC 신청에 있어서 동일 종류의 증빙자료를 제출했는데, 한 건은 승인되고 다른 한 건은 추가 증빙자료를 요구하는 경우가 있다. 또한, IRC가 승인 되는 기간도 예측하기 어려우며, 어떤 경우 며칠이 걸리고 다른 경우 몇 주가 걸린다. 이러한 일관성 부족은 업무 프로세스의 문제라고 생각한다. 외국인 투자자 등록을 심사하고 승인하는 담당자가 1~2명에 불과한 것으로 알고 있으며, 신청 건수가 많으면 승인이 지연된다. 또한 담당자도 자주 교체되어서 담당자에 따라 요구하는 증빙서류의 편차가 발생하기도 한다. 이 때문에 투자자 입장에서 언제 투자를 개시할 수 있는지 불확실해지고 이러한 부분들이 한국 시장의 매력도를 떨어트리는 요인이 된다. 선진시장의 경우 신규 투자자 가입, 즉 온보딩(onboarding) 절차가 간소화 및 표준화되어 있으며, 한국에 비해 신속하고 일관되게 이루어진다. (글로벌 자산운용사)

한국 정부가 IRC를 폐지하고 LEI로 대체할 것으로 알고 있다. 하지만 외국인 투자자는 이미 IRC에 어느 정도 익숙해져 있다. 그동안의 문제는 IRC 자체보다는 발급받는 절차에 있었다. 외국인 투자자에게 어려움은 IRC 발급을 위해 요구되는 증빙자료와 이러한 증빙자료를 인쇄본(hard copy)으로 제출해야 한다는 것이다. 이러한 점은 계좌 개설에서 더욱 문제가 된다. 외국인 계좌 개설을 위해서는 많은 증빙서류가 요구된다. 선진시장에서 통용되는 증빙서류가 한국에서는 인정되지 않거나, 추가 증빙서류를 요구하는 경우가 많다. 여기에 외국인은 한국 시장에 투자하기 위해 현지 증권사, 수탁은행 등 모든 금융기관에 각각 증빙서류를 제출해야 한다. 이 부분이 가장 큰 불편함을 느끼는 점이다. (글로벌 은행)

IRC 폐지 소식은 환영할 일이지만, 한국 내 계좌 개설 절차의 불확실성은 여전히 외국인 투자자에게 중요한 고려 사항이다. 현재로서는 LEI에 대한 세부적인 내용이 아직 발표되지 않아 파악하기 어려운 부분이 많다. 예를 들어 기존 IRC 발급에 필요했던 절차와 서류, 특히 고객알기제도(Know Your Customer: KYC) 및 자금세탁방지(Anti Money Laundering: AML) 등을 위한 고객 실사(due dilligence)가 전적으로 없어지는 것인지, 아니면 다른 형태의 규제로 대체되어 계좌 개설 과정으로 이전된 것인지 아직 불명확하다. 따라서 외국인 투자자 등록 의무 폐지가 실질적인 편의성 개선으로 이어지려면, 계좌 개설 과정에서의 요구 사항과 절차를 명확히 하고, 가능한 한 간소화하는 방향으로 정책이 구체화 되어야 할 것이다. (글로벌 커스터디은행)

인터뷰 관계자들은 IRC 폐지의 효과를 낮게 평가하는 주요 이유로 외국인 투자자 등록 이후의 과정에 있어서는 큰 변화가 없기 때문이라고 설명한다. 계좌 개설에서 청산결제까지 여전히 외국인 투자자의 입장에서는 여러 가지 불편함과 비효율성이 존재한다고 지적한다.

IRC 폐지는 한국 정부가 올바른 방향으로 나가고 있음을 보여준다. 그러나 운영상에서 거래 주문이나 결제가 처리되는 방식은 변함이 없다. 한국에서는 틀린 계좌로 주문을 내는 경우 이를 수정하는 게 매우 어렵다. 이러한 리스크는 여전히 존재한다. 그래서 해외 금융회사는 한국에서 주문 오류에 대해서 걱정을 많이 한다. 한 주의 주문 오차가 엄청난 골칫거리가 되고 경고까지 받을 수 있다. 이는 바이사이드(buy side)가 더 고민하지만 셀사이드(sell side)도 공감하는 부분이다. 다른 선진시장에서는 주문 오류를 좀 더 유연하게 대처할 수 있도록 해준다. IRC 폐지는 한 편으로는 투자 개시를 쉽게 하는 데 도움이 되지만 실질적으로 플랫폼에서 업무를 간소화하고 최대한 효율적으로 만들기 위해서는 해야 할 일이 아직 많이 남아 있다. (글로벌 커스터디은행)

외국인 투자자 등록은 폐지되었지만, 계좌 개설 이후의 프로세스(down stream process)는 여전히 변한 게 없다. 이는 해외 금융회사들이 정보를 공유하는 포럼 등에서 널리 알려진 한국 시장의 문제점이다. 한국에서 흘러나오는 정보를 보면 이러한 점들이 명확하게 인지되지 못하는 것 같다. 한국에서는 마치 이러한 문제들이 대부분 해결된 것으로 간주하는 것으로 보인다. 그러나 한국 시장에 실제 참여하고 있는 해외 금융회사 관계자들의 피드백을 들어보면 문제는 여전히 존재하고 있다. 이 부분이 해결된다면 한국 시장에는 매우 큰 도움이 될 것으로 생각한다. (해외 증권사)

일부 인터뷰 참가자는 IRC와 LEI의 공존으로 계좌 관리가 복잡해질 수 있다는 우려를 제기한다. 기존 IRC 발급자는 LEI를 발급받지 못하기 때문에, 글로벌 금융회사는 두 가지 유형의 계좌를 관리해야 하기 때문이다.

한국 정부의 발표에 따르면 기존 고객은 IRC를 유지하고 신규 고객만 LEI를 사용할 수 있다. 그러나 IRC와 LEI의 공존은 향후 계좌 관리의 복잡성을 야기할 수 있다. 글로벌 자산운용사 등은 한국에 투자하는 수백, 수 천 개의 외국인 고객 계좌를 보유하고 있는데, 이중 대부분은 IRC이지만 일부는 LEI가 될 것이다. 그리고 LEI의 비중은 점차 늘어나기 마련이다. IRC와 LEI 두 유형의 계좌를 관리하는 것은 복잡해질 수 있으며, 지금은 예측하지 못하는 문제가 발생할 수도 있다. (글로벌 자산운용사)

3) 외국인 투자자 계좌(옴니버스 계좌)

외국인 투자자 계좌 관리 문제는 다수 인터뷰에서 지적된 사항이다. 가장 큰 문제점은 한국에서는 진정한 외국인 통합계좌, 즉 옴니버스 계좌가 제공되지 않고 있다는 것이다. 그 이유는 현재 한국의 옴니버스 계좌로는 통합 매매주문이 가능하지만, 통합 청산결제는 가능하지 않기 때문이라고 설명한다. 이로 인해 글로벌 자산운용사, 은행 등이 선진시장에서 사용하는 옴니버스 계좌를 한국에서는 사용하기 어렵다고 지적한다.19)

근본적인 문제는 한국은 여전히 외국인 투자자를 식별하는 ‘ID 시스템’을 유지하고 있다는 점이다. IRC 폐지 등 최근 정부가 발표한 다양한 방안들은 한국 시장에 대한 외국인 투자자의 편의성을 높일 것으로 기대된다. 그러나 여전히 외국인의 계좌 관리는 최종투자자 단위로 이루어져야 할 필요가 있어서 개선할 여지가 남아 있다. (글로벌 은행)

통합계좌에는 ‘명의자 모델’과 ‘옴니버스 모델’의 두 가지 유형이 있다.20) 선진시장에서 글로벌 자산운용사, 증권사, 수탁은행 등이 사용하는 것은 옴니버스 모델이다. 반면, 이들이 한국 시장에서 사용하는 것은 명의자 모델에 가깝다. 명의자 모델은 소수 고액자산가 고객을 관리하는 프라이빗뱅킹(private banking)에서는 사용할지 몰라도, 글로벌 자산운용사들은 더 이상 사용하지 않는 모델이다. 한국의 외국인 통합계좌에는 옴니버스 트레이딩(omnibus trading) 기능이 제공되지만, 아직 옴니버스 청산결제(omnibus settlement and clearing)는 제공되지 않는다. 해외 금융회사는 한국 금융당국이 그간 외국인 투자자의 편의성을 높이기 위한 통합계좌 개선 방안에 감사함을 느낀다. 예를 들어 IRC가 준비되지 않은 상황에서도 투자를 개시할 수 있고, 주문 정정(cancel correct)도 기존 T+1에서 T+2로, 즉 결제 이전까지 허용해줄 것으로 알고 있다. 이러한 추가적인 유연성은 자산운용사 등 해외 금융회사에게 매우 유용하다. 정부가 최근 발표한 거래내역 보고 요건 면제나 보고 간소화 조치 등도 많은 도움이 될 것으로 생각한다. 하지만, 한국의 통합계좌로는 청산결제까지 일괄적으로 이루어지지 못하기 때문에 시장에는 여전히 비효율성이 존재한다. (금융협회)

정부가 최근 발표한 통합계좌 개선 방안은 자산운용사, 증권사 등의 금융회사에는 의미 있는 것으로 생각한다. 또한, ICSD와 관련해서는 별도의 옴니버스 계좌 방안이 도입되는 것으로 알고 있다. 하지만, 현재 우리와 같은 글로벌 커스터디은행의 경우 옴니버스 계좌의 사용이 사실상 가능하지 않다. 글로벌 커스터디은행의 경우 한국에서는 여전히 IRC 단위로 고객 계좌를 개별 관리해야 한다. 글로벌 커스터디언을 사용하는 고객이 궁극적으로 원하는 것은 여러 나라의 자산에 투자하는 데 있어서 하나의 플랫폼을 사용해서 높은 수준의 편의성과 효율성을 얻는 것이다. 이를 위해서는 각국의 외국인 투자자 계좌 관리 방식이 호환성을 지녀야 한다. (글로벌 커스터디은행)

한국에서는 거래 포지션이 펀드매니저 수준이 아닌 펀드 수준에서 정확해야 한다. 이는 상당한 관리의 복잡성과 위험을 수반한다. 만약 운영상의 실수로 잘못된 계좌에서 매도를 하게 되면, 이는 무차입 공매도(naked short-selling) 혐의를 받을 수 있다. 한국에서는 이러한 거래 실수에 대한 벌금이 현재 매우 크다는 것을 모두가 알고 있다. (금융협회)

브로커들의 경험에 따르면, 한국에서 여러 계좌를 운영하는 것은 매우 복잡하며, 실수를 수정할 수 있는 유연성은 거의 없다는 불만을 토한다. 옴니버스 거래는 나머지 운영 절차가 잘 작동할 때 도움이 되며, 특히 결제 전에 계좌를 수정할 수 있는 유연성이 필요하다. 선진시장에서는 이러한 유연성을 제공한다. 그러나 현재 한국에서는 이러한 유연성이 사실상 없다. 한국에서는 이로 인한 어려움을 충분히 이해하지 못하고 있는 것 같다. (글로벌 헤지펀드)

4) 거래 가이드라인

인터뷰에서 가장 많이 거론된 사항은 한국의 거래 가이드라인 투명성이다. 다수 인터뷰 참가자는 해당 이슈를 한국의 시장접근성 제고를 위해 풀어야 할 최우선 과제로 손꼽았다.21) 특히 이상거래(abnormal trading)에 대한 명확한 기준이 공개되지 않는다는 점을 문제로 삼았다. 또한 이상거래 관련 경고나 제재에 있어서 사전 및 사후적 규명 절차가 불투명하다고 지적한다.

선진시장의 공통된 두 가지 특징은 투명한 거래 가이드라인과 경쟁적인 시장환경이다. 이상거래 관련 지침의 투명성 제고는 한국이 선진국 시장으로 격상되기 위해서 우선적으로 다루어야 할 문제다. 이는 근본적으로 시장 감시체계에 관한 이슈이며, 해외 투자자의 관점에서 한국은 선진시장에 비해 이부분에 있어서 유연성이 상당히 부족한 것으로 느낀다. (글로벌 증권사)

한국 시장에서 가장 중요한 이슈는 명확한 거래 지침이다. 예를 들어 종가 경매와 관련하여 허용되는 움직임의 범위다. 선진시장에서는 시장 마감 시점에 투자자들이 어떻게 행동하는지, 특정 지수 이벤트(index event)일이 일반 거래일과 어떻게 다른지, 이유가 무엇인지 등에 대해 시장참여자와 거래소 간에 많은 논의가 이루어진다. 그리고 이러한 점들을 감안하여 시장감시에 대한 기대치를 조정한다. 심지어 중국의 경우에도 이러한 부분은 잘되어 있다. 한국에서도 종가에 대한 제한선(red line) 등을 보다 명확하게 하는 등 의미 있는 대화가 이루어지고 있는 것으로 알고 있다. 그럼에도 불구하고 거래 지침은 여전히 문제가 되고 있다. 커뮤니케이션이 투명하지 않기 때문에 해외 금융회사는 과거 자신들이 암묵적으로 이해하는 제한선에서 벗어나는 것을 꺼린다. 이는 특히 지수 변경이 원활하게 이루어지기 어렵다는 것을 의미한다. 우리는 글로벌 자산운용사 등의 포트폴리오 리밸런싱(rebalancing)을 지원하기 위한 유동성을 공급한다. 이 과정에 우리는 증권을 매입하는 측으로 리스크를 이전하는 활동에 있어서 자신감을 가지고 싶어한다. 가격 변동 제한 및 거래량 변동 제한을 두고 있는 한국의 경우 이러한 리스크 이전이 매우 어렵고 불균형적으로 이루어질 수 있다. 이 문제는 모든 지수제공자들 사이에 논의되고 있는 사항이며, 한국이 선진시장으로 격상되기 위해 해결해야 할 사항이다. (시장조성자)

선진시장의 경우 경매시 가격 변동에 대한 민감성의 제약은 있지만 한국과 같이 거래량도 제한하는 경우는 없다. 거래량 제한은 시장의 완만한 조정을 방해한다. 예를 들어 지수 변경일에는 거래량이 평소 경매의 10배에 달할 수 있지만, 이를 예측하기는 매우 어렵다. 이처럼 이상거래 지침의 불투명성은 완만한 인덱스 조정을 어렵게 만들며, 이 경우 시장의 효율적 위험 배분이 이루어지지 못한다. 이는 인덱스 상품 제공자 입장에서는 매우 어려운 상황이다. 한국과 비교할 때 미국, 영국, 홍콩, 싱가포르 등 선진시장의 경우 포지션 조정에 대한 유연성이 상대적으로 높다. 우리는 이 이슈에 관해 많은 전문가를 동원할 수 있고, 여러 시장참여자와의 대화를 환영한다. 이를 통해 올바른 거래 규칙이 마련되고, 안심할 수 있는 거래 환경이 형성될 수 있도록 돕고자 한다. (글로벌 자산운용사)

지금은 모든 트레이딩이 알고리즘으로 자동화되어 있다. 특정 국가에서의 트레이딩 알고리즘에는 시장 요소뿐만 아니라 규제, 규정, 지침 등의 거래 요소도 모두 프로그램에 포함되어 있다. 그러나 한국 시장에서는 거래 규정이나 지침이 홍콩, 싱가포르 등 선진시장에 비해 투명하지 못하다. 심지어 중국에 비해서도 한국의 거래 지침 투명성은 뒤떨어지는 것으로 평가된다. 중국의 경우 시장참여 및 취급 가능 거래 상품은 상대적으로 제한되어 있지만, 거래가 허용되는 금융상품에 있어서는 거래 가이드라인이 명확하다. 그러나 한국 시장은 수수께끼 같은 부분이 많으며, 특히 시스템 트레이더에게는 공정한 경쟁 시장이 아니라는 느낌을 가지게 된다. 어쩌면 이는 책임소재를 명확하게 하지 않기 위해서일 수도 있다는 생각을 갖게 된다. (시스템 트레이더)

인터뷰 참가자는 이상거래 관련 심의과정(adjudication process)도 개선되어야 한다고 지적한다. 특히 이상거래 경고 등에 대한 설명이 명확하게 제공되지 않고, 사전 및 사후적으로 해외 금융회사의 입장을 소명할 수 있는 기회가 충분하게 주어지지 않는다고 설명한다.

해외 금융회사는 현지 규정을 준수하면서 거래하고자 한다. 다만 그 규정이 무엇이고, 특히 위반 사항이 무엇인지 정확하게 알 수 있어야 한다. 이러한 정보는 해외 금융회사에게 직접 전달되지 않고, 사용하는 로컬 브로커(증권사)에게만 제공된다. 그러나 문제가 발생할 경우 로컬 브로커마다 각각 다른 설명을 해주기 때문에 정확한 상황 파악이 어렵다. 우리는 거래소와 직접 소통하기를 바란다. 하지만, 거래소와의 직접 의사소통이 어려운 경우가 많다. 특히, 이상거래 관련 가이드라인은 공개 자료가 아니고 거래소가 회원사인 로컬 브로커에게만 제공하며, 로컬 브로커들은 이 내용을 고객이나 해외 계열사와도 공유하지 못하게 하는 것으로 해외 금융회사들은 알고 있다. (글로벌 헤지펀드)

해외 금융회사는 여러 로컬 브로커들을 사용한다. 이상거래 경고를 받을 경우 그 이유를 물어보면 브로커마다 설명이 다르다. 또 하나의 문제는 로컬 브로커가 어떤 고객에게 경고의 원인을 파악하여 설명해주지만, 다른 고객에게는 그렇게 해주지 않는 경우가 있다. 예를 들어 대형 금융회사에는 정보를 제공해주지만, 작은 규모 고객을 위해서는 노력하지 않는 것이다. 이로 인해 해외 금융회사 간에도 차별이 생기며, 정보에 있어서 경쟁력의 격차가 발생한다. 이는 한국이 공정하지 않은 시장환경을 조성하는 결과를 초래할 수 있으며, 일부 해외 금융회사는 이러한 부분을 차별적 대우로 간주한다. (시장조성자)

한국에서는 업계의 경고 조치 관련 심의 프로세스는 조금 더 투명하고 공식적인 체계를 적용할 필요가 있다. 경고를 취하기 이전에 가급적 고객과 적극적으로 접촉해서 전후 상황에 대해 설명해주고 고객이 소명할 수 있는 기회를 제공할 필요가 있다. 선진시장에서는 이러한 과정을 거친 후 최종적으로 경고 조치가 결정되는 것이 관행이다. 예를 들어 일본의 경우 조사가 필요한 거래 패턴이 포착되면, 결론 도출 또는 시정 조치 확정 이전에 거래소 회원사와 일련의 질의응답 및 사실확인을 위한 논의와 의견 청취 과정을 거치는 것이 일반적인 관행이다. 홍콩거래소 또한 경고 조치를 취하기 이전에 시장참여자들과 적극적인 논의를 통해 해당 행위의 배경을 확인하는 과정을 두고 있다. 충분한 정보가 공유되는 논의 및 심리 절차의 구축은 이상거래 방지에도 도움이 될 것으로 생각된다. (글로벌 은행)

일부 인터뷰 참가자는 한국에서 받은 경고나 제재가 경미한 수준이라도 글로벌 금융회사 입장에서는 큰 영향을 미칠 수 있다고 설명한다.

글로벌 금융회사의 경우 다국적 사업을 하기 때문에 어느 한 국가에서의 제재는 그룹 전체에 영향을 미칠 수 있다. 우선 특정 국가에서의 경고 발생은 내부 컴플라이언스 측면에서 문제가 될 수 있으며, 경고가 누적되면 해당 국가의 영업 활동을 위축시킬 수 있다. 또한, 한국에서의 경고가 글로벌 금융회사의 다른 지역 사업에도 영향을 미칠 수 있다. 예를 들어 한국에서 경고를 받은 특정 글로벌 금융회사가 아시아 내 다른 국가에서 신규 라이선스를 신청할 경우 해당 국가의 금융당국은 그 금융회사가 다른 국가에서 받은 경고나 벌금에 대한 정보를 요구할 수 있다. 따라서 한국 시장에서의 경고 또는 경미한 제재도 글로벌 금융회사에는 큰 영향을 미칠 수 있다. 이는 글로벌 금융회사가 한국시장에서 거래하는 데 있어서 소극적이거나 투자 규모를 제한하는 요인으로 작용할 수 있다. (글로벌 은행)

5) 공매도

한국 공매도 제도의 개선은 대부분 인터뷰 참가자가 지적한 사항이다. 이는 공매도가 단순히 트레이딩 전략 구현을 위한 수단이 아니라 시장의 효율성 및 경쟁도 차원에서 중요하기 때문이라고 강조한다. 일부 인터뷰 참가자는 공매도 제도 개선을 한국이 선진시장으로 격상되기 위해 풀어야 할 주요 과제로 손꼽는다.

한국이 선진시장으로 격상되기를 원한다면 두 가지 요건을 만족해야 한다. 첫 번째는 거래 지침의 투명성이다. 두 번째는 시장의 탄력성이다. 그리고 시장 탄력성의 핵심 요소는 공매도다. 공매도는 시장의 효율적 가격 형성을 가능하게 하며, 이와 더불어 다양한 플레이어들이 참여할 수 있는 기반을 마련해준다. 현재 한국에서는 어느 종목을 공매도할 수 있는지 제약이 있고, 또한 어떻게 공매도를 할 수 있는지에 대한 지침이 불명확하여 비효율성이 발생한다. 우리는 한국 규제당국의 공매도 지침에 대해 궁금해한다. 문제의 원인이 무엇이며, 달성하고자 하는 목적이 무엇인지를 알고 싶어 한다. 만약 가격 하락에 대한 우려라면, 더 나은 서킷 브레이커(circuit breaker)를 도입할 수 있다. 이는 공매도를 제한하거나 할당량을 두는 것보다 효과적인 방법이라고 생각한다. 우리는 선진시장의 경험을 바탕으로 금융당국이 원하는 목적을 달성하는 데 도움이 되고 싶다. (글로벌 은행)

공매도는 단순히 특정 금융회사 또는 사업에 국한된 이슈가 아니다. 공매도의 필요성과 중요성에 대해서는 모두의 의견이 일치한다. 이는 헤지펀드 등 공매도를 집중적으로 하는 특정 섹터에 국한된 이슈가 아니다. 그 이유는 공매도가 시장의 전체적 유동성 공급과 가격 발견에 있어서 중요한 역할을 하기 때문이다. 글로벌 자산운용사의 경우에도 공매도를 집중적으로 하지는 않지만, 다양한 유동성 공급자들이 시장에 참여하여 거래 비용을 낮추고 원하는 투자 포트폴리오를 효율적으로 구성할 수 있기를 바란다. 공매도를 제약하는 것은 시장의 다양성과 경쟁도를 낮추는 결과를 가져다준다. (글로벌 자산운용사)

글로벌 자산운용사나 투자은행들도 시장의 다양한 유동성 공급자의 참여를 원한다. 시장 플레이어의 다양성은 해당 자본시장의 매력도 및 시장접근성과 직결된다. 시장조성자들은 거래 비용을 낮추고, 거래의 선택지를 확대하여 투자자와 기업에게 혜택을 제공하는 중요한 역할을 한다. 그런데 시장조성자 등 다양한 플레이어가 시장에 참여하기 위해서는 공매도와 같은 도구가 필요하다. 선진시장에서는 다양한 종류의 금융회사들이 공존하는 생태계가 형성되어 있어서 이러한 유동성 공급이 효율적으로 이루어질 수 있다. (글로벌 은행)

인터뷰 참가자는 공매도가 허용되는 종목에 있어서도 제약이 과도하고 거래에 대한 유연성이 부족하다고 밝힌다. 특히, 한국의 경우 무차입 공매도로 지정되는 기준이 매우 엄격하고, 선진시장과 달리 여러 예외적인 경우를 인정하지 않는다고 설명한다.22)

동일한 방식으로 공매도 주문을 냈을 때, 미국, 영국, 홍콩, 싱가포르 등의 시장에서는 위반 사항이 아닌 거래가 한국에서는 무차입 공매도로 간주될 수 있다. 선진시장의 경우 공매도의 기능을 중요하게 여기기 때문에 시장에서의 실질적 운용상 어려움과 복잡함을 인정해주는 유연성을 갖추고 있다. 반면 한국의 경우 무차입 공매도를 매우 엄격하게 해석하며, 사소한 운영상의 오류에 대해서도 예외를 두지 않는다. (시장조성자)

한국에서는 계좌 관리 오류로 주문을 냈을 때 무차입 공매도로 간주 될 수 있으며, 이로 인해 부과되는 벌금과 제재가 매우 높다. 특히, 펀드매니저가 아닌 펀드 단위에서 포지션을 관리해야 하는 한국의 규정은 이러한 문제와 위험을 더욱 부각시킨다. 이러한 규정들은 투자자 보호와 시장 안정성을 위한 것이지만, 해외 금융회사 입장에서는 그 정도가 과도하게 느껴진다. (글로벌 은행)

일부 인터뷰 참가자는 공매도의 순기능에 대한 이해 부족을 주요 문제점으로 지목한다. 공매도에 대한 이해를 제고하고 균형 잡힌 시각을 형성하기 위해 투자자 교육 강화를 제언한다.

한국에서는 외국인 투자자의 공매도 자체를 부정적으로 보는 것으로 느껴진다. 이는 공매도의 합법성 또는 불법성의 여부와 상관없이, 외국인 투자자가 시장을 교란하고, 불공정한 위치에서 경쟁한다는 인식에 기반한 것 같다. 이러한 인식은 공매도의 순기능에 대한 이해가 부족한 데 원인을 두고 있다고 생각한다. 공매도는 시장의 중요한 기능을 제공하지만, 이에 대한 이해가 부족하거나 오해가 있을 수 있다. 특히, 일반 투자자들은 공매도가 시장의 안정성을 훼손하고 주가 하락을 부추기는 요인으로 오해할 수 있다. (글로벌 증권사)

공매도에 대한 리테일 투자자의 부정적 시각은 한국의 경우에만 해당되는 것이 아니며, 일반적으로 관찰되는 현상이다. 모든 시장에서는 리테일 투자자가 가장 큰 비중을 차지하지만, 공매도를 사용하는 리테일 투자자는 실질적으로 없다고 볼 수 있다. 공매도는 주로 대형 기관투자자가 수행하며 이들이 가격 형성을 주도한다. 리테일 고객이 공매도를 사용하는 경우가 드물기 때문에 공매도, 특히 공매도의 순기능에 대한 이해도가 낮기 마련이다. 따라서 투자자 교육이 핵심이다. 공매도의 긍정적인 측면과 시장 기능에 대한 이해를 높이는 것이 중요하다. 공매도는 시장 참여자 간의 거래 유동성을 증가시키고, 가격 발견 과정을 개선하는 데 도움을 준다. 이러한 혜택은 리테일 고객도 향유한다. 공매도에 대한 교육 강화를 통해 투자자들이 더 안정적이고 효율적인 시장에서 거래할 수 있는 환경을 조성할 필요가 있다. (글로벌 헤지펀드)

6) 영문 공시

인터뷰에서는 영문 공시 확대의 필요성에 대한 논의도 이루어졌다. 인터뷰 참가자들은 현재 영문 공시가 부족하여 외국인 투자자들이 투자 의사결정에 필요한 정보를 충분히 제공받지 못하고 있다고 지적한다. 또한, 공시 자료 번역에 따르는 비용과 정보 제공의 지연 문제도 언급되었다. 일부 참가자들은 영문 공시 부족을 외국인 투자자에 대한 차별로 인식하기도 한다.

한국 시장은 30%가 외국인 투자자다. 이는 한국이 실질적으로 국제적 투자자 기반을 가지고 있음을 의미한다. 외국인 투자자를 중요하게 여기지 않는다면 이는 잘못된 생각이다. 따라서 외국인 투자자가 필요로 하는 정보를 적절하게 제공하는 데 관심을 가져야 한다. 그러나 현재 제공되는 영문 자료는 상당히 부족하며, 이러한 상황은 한국 시장이 외국인 투자자를 존중하지 않는다는 인식을 줄 수 있다. (시스템트레이더)

기업 공시는 투자 결정에 필수적인 정보를 제공한다. 해당 기업의 중장기적인 사업 전략, 배당 계획 등을 알려줌으로써 투자자는 어떤 기업에 투자를 확대하거나 축소할지를 결정할 수 있다. 한국에서는 영문 기업 공시가 부족하여 국문 기업 공시를 번역해야 하는 번거로운 절차를 거치고 있다. 이는 외국인 투자자가 추가 비용을 지불하고, 중요한 정보의 제공이 지연되는 문제를 발생시킨다. 영문 공시 부족은 외국인 투자자가 주요 정보를 확보하는 데 불리한 입장 및 높은 비용과 리스크 감수해야 하는 상황을 만든다. 이러한 문제는 한국 시장에 대한 투자를 제한하는 요인이 될 수 있다. (글로벌 은행)

한국거래소의 전자공시서비스(KIND)나 금융감독원의 전자공시서비스(DART)에서 제공되는 자료를 비교해 볼 때, 동일 기업의 국문 공시에 비해 영문 공시는 정보가 제한적인 경우가 일반적이다. 국문과 영문 공시 자료의 분량만 봐도 그 차이를 확인할 수 있다. 따라서 영문 공시가 제공되는 기업의 경우에도 국문 공시에서 어떠한 내용이 빠져 있는지를 확인하기 위해서는 결국 국문 자료를 번역해야 한다. 또한 국문 공시가 먼저 제공되고 영문 공시는 시차를 두고 올라오는 경우가 많다. 이 때문에 외국인 투자자는 정보를 상대적으로 늦게 전달받게 되어 불리한 조건으로 투자하게 된다. 이는 외국인 투자자들이 공정하지 않은 투자 환경으로 인식할 수 있다. (글로벌 은행)

일부 인터뷰 참가자는 영문 자료가 기업 공시에만 국한되지 않고, 각종 정책 및 제도 관련 자료로도 확대될 필요가 있다고 설명한다. 특히 중요한 제도 변경에 대한 정부 보도자료가 영문으로 제공되지 않거나, 국문 자료에 비해 내용이 축소되어 제공되는 경우가 문제라고 지적한다. 또한, 실무직인 차원에서 해외 금융기관과 국내 금융기관 간의 시스템 인터페이스도 메뉴 등 추가적으로 영문화하는 것이 효율성 측면에서 도움이 될 수 있다고 제언한다.

한국에서는 경우 주요 제도나 규제 변경에 대한 금융기관 또는 정부 보도자료가 영문으로 충분히 제공되지 않는 경우가 많다. 이로 인해 한국 시장에 투자하거나 사업하는 해외 금융회사는 현지 법무법인을 통해 자료를 번역하고 법률적 해석을 의뢰해야 한다. 물론 이러한 방식도 가능하지만, 이는 불필요한 비용을 발생시킨다. 더 큰 문제는 외국인 투자자나 해외 금융회사가 제도나 규제 변경에 대응할 수 있는 충분한 시간을 제공받지 못한다는 점이다. 특히 한국에서는 제도나 규제 변경이 해외 금융기관의 의견 수렴 없이 이루어지거나, 충분한 준비 기간을 주지 않고 발표되는 경우가 있다. 이 부분은 해외 금융기관이 한국 시장에 대해 가지는 주요 불만 사항 중 하나다. (글로벌 은행)

영문화는 공시 등 자료뿐만 아니라 시스템 연결성 측면에서도 개선의 여지가 있다. 주요 금융허브에서는 시장에서 사용하는 시스템 간의 높은 연결성(connectivity)과 호환성(compatibility)을 제공하려고 노력한다. 반면, 우리가 거래하는 한국 로컬 금융기관의 시스템은 영어로 된 메뉴 지원이 충분하지 않다. 이 때문에 시스템에 일부 정보를 입력하기 위해서는 한국어를 이해할 수 있는 현지 대리인을 통해야 한다. 다른 시장의 경우 SWIFT 메시지 지원 등 시스템적으로 작업을 자동화하고 확장성을 높일 수 있게 설계되었다. 이러한 부분들도 한국 자본시장의 효율성을 높일 수 있는 영역이라고 생각한다. (글로벌 커스터디은행)

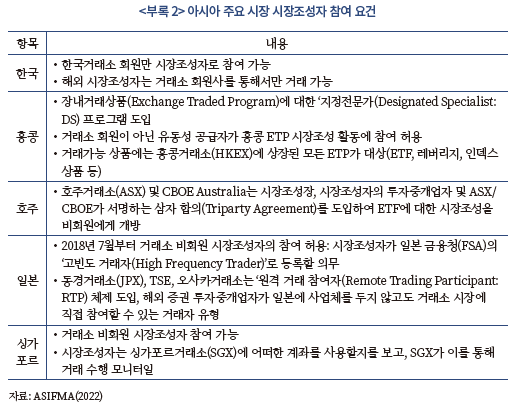

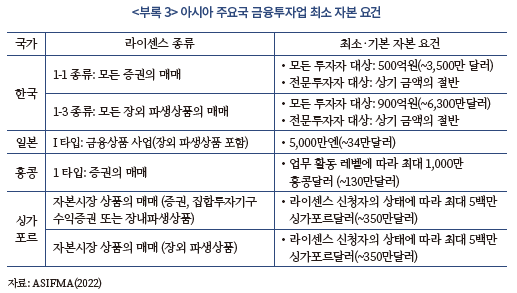

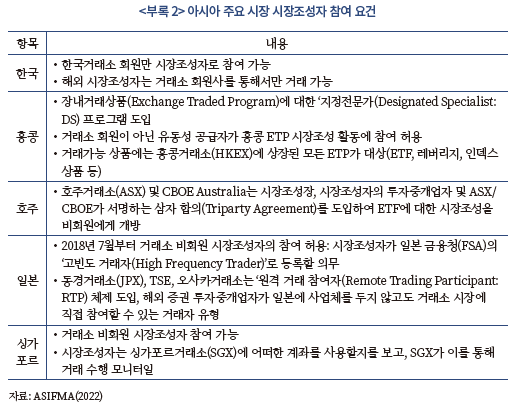

7) 시장참여

인터뷰 참가자 일부는 한국의 시장참여 요건이 선진시장에 비해 제한적이라고 지적한다. 이러한 의견은 주로 글로벌 금융회사에 비해 규모가 상대적으로 작은 시장조성자로부터 제기된다. 특히 한국에서는 일본, 홍콩, 싱가포르, 호주 등에서 도입하고 있는 해외 시장조성자의 원격 참여(remote participation)가 허용되지 않는 점이 문제로 지적된다.23) 또한, 일부 해외 금융기관은 한국 시장 진출을 검토하고 있지만, 증권업 인가 비용과 인력 요건이 선진시장에 비해 부담스럽다고 설명한다.

우리는 모든 플레이어에게 동일한 시장 참여 기회를 제공하는 것을 원한다. 우리는 경쟁이 존재하는 시장이 궁극적으로 투자자에게 이익이 된다고 믿는다. 경쟁은 비용을 낮추고 효율성을 높이며 그 혜택은 모두에게 돌아간다. 그러나 현재 한국 시장에서는 해외 금융회사가 거래소의 공식 시장조성자로 참여할 수 없다. 한국에서는 시장조성자가 되기 위해서는 거래소 회원사여야만 한다. 반면 홍콩에서는 거래소 회원사가 아니더라도 시장조성자에게 동일한 혜택이 주어진다. 예를 들어 홍콩에서는 해외 금융회사가 시장조성자로 활동할 경우 대량 공매도 면제(large short-selling exemption), 결제 기간 연장(extended settlement windows), 거래 수수료 할인 또는 리베이트(reduced fees and rebates), 주문 취소율(order cancellation rates) 확대 등 현지 시장조성자와 같은 혜택을 받을 수 있다. 또한, 홍콩, 싱가포르, 일본 등의 시장에서는 거래소 회원사가 아니더라도 시장조성자로 활동할 수 있는 원격 참여(remote participation) 프로그램이 마련되어 있다. 우리는 일본 시장에서도 로컬 브로커를 사용하고 있는데, 시장조성자로 등록하면 로컬 플레이어와 동등한 혜택이 주어진다. 그 조건으로 우리는 일정 시간 동안 최대 일정 수준의 호가를 제시해야 한다. 이러한 시스템은 공정한 경쟁을 촉진하고 궁극적으로 투자자에게 이익이 되는 시장 환경을 조성한다. (시장조성자)

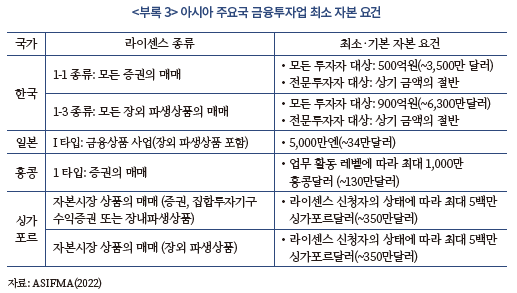

일부 인터뷰 참가자는 한국 시장의 진입장벽이 선진시장에 비해 높다고 설명한다. 특히 한 해외 금융회사는 한국 지점 설립을 검토하고 있으나, 최소 자본 및 인력 요건이 큰 부담이 된다고 설명한다. 이러한 높은 진입장벽은 해외 금융회사가 한국 시장에 진출하는 데 있어 중요한 장애물로 작용하고 있으며, 이를 완화하기 위한 정책적 고려가 필요하다고 제언한다.24)

우리는 홍콩, 싱가포르, 호주, 일본, 중국 등 아시아의 주요 시장에서 ETF에 특화된 시장조성자 사업을 하고 있다. 홍콩의 경우 현재 280개 정도의 ETF가 상장되어 있으며, 우리는 225개의 ETF에 대한 시장조성자 역할을 하고 있다. 한국 시장에도 참여하고 있으며, 한국 ETF 시장도 거래량 기준으로 세계 5~6위에 속하는 매우 매력적이고 성장성이 높은 시장이다. 이에 따라 우리 회사는 한국 시장에 진출하기 위해 서울에 영업소 설립을 검토하고 있다. 그러나 한국 시장의 진입장벽이 높은 점이 문제다. 최소 자본 요건도 상대적으로 높지만 10명 이상의 인력을 두어야 하는 규정이 상당히 부담스럽다. 현재 한국에서 본격적으로 활동하고 싶은 해외 금융회사는 완전한 브로커리지로 설립되어야 하며, 여기에는 고객과 관련한 각종 요건이 수반된다. 우리와 같은 금융회사는 사실상 고객이 없고 시장조성이 유일한 사업이다. 한국에서는 라이선스를 위해 최소 10명의 인력과 6,200만 달러를 투자해야 하는데 이는 다른 시장에 비해 매우 높은 기준이다. 예를 들어 싱가포르에서는 350만달러와 인력 요건이 없고, 홍콩에서는 40만 달러와 인력 요건이 없으며 일본도 약 35만 달러와 인력 요건이 없다. 현재는 우리는 한국 시장을 탐색하는 단계이기 때문에 사실상 필요한 인력은 2~3명 정도면 충분하다. 나중에 사업이 잘되면 인력을 확장해서 10명 또는 그 이상을 둘 수 있다. 하지만 처음부터 장벽이 너무 높으면 시장참여 자체를 포기할 수 있고, 이는 매우 안타깝게 느껴진다. (시장조성자)

선진시장에서는 경쟁이 더 자유롭고 다양한 역랑을 가진 플레이어들이 경쟁하는 반면, 한국 시장은 보호주의적이고 제한적인 경향이 있다. 이러한 제한은 시장의 발전과 혁신을 억제할 수 있다. 따라서 한국 시장은 더 열린 경쟁 환경을 조성하고 해외 금융회사의 진입을 촉진하는 노력이 필요하다. 한국의 금융투자업은 경쟁이 제한적인 것으로 여겨지고 있다. 이는 다양한 대형 및 중소형 금융회사가 치열하게 경쟁하는 선진시장의 구조와 대조된다. 이러한 구조는 로컬 금융회사를 보호하는 데 효과적일 수 있지만, 그 비용은 투자자가 부담하게 되고, 한국 자본시장의 혁신을 제한하는 요인이 될 수 있다. 해외 금융회사는 규모와 상관없이 한국 시장에서 공정하게 경쟁하고, 그들이 기여한 만큼 보상을 받을 수 있는 시스템이 마련되기를 원한다. 이를 위해 한국 시장은 더 개방적이고 경쟁을 촉진하는 방향으로 나가야 한다. (시장조성자)

우리 회사는 전 세계적으로 활동하는 시스템트레이더이며, 아시아 시장에 진출한 지는 20년이 넘었다. 한국 시장의 문제 중 하나는 경쟁이 부족하다는 것이다. 이로 인해 시장이 정체되어 있다. 특히 한국처럼 ‘코리아 디스카운트’가 있는 경우 경쟁을 환영해야 한다. 시장의 경쟁력을 제고하는 데 있어서는 우리와 같은 시스템트레이더의 역할도 중요하다. 다양한 플레이어들이 시장에 참여해야 경쟁이 촉진되고 효율성이 증진된다. 그러나 우리와 같은 시스템트레이더는 늘 의심의 눈초리로 바라보는 경향이 있다. 시스템트레이더들은 누구보다 리스크 관리와 준수에 많은 시간과 돈을 투자하고 있다. 가끔 문제가 발생하는 경우가 있지만, 이를 방지하기 위해 꾸준히 노력하고 있다. 이 산업은 매우 잘 통제된 하이테크 산업으로, 누군가가 체계적으로 산업에 불법적으로 영향을 미치려고 한다면 이를 숨기기는 매우 어렵다. 대부분 시스템트레이더는 글로벌 평판을 유지하기 위해 리스크 관리에 매우 열심히 노력하고 있다. (시스템트레이더)

8) 소통

다수의 인터뷰 참가자는 시장접근성을 높이는 가장 효과적인 방법으로 소통 강화를 제언한다. 일부 인터뷰 참가자는 규제 변경 없이도 소통의 강화만으로 한국의 시장접근성 평가가 제도될 수 있다고 설명한다. 소통의 개선이 가장 필요한 부분으로는 주요 제도나 규제의 변경에 있어서 해외 금융기관을 대상으로 하는 의견 수렴, 즉 컨설테이션이 충분하지 못하고 주로 형식적으로만 이루어진다는 점을 지적한다. 특히 이러한 형식적인 컨설테이션이 주요 선진시장의 절차 및 관행과 대조된다는 점을 강조한다. 이를 개선하기 우해 실질적으로 적극적인 의견 수렴 과정을 도입해야 하며, 해외 금융기관들이 제기하는 의견과 제안을 보다 진지하게 고려하는 자세가 필요하다고 제언한다.

한국이 선진시장으로 격상되기 위해서는 단순히 MSCI나 FTSE Russell이 지적하는 요구 사항을 형식적(checking-off boxes)으로 대응하는 방식으로 접근해서는 안 된다. 또한, 제도나 규제의 차원에서만 접근하는 경우 원하는 결과를 얻지 못할 수 있다. 진정한 개선을 위해서는 문제의 원인을 이해해야 하고, 무엇보다 소통이 중요하다. 한국의 시장접근성은 규제 변경 없이도 제고할 수 있는 부분이 많다. 기존의 틀을 유지하면서도 효율성을 높이는 방안들이 있다. 그리고 우리는 이러한 문제들을 선진시장의 경험과 전문가를 지원해 함께 풀어나가고자 한다. (글로벌 자산운용사)

한국의 경우 외국인 투자자 및 해외 금융회사에도 영향을 미치는 중요한 제도 변경을 시장과의 충분한 소통 없이 발표하는 경우가 빈번하다. 또한, 영문 보도자료 등의 제공도 부족하여 현지 법률사무소를 통해 해당 내용을 번역하고 법률적 해석을 받아야 하는 비용이 발생한다. 주요 선진시장의 경우 중요한 제도 변경에 있어서는 1년 이상의 충분한 검토 기간을 두고 마련한다. 또한, 이러한 과정에는 시장의 주요 이해관계자가 참가하고 의견을 수렴하는 컨설테이션(consultation) 절차를 두고 있다. 한국의 경우에도 해외 금융회사의 의견을 수렴하는 경우가 있지만, 내용을 검토하고 의미 있는 의견을 제시하기 위한 충분한 시간을 주지 않는 경우가 많다. 이러한 의견 수렴 절차는 다소 형식적으로 받아들여지고 있다. (글로벌 은행)

새로운 제도를 마련하는 데 있어서 사전에 시장의 의견을 충분히 수렴하는 것은 제도의 실효성 측면에서 매우 중요하다. 그러나, 한국의 경우 사전적 의견 수렴 없이 단순히 새로운 제도를 발표하는 경우를 많이 경험했다. 이 때문에 새로운 제도가 시장에 도입된 이후 부작용이 발생하는 경우가 생긴다. 이러한 부작용은 사전에 의견 수렴을 충실히 한다면 충분히 예견하고 방지할 수 있다. 2017년 도입된 옴니버스 계좌가 이러한 점들을 보여주는 사례다. 옴니버스 계좌를 도입하기에 앞서 해외 금융회사의 의견을 심도 있게 들어보고 제도에 반영했다면 지금처럼 옴니버스 계좌가 유명무실해지지 않았을 거라고 생각한다. (글로벌 커스터디은행)

한국의 컨설테이션은 아시아의 다른 시장에서 경험하는 컨설테이션과는 매우 다르다. 선진시장의 컨설테이션은 진정한 컨설테이션이다. 선진시장의 컨설테이션은 해결하고자 하는 문제와 계획이 무엇인지, 금융회사의 비즈니스와 시장에 어떻게 영향을 미치는지, 그리고 의도하지 않은 부작용은 무엇인지 등을 심도 있게 논의한다. 반면 한국에서는 현지 브로커들을 통해 정보가 전달된다. 현지 브로커는 해외 금융회사를 고객으로 두고 있지만 해외 금융회사를 대표하는 것은 아니다. 현지 브로커들은 해외 금융회사의 의견을 구하기도 하지만, 이는 주로 형식적이다. 새로운 규정이 이미 상당 부분 정해진 상태에서 의견을 구하는 것은 사실상 통보라고 볼 수 있다. (시스템트레이더)

해외 금융기관도 한국 자본시장의 발전을 원하며, 이를 위해 도움이 되는 의견을 제시하고 싶어 한다. 우리가 원하는 것은 해외 금융회사에게만 유리한 시장 규제나 환경을 마련하는 것이 아니다. 해외 금융회사들이 바라는 한국 자본시장의 모습은 해외나 국내 금융회사의 차별 없이 공정하고, 시장 발전에 기여하는 만큼 보상받는 구조이다. 특히 한국에서는 일부 대형 글로벌 금융회사의 의견은 참조하지만, 우리와 같은 작은 금융회사는 한국의 주요 관계자를 만나고 논의할 수 있는 기회가 제공되지 않는다. 한국은 해외 금융회사 중에서는 대형사만 시장에 참여하기를 바라는 것처럼 느껴진다. (시장조성자)

V . 결론 및 시사점

한국 자본시장은 세계 상위권에 속하는 규모에 비해 저평가되고 있다. MSCI 및 FTSE Russell이 한국 자본시장을 신흥시장으로 분류하는 이유는 시장접근성이 떨어지는 것으로 보기 때문이다. 따라서 한국 자본시장의 선진시장 격상은 시장접근성 제고에 달려 있다. 그러나 MSCI 및 FTSE Russell이 요구하는 선진시장 수준의 시장접근성을 달성하는 것은 쉽지 않은 과제다. 시장접근성 제고를 위해서는 일정 수준의 제도 변경이 필요하며, 일부는 기존 정책 목적과 상충될 수 있다. 또한 시장접근성을 어떻게 제고하고 얼마만큼 해야 하는지도 불명확하다. 그럼에도 불구하고 MSCI 및 FTSE Russell의 시장접근성 기준을 이해하고, 해외 금융기관과의 인터뷰 내용을 참작해보면, 시장접근성 제고를 위한 몇 가지 원칙이 제시된다.

첫째, 시장접근성 제고는 포괄적인 관점으로 접근해야 한다. 시장접근성은 외국인 투자자 입장에서 전체적 투자과정의 용이성 및 효율성을 평가하는 것이다. 투자과정의 특정 단계나 부분만 개선하고 다른 부분에 문제가 남아 있을 경우 시장접근성 제고로 인정받지 못할 수 있다. 최근 정부가 발표한 각종 시장접근성 개선 방안에 관해서도 외국인 투자자 관점에서 정책이 의도한 효과를 낼 수 있는지 확인하는 데 주의를 기울여야 하며, 이와 더불어 누락된 부분이 남아 있는지를 확인하는 것도 중요하다. 고무적인 측면은 시장접근성의 사항들이 서로 상호작용하기 때문에 핵심 사항의 해결로 여러 연계된 부분들이 함께 해소될 가능성이 있다는 점이다.

둘째, 시장접근성 제고에는 절차와 관행이 포함되어야 한다. MSCI 및 FTSE Russell의 시장접근성은 단순히 제도나 규제의 평가에 그치지 않고, 이러한 제도와 규제가 외국인 투자자에 어떻게 영향을 미치는지를 평가하는 것이라고 밝히고 있다. 해외 금융기관과의 인터뷰에서도 한국 시장접근성의 많은 문제가 제도나 규제 자체에서 있는 것이 아니라 이러한 제도와 규제가 적용되는 투명성, 일관성 및 예측 가능성에서 비롯된다고 강조한다. 따라서 시장접근성 제고 계획은 한국 자본시장에 자리잡고 있는 절차, 관행 및 문화 개선을 위한 조치도 포함되어야 한다.

셋째, 시장접근성 제고에는 외국인 투자자 및 해외 금융기관과의 소통이 중요하다. MSCI 및 FTSE Russell의 정책에 의해 해외 금융기관은 시장접근성 평가의 주요 결정자 역할을 한다. 시장접근성 개선 방안이 아무리 잘 설계되었더라도 해외 금융기관의 동의를 얻지 못하면 무용지물이 될 수 있다. 따라서 시장접근성 제고 방안이 의도한 효과를 충분히 달성하려면, 계획의 초기 단계부터 해외 금융기관과 적극적으로 소통하고, 충분한 시간을 제공하여 의미 있는 피드백을 받을 수 있도록 하는 것이 중요하다.

종합해보면 시장접근성을 개선하기 위해서는 외국인 투자자의 전체적인 투자 과정을 다루는 포괄적인 접근이 필요하다. 이러한 전체 투자 과정에는 금융당국, 시장 인프라 기관, 국내 금융회사 등 많은 이해관계자가 역할을 하기 때문에 다양한 주체 간의 협력을 기반으로 한 시장접근성 개선 방안을 개발하는 것이 중요하다. 또한 이러한 과정에는 다양한 해외 금융기관의 참여도 포함되어야 한다.

1) 이승호(2022), 김한수(2023)

2) MSCI는 ‘Global Market Accessibility Review’, FTSE Russell은 ‘Fixed Income Country Classification Announcement’를 주기적으로 발간한다.

3) 이승호(2022), 김한수(2023)

4) 2023년 현재 MSCI World Index에 속해있는 23개국 중 중국 및 말레이시아를 제외하고 모두 완전 교환가능 통화(fully convertible currency)를 두고 있다. 반면, 원화의 경우 부분 교환가능 통화(partially convertible currency)로 구분된다.

5) NDF 시장에서 결제는 일반적으로 미국 달러로 이루어진다. NDF는 현물 결제가 없는 선물 계약으로, 계약 만기 시점에 계약된 환율과 실제 현물 환율의 차액을 미국 달러로 결제한다.

6) 이러한 지적은 본 보고서의 작성 당시 가장 최근 발간된 2023년 3월 MSCI 시장접근성 보고서(MSCI Global Market Accessibility Review)에 포함되어 있는 내용이며, 금융당국은 2023년 12월 한시적 공매도 전면 금지를 발표하였다.

7) 이승호(2022)

8) FTSE Russell(2018)

9) 김한수(2023)

10) 한국의 경우 2009년에서 2010년 사이 한국예탁결제원(Korea Securities Depository: KSD)이 유로클리어와의 업무 연계를 통해 국채통합계좌를 도입하였으나, 이후 외국인 국채투자에 대한 비과세 철회, 선물환 포지션 규제, 외환 건전성 관리 강화 등의 조치가 시행되면서 운영이 중단되었다.

11) 본 보고서에서는 기획재정부, 한국은행, 금융위원회, 금융감독원, 한국거래소, 예탁결제원 등이 공동으로 마련한 정책 등에 대한 주체를 편의상 ‘정부’로 통칭한다.

12) 관계기관 합동(2023. 2. 7)

13) 관계기관 합동(2023. 1. 20)

14) 기획재정부(2024. 2. 21)

15) MSCI(2023)

16) FTSE Russell(2022)

17) ASIFMA는 아시아 지역 증권 산업 및 금융시장을 대표하는 비영리 협회이며, 아시아 지역에서 활동하는 159개의 금융기관을 회원사로 두고 있다. ASIFMA는 MSCI 및 FTSE Russell의 시장접근성 평가 및 국가 분류에 있어서 자문과 의견을 제공하는 주요 금융기관에 포함된다.

18) 소개되는 주제는 인터뷰 당시 참가자가 가장 중요하게 여기는 사항들이다.

19) 일부 인터뷰 참가자들은 이러한 한국 옴니버스 계좌의 문제가 IRC 폐지의 효과를 낮게 평가하는 이유라고 설명한다.

20) 명의자 모델에서는 고객 자산이 금융회사 명의로 등록되지만, 각 고객의 자산은 개별적으로 분리된 계좌에서 관리된다. 이러한 통합계좌 모델은 개별 고객의 자산이 명확하게 구분되어 투명성과 안정성의 이점을 지니지만, 계좌 관리의 복잡성 및 비용이 증가하게 된다. 옴니버스 모델의 경우 고객 자산이 금융회사 명의로 등록되고, 여러 고객의 자산이 하나의 통합계좌에서 함께 관리된다. 이러한 방식은 관리의 효율성 및 비용 절감의 장점을 지니지만 단점으로는 자산의 투명성이 낮아지고, 개별 고객의 자산을 식별하고 보호가 어려울 수 있다.

21) 한국거래소는 여타 주요 거래소와 마찬가지로 이상·불공정거래를 감시하는 시스템을 두고 있다. 해당 시스템에서 이상·불공정한 것으로 의심되는 거래가 포착될 경우 거래소는 투자 주문자에게 경고를 통보할 수 있다. 외국인 투자자의 경우 이는 투자를 중개하는 현지 증권사를 통해 경고가 전달된다. 또한 심각성이 높은 것으로 판단되는 이상거래의 경우 시장감시위원회의 심의를 통해 불공정거래 여부를 판단하고 벌금 등을 부과할 수 있다. 나아가 특정 기간 내에 일정 수의 경고 건수가 누적될 경우 거래정지 명령이 내려질 수 있다.

22) 인터뷰 관계자가 언급하는 예외 경우와 관련해서는 <부록 1>을 참고할 수 있다. 홍콩의 경우 무차입 공매도를 원칙적으로 금지하고 있지만, 홍콩증권선물위원회(Securities and Futures Commission: SFC)의 공매도 지침(The Guidance Note on Short Selling Reporting and Stock Lending Record Keeping Requirements)에서는 무차입 공매도에서 제외되는 다양한 예시를 열거하고 있다.

23) 홍콩의 경우 장내거래상품에 대해 ‘지정전문가(Designated Specialist: DS)’ 프로그램을 도입하여 홍콩거래소 회원사가 아니라도 모든 장내거래상품(Exchange Traded Products: ETP)의 시장조성 활동 참여가 허용된다. 일본의 경우 2018년 7월부터 ‘고빈도 거래자(High Frequency Trader)’로 등록한 거래소 비회원 시장조성자의 시장참여를 허용하고 있다. 또한 도쿄거래소(Japan Exchange: JPX), TSE 및 오사카거래소는 ‘원격 거래 참여자(Remote Trading Participant: RTP)’ 체제를 도입하여 해외 증권 투자중개업자가 일본에 사업체를 두지 않고도 거래소 시장에 직접 참여가 가능하다. 호주, 싱가포르 또한 거래소 비회원의 시장조성자 활동을 허용하고 있다

(<부록 2>).

24) <부록 3>은 아시아 주요 시장의 진입 요건을 보여준다.

참고문헌

기획재정부, 2024. 2. 21, 외국인투자자들의 국내 주식‧채권 투자를 위한 원화거래가 편리해집니다, 보도자료.

관계기관 합동, 2023. 1. 20, 외국인 투자자의 자본시장 접근성 제고방안, 보도자료.

관계기관 합동, 2023. 1. 31, 글로벌 스탠더드에 부합하는 배당절차 개선방안, 보도자료.

관계기관 합동, 2023. 2. 7, 글로벌 수준의 시장접근성 제고를 위한 외환시장 구조 개선방안, 보도자료.

김한수, 2023,『세계국채지수(WGBI) 편입에 따른 영향 및 시사점』, 자본시장연구원 이슈보고서 23-02.

이승호, 2022,『MSCI 선진국지수 편입의 효과, 선결과제 및 시사점』, 자본시장연구원 이슈보고서 22-06.

ASIFMA, 2022, Korea Capital Markets 2022 and Beyond: Opportunities and Challenges.

FTSE Russell, 2023, FTSE Fixed Income Country Classification Announcement, March.

FTSE Russell, 2022, FTSE Fixed Income Country Classification Process.

FTSE Russell, 2018, FTSE Fixed Income Client Consultation: Fixed Income Country Classification Framework.

MSCI, 2023, MSCI Global Market Accessibility Review.

MSCI, 2022, MSCI Market Classification Framework.

<부록>

한국 자본시장은 세계 상위권에 속하는 규모에 비해 걸맞지 않은 평가를 받고 있다. 2022년 기준 한국 주식시장 시가총액은 2.2조달러로 세계 11위, 상장기업 수는 2,318개로 세계 8위 자리를 차지하고 있다. 또한 2022년 한국 채권시장 발행잔액은 2.2조달러로 세계 11위 국가에 속하며, 아시아 지역에서는 중국, 일본 다음으로 큰 시장을 형성하고 있다. 그럼에도 불구하고 일부 글로벌 지수기관은 한국 자본시장을 신흥시장으로 분류하고 있다. 대표적으로 MSCI 및 FTSE Russell이 각각 한국 주식, 국채를 신흥시장지수에 포함하고 있다.

MSCI 및 FTSE Russell이 한국을 신흥시장으로 분류하는 이유는 시장접근성(market accessibility)에 있다. MSCI 및 FTSE Russell은 지수에 포함할 국가를 결정하기 위한 국가 분류 기준을 두고 있으며, 이는 양적 평가와 질적 평가로 구성되어 있다. 한국은 두 지수기관이 사용하는 양적 평가에서 선진시장 기준을 충분히 충족하고 있지만, 시장접근성으로 명칭되는 질적 평가에 있어서 선진시장 수준을 하회하고 있다. 따라서 한국 자본시장이 선진시장으로 분류되기 위해서는 MSCI 및 FTSE Russell이 정의하는 시장접근성의 제고가 필요하다.

한국 자본시장의 시장접근성을 논의하기에 앞서 MSCI 및 FTSE Russell이 말하는 선진시장이 무엇인지를 생각해볼 필요가 있다. 일반적으로 선진지장이라고 하면 시장의 발전도, 고도화, 성숙도 등 ‘선진성’을 의미하는 것으로 이해된다. 그러나 MSCI 및 FTSE Russell의 국가 분류 기준, 특히 시장접근성 기준은 기본적으로 외국인 투자자 및 해외 금융기관의 관점에서 특정 시장이 전체적 투자 과정의 편의성과 효율성을 갖추고 있는지를 평가하는 것이다. 이러한 부분들은 시장의 ‘선진성’과 일부 연계성을 지니고 있지만, 엄밀하게 보면 ‘선진성’과 일치하는 것은 아니다. 그럼에도 불구하고 한국 자본시장이 선진시장 지위를 확보하는 것은 중요하게 여겨지며, 한국 정부가 오랜 기간 추진해 온 정책과제에 포함된다. 우선 선진시장 격상은 상징적인 의미를 가지며, 대내외적으로 한국 자본시장의 위상을 높이는 계기가 될 수 있다. 나아가 MSCI 및 FTSE Russell의 선진시장지수 편입 시 이에 따른 경제적인 효과도 기대된다. MSCI 및 FTSE Russell 지수는 외국인의 글로벌 투자 포트폴리오 구성에 벤치마크로 활용되는 만큼 선진시장지수 편입은 한국 자본시장에 대한 투자 증가로 이어질 것으로 예상된다. 이와 더불어 선진시장지수 포함은 외국인 투자자 구성 측면에서도 긍정적 효과가 기대된다. 선진시장지수 편입으로 연기금, 국부펀드 등 장기투자 성향의 외국인 투자자 비중이 증가하면 시장 안정성도 높아질 수 있다.1)

실효성 있는 시장접근성 제고 방안을 마련하기 위해서는 해외 금융기관이 한국 자본시장을 바라보는 시각에 대한 이해가 필요하다. 그 이유는 MSCI 및 FTSE Russell이 특정 국가의 시장접근성을 자체적으로만 판단하는 것이 아니라 글로벌 자산운용사, 은행, 기관투자자 등 주요 해외 금융기관의 의견을 수렴하여 국가 분류 결정에 반영하기 때문이다. MSCI 및 FTSE Russell은 국가 분류 의사결정에 앞서 해당 시장에서 활동하는 해외 금융기관을 대상으로 설문조사 등을 실시하여 평가에 반영한다. 이는 시장접근성이 특정 국가의 제도나 규제만을 보는 것이 아니라 제도와 규제가 외국인 투자자 및 해외 금융회사의 입장에서 어떻게 작동하는지를 포괄적으로 검토하기 위한 것이다. 그러나 MSCI 및 FTSE Russell이 주기적으로 발간하는 자료만으로는 이러한 해외 금융기관의 시각을 파악하기 어렵다. 해당 자료는 해외 금융기관의 의견이 간략하게만 요약되고, 문제의 배경 등 자세한 내용이 생략되어 있기 때문이다.2)

본 보고서는 한국 자본시장의 시장접근성에 대한 해외 금융기관의 시각을 소개하는 데 목적을 두고 있다. 이를 위해 현재 한국 자본시장에 참여하고 있는 주요 해외 금융기관과의 인터뷰를 진행하였다. 인터뷰 대상은 글로벌 은행, 자산운용사, 커스터디은행, 증권회사, 시장조성자, 헤지펀드, 시스템트레이더 및 주요 금융협회 관계자를 포함한다. 인터뷰에 참여한 해외 금융기관 수는 15개, 참여 인원 수는 45명에 달한다. 유념할 점은 본 보고서의 목적이 해외 금융기관의 입장을 대변하거나 정당성을 부여하고자 하는 것이 아니라는 것이다. 해외 금융기관의 시각은 주관적인 측면이 있더라도 시장접근성 평가에 중요하게 작용하기 때문에 그 내용을 소개하고자 하는 것이다.

본 보고서의 구성은 다음과 같다. II장에서는 한국 자본시장의 양적 및 질적 위상을 살펴보며, 시장 규모 측면에서 한국 주식시장 및 채권시장의 위치와 MSCI 및 FTSE Russell의 국가 분류를 비교한다. III장에서는 한국 자본시장이 신흥시장으로 평가되는 이유를 MSCI 및 FTSE Russell의 시장접근성 기준 관점에서 살펴보며, 이와 함께 최근 정부가 발표한 시장접근성 개선 방안의 주요 내용을 정리한다. IV장에서는 인터뷰를 통해 파악된 한국 자본시장의 시장접근성에 대한 해외 금융기관의 시각을 소개한다. 이 장의 구성은 인터뷰 인용문 중심으로 구성되어 있다. 마지막으로 V장에서는 한국 자본시장의 시장접근성 제고 방안 마련에 고려해야 할 주요 사항을 제시한다.

II . 한국 자본시장의 위상

1. 한국 자본시장의 양적 위상

자본시장의 수준을 결정하는 절대적 기준은 없으나, 일반적으로 자본시장에 대한 평가는 양적 측면과 질적 측면을 함께 고려한다. 양적인 측면에서 한국 자본시장은 선진시장 반열에 포함될 충분한 자격을 지니고 있다.

<그림 II-1>은 주식시장 및 채권시장 규모 상위 20개 국가 순위를 보여준다. 2023년 2/4분기 기준 한국 주식시장 시가총액은 2.2조달러로 세계 10위 국가 자리를 차지하며, 아시아에서는 중국, 일본 다음으로 큰 시장이다. 2022년 3/4분기 기준 한국 채권시장 발행잔액은 1.8조달러 수준으로 세계 13위 자리를 차지하며, 아시아에서는 일본, 중국, 호주 다음으로 큰 시장이다. 이와 더불어 한국 자본시장은 상장기업 수, 채권발행 기업 수, 주식 및 채권 거래량, 파생상품 시장 규모 등 다양한 양적 측면에서 세계 상위권에 속한다.

2023년 상장잔액 기준 외국인 투자자의 국내 채권 보유 금액은 243조원에 달하며, 이는 국내 채권시장의 9.7% 수준이다. 외국인 투자자의 국내 채권 투자 상장잔액은 2015년 102조원에서 2023년 243조원으로 2배 이상 증가하였다. 외국인 투자자는 주로 국내 국채에 투자하며, 2023년 외국인의 국내 채권 보유금액은 국채 90.4%, 특수채 9.5% 및 회사채 0.1%로 구성되어 있다. 한국 국채의 외국인 투자자 비중은 상장잔액 기준 2015년 12.7%에서 2023년 20.4%로 증가하는 추세를 보이고 있다.

한국 자본시장은 규모적으로 세계 상위권에 속하지만, MSCI 및 FTSE Russell은 각각 한국 주식 및 채권 시장을 신흥시장으로 분류하고 있다. 다음으로는 MSCI 및 FTSE Russell의 국가 분류 현황을 살펴본다.

가. MSCI의 주식시장 분류

<표 II-1>은 2023년 현재 MSCI의 주식시장지수 국가 분류 현황을 보여준다. MSCI는 각국의 주식시장을 평가하여 선진시장, 신흥시장, 프런티어시장으로 분류하고, 이에 기반하여 선진시장지수(MSCI World Index), 신흥시장지수(MSCI Emerging Market Index), 프런티어시장지수(MSCI Frontier Market Index)에 포함한다. MSCI의 주식시장지수에 포함된 국가 수는 75개에 달하며, 이는 선진시장 23개, 신흥시장 24개, 프런티어시장 28개로 구성되어 있다.

2023년 현재 한국 주식시장은 MSCI에 따라 신흥시장으로 분류되며, 아시아 지역에서는 중국, 인도, 인도네시아, 말레이시아, 필리핀, 대만 및 태국이 같은 그룹에 속해있다. 앞서 살펴본 바와 같이 2023년 2/4분기 기준 한국 주식시장 시가총액은 세계 10위 자리를 차지하고 있으며, MSCI 주식시장 지수에 포함되는 75개 국가 중 65개 국가보다 규모가 크다. 한국 주식시장은 MSCI World Index에 포함된 23개 국가 중 14개 국가보다 높은 시가총액을 기록하고 있다. 또한, MSCI World Index의 아시아 지역 국가 중 일본을 제외한 나머지 5개 국가보다 한국의 시가총액이 높다.

<표 II-2>는 2023년 현재 FTSE Russell의 국채지수 국가 분류 현황을 보여준다. FTSE Russell의 주요 국채지수에는 선진시장국채지수(World Government Bond Index: WGBI), 신흥시장국채지수(Emerging Market Government Bond Index: EMGBI) 및 프런티어신흥시장국채지수(Frontier Emerging Government Bond Index: FTEMGBI)가 있다. FTSE Russell의 국채지수에는 총 52개 국가가 포함되어 있으며, 이는 선진시장 24개, 신흥시장 18개, 프런티어신흥시장 15개 국가로 구성되어 있다. FTSE Russell의 국채지수는 포함하는 국가에 있어서 배타적이지 않기 때문에 하나의 국가가 복수의 지수에 포함될 수 있다. 중국, 말레이시아, 멕시코, 남아프리카 공화국 및 태국이 WGBI 및 EMGBI 지수에 동시 포함되어 있다. 이들 국가의 채권시장은 신흥시장의 성격을 지니면서 동시에 선진시장의 기준을 만족하는 ‘교차시장(crossover markets)’으로 정의되어 선진시장 및 신흥시장 국채지수에 동시 포함된다.

2023년 현재 한국 국채는 FTSE Russell의 신흥시장지수(EMGBI)에 포함되어 있으며, 아시아 지역에서는 중국, 말레이시아, 인도네시아, 필리핀, 인도 및 태국이 같은 그룹을 형성한다. 2023년 3/4분기 기준 한국 국채 발행잔액은 FTSE Russell 국채지수에 포함된 52개 국가 중 41개 국가, WGBI에 포함된 24개 국가 중 15개 국가보다 큰 수준이다. 또한, 한국 국채 발행잔액은 WGBI에 포함된 6개 아시아 국가 중 중국 및 일본을 제외한 4개 국가보다 큰 규모다. 2023년 3/4분기 기준 한국 국채 발행잔액은 WGBI에 포함된 호주의 1.6배, 인도네시아의 2.0배, 말레이시아의 3.5배, 싱가포르의 4.8배 수준이다.

III. 한국 자본시장의 시장접근성

1. MSCI 및 FTSE Russell 국가 분류 기준

MSCI 및 FTSE Russell은 주요 지수에 포함될 국가를 결정하기 위한 국가 분류 기준을 두고 있다. 두 지수기관의 국가 분류 기준은 정량적 기준과 정성적 기준으로 구성되어 있으며, 정성적 기준은 시장접근성으로 명칭한다. <표 III-1>은 MSCI 및 FTSE Russell의 선진시장지수에 포함되기 위한 정량적 기준을 보여준다. 현재 한국 주식시장 및 국채시장은 두 지수기관의 정량적 기준을 모두 충족하고 있다.3)

가. MSCI 주식시장 시장접근성 기준

<표 III-2>는 MSCI가 사용하는 주식시장 시장접근성 기준을 보여준다. MSCI의 시장접근성 기준은 5개 범주 및 18개의 세부 항목으로 구성되어 있다. MSCI의 시장접근성 기준은 몇 가지 주요 특징을 지닌다. 첫째, 시장접근성은 기본적으로 외국인 투자자 관점에서의 평가다. 시장접근성의 일부 항목은 국내외 투자자 모두에게 적용되지만, 다수 항목은 외국인 투자자 전용 사항이다. 둘째, 시장접근성은 투자의 전체적 과정을 살펴보는 것이다. 여기에는 투자자 등록부터 청산결제까지 투자의 모든 단계를 포함한다. 셋째, 시장접근성은 정성적 평가라는 점이다. 시장접근성의 내용을 살펴보면 ‘효율성’, ‘투명성’, ‘일관성’, ‘시의성’ 등 주관적 판단의 여지가 상당히 많다.

1) 외환시장 자유화

MSCI가 한국 외환시장에 대해 지적하는 사항은 역외 외환시장의 부재와 역내 외환시장의 제약이다. 이와 관련하여 MSCI가 추가적인 설명을 제공하지는 않지만, 주요 문제점은 다음으로 파악된다. 첫째, 역외 외환시장의 부재는 외국인의 한국 주식투자를 위한 자금조달 및 환율 리스크관리를 어렵게 만든다. 이 부분은 외국인의 국내 채권 투자에도 동일하게 적용되는 사항이다.4) 원화 역외 외환거래시장은 차액결제선물환(Non-deliverable Forward: NDF) 시장이며, NDF 시장의 경우 환율 헤지의 기능을 일부 제공하지만, 증권 투자나 결제를 위한 자금조달의 수단으로 기능하기는 어렵다.5) 따라서 외국인은 투자 및 결제 자금조달을 위해 역내 외환시장을 활용해야 한다.

역내 외환시장의 경우 MSCI가 구체적으로 언급하지는 않으나, 외환거래 시간의 제약과 외환거래시장의 경쟁도를 문제 삼고 있는 것으로 파악된다. 우선 역내 외환거래 시간은 증시 마감과 겹쳐서 외국인 투자자는 결제 자금을 전날 또는 익일 조달해야 하며, 이로 인해 환율 변동의 오버나이트(overnight) 리스크를 부담해야 한다. 또한, 역내 외환거래시장은 외환당국으로부터 외국환은행 허가를 받은 국내 금융기관만 참여할 수 있는 규제를 두고 있다. 이로 인해 외국인 투자자의 관점에서는 원화 거래 선택지가 제한되고 환전 비용이 증가한다.

2) 외국인 투자자 등록 및 개좌 개설

MSCI는 외국인 투자자 등록 및 계좌 개설에는 ‘상당한(significant)’ 양의 증빙서류와 기간이 소요되는 점을 개선이 필요한 사항으로 지적한다. 외국인 투자자는 한국 상장증권에 투자하기에 앞서 금융감독원에 외국인 투자자로 등록하고 승인을 받도록 되어 있다. 금융감독원의 승인을 받은 외국인 투자자에게는 외국인투자등록증(Investment Registration Certificate: IRC)이 부여되고 계좌 관리는 IRC 단위로 이루어진다. 우선 이러한 외국인 투자자 등록 의무화는 선진시장에는 없는 제도로, 이에 수반되는 비용과 절차가 문제점으로 추정된다. 이와 더불어 IRC 발급 및 계좌 개설을 위한 증빙서류, 기간 등 절차적인 부분이 선진시장에 비해 과도하다고 평가하는 것으로 해석할 수 있다.

3) 정보흐름 및 외국인 투자자 동등 권리

MSCI는 ‘정보흐름’ 세부 항목에서 한국 기업의 영문 공시 부족 및 배당절차를 문제점으로 지적한다. 영문 공시를 제공하는 기업 수와 공시의 범위가 늘어나고 있지만, 선진시장에 비해서는 여전히 부족한 것으로 평가하는 것으로 볼 수 있다. 기업 영문 공시 부족은 시장접근성의 ‘외국인 투자자 동등 권리’ 세부 항목에서도 지적되는 사항이다. 이는 기업 영문 공시가 외국인 투자자 입장에서 정보 제공의 측면과 더불어 외국인에 대한 차별로 보고 있음을 시사한다. 국내 기업 배당절차와 관련해서는 선진시장의 표준과 달리 국내에서는 배당기준일 이후 배당금이 공시되며, 예상 배당금 정보가 미제공되는 부분을 문제점으로 삼고 있는 것으로 파악된다. 또한, 외국인 투자자 동등 권리와 관련해서 MSCI는 국내 기업의 지배구조가 해외 기관투자자로부터 “종종 의문을 받고 있다(often questioned)”라고 설명하지만, 구체적으로 지배구조와 관련된 어떠한 부분들이 주요 문제점인지는 언급하지 않는다.

4) 청산 및 결제

청산결제에 대한 MSCI의 지적 사항은 외국인 통합계좌, 즉 옴니버스 계좌(omnibus account)와 관련되어 있다. 옴니버스 계좌는 여러 고객의 자산을 하나의 계좌로 통합하여 관리하는 수단으로, 금융기관은 중개인으로서 다수의 고객을 대신하여 증권을 보유하고 거래할 수 있다. 한국 정부는 2017년 외국인의 국내 증권 투자 편의성을 제고하기 위해 옴니버스 계좌 제도를 도입했다. 그러나 한국의 옴니버스 계좌는 일괄 매매주문이 가능하지만, 청산결제에 있어서는 통합계좌의 이점을 가지지 못한다. 이는 옴니버스 계좌를 사용하는 경우에도 최종투자자 단위로 거래내역을 결제 후 즉시(T+2) 금융감독원(Financial Investment Integrated System: FIMS)에 의무적으로 보고해야 하는 규정을 두었기 때문이다. 이러한 보고의무는 시세조작, 불법거래 등을 방지하기 위한 목적을 두고 있지만, 외국인 투자자의 입장에서는 옴니버스 계좌의 실효성을 떨어트리는 부작용을 지니며 이로 인해 한국의 옴니버스 계좌를 사용하는 해외 금융회사가 없는 상황이다. MSCI의 청산결제 관련 또 다른 지적 사항은 증권거래의 결제를 위한 원화차입기구(overdraft facility)의 부재다. 현재 국내 외환법규는 위기 시 외국인의 원화 투매 방지를 위해 원화 차입을 원칙적으로 금지하고 있다.

5) 공매도

MSCI는 한국의 공매도 재개 일정 불확실성을 시장접근성 문제로 지적한다. 한국 금융당국은 코로나19 위기 당시 2020년 3월 공매도를 한시적으로 금지하였다가 2021년 5월 코스피200 및 코스닥150 종목에 한해서 공매도를 재개하였다. MSCI는 공매도 전면 재개에 대한 일정이 공개되지 않고 있는 점을 문제로 지적하고 있다.6)

6) 제도의 안정성

MSCI는 한국 ‘제도의 안정성’을 개선 가능 수준으로 평가하고 있으나 이와 관련해서는 별도의 설명을 제공하지 않는다. 제도의 안정성에 대한 MSCI의 일반적인 설명은 “정부 개입의 실적과 현재의 외국인 투자 제한 수준”이다. MSCI는 정부 개입은 주로 과거 이력에 초점을 두고 있으며, 특히 위기 상황 시 외국인 투자자에 대한 차별 가능성을 염두에 두고 있다고 설명한다. 단정하기 어렵지만, 과거 한국의 공매도 금지 사례 등이 지적되는 것으로 추정해볼 수 있다.

7) 기타 시장접근성 개선 사항

MSCI는 앞서 소개된 내용 외에 추가적인 시장접근성 개선 사항을 지적한다. 첫째, 외국인 투자자가 활용할 수 있는 단순 이전(in-kind transfer) 및 장외거래가 제한적인 점이 문제로 제기된다. 국내에서 외국인 투자자의 상장증권 거래는 장내거래를 원칙으로 하고 있으며, 장외거래의 경우 금융감독원의 사전심사가 필요하다. 둘째, 주식시장 데이터 사용권에 대한 제한이 투자 수단 및 상품 범위를 제한한다고 주장한다. 해당 사항은 한국거래소가 산출하는 코스피200 등 지수사용권 제한과 관련된 것으로 파악된다.7) 셋째, 외국인 추가 투자 여력이 언급된다. 한국은 여타 국가와 마찬가지로 경제적, 안보적 보호를 위해 방송, 통신, 항공, 금융, 에너지 등 특정 산업에 속하는 일부 기업에 대한 외국인 투자자 지분한도를 두고 있다. MSCI는 외국인의 투자가능 지수(Investable Market Index: IMI)에 있어서 외국인 지분한도로 인해 포트폴리오의 1.0% 이상이 영향을 받을 경우 문제점으로 본다.

나. FTSE Russell 채권시장 시장접근성 기준

<표 III-5>는 FTSE Russell의 채권시장 시장접근성 기준을 보여준다. FTSE Russell의 채권시장 시장접근성 기준은 5개의 범주와 17개의 세부 항목으로 구성되어 있다. FTSE Russell은 시장접근성의 17개 세부 항목을 평가하여 종합적으로 개별 시장에 대해 Level 2(선진시장), Level 1(신흥시장), Level 0(프런티어시장)의 3개 등급을 부여한다. <표 III-5>는 채권시장 시장접근성에 대한 전반적인 기준이며, 국채시장에만 국한되지 않는다.

<표 III-5>에서 볼 수 있듯이, Level 2 등급을 받기 위해서는 17개 세부 항목 전체에 있어서 ‘완전 충족’ 수준의 평가를 받아야 한다. 개별 국가 국채가 WGBI에 포함되기 위해서는 정량적 기준을 충족하고 정성적 기준인 시장접근성 평가에서 Level 2 등급을 받아야 하며, 이와 더불어 IMF 또는 World Bank에 의해 신흥국 또는 선진국으로 분류되어야 한다. 경제개발 수준이 신흥국으로 평가되는 국가인 경우에도 국채가 WGBI에 포함될 수 있으며, 2023년 현재 중국 및 말레이시아가 그 경우에 속한다.8)

2023년 현재 한국은 IMF 및 World Bank에 의해 선진국으로 분류되지만, 채권시장은 FTSE Russell의 시장접근성 기준에 따라 Level 1 등급을 부여받고 있어서 신흥시장으로 분류된다. FTSE Russell은 국가 분류 조정 대상의 경우 ‘관찰대상국(watch-list)’으로 지정하며, 한국은 2022년 9월부터 WGBI 편입 대상인 관찰대상국에 포함되어 있다.

1) 외국인 차별적 과세제도

FTSE Russell은 주요 선진시장의 표준으로 자리 잡고 있는 외국인 국채 투자 비과세를 WGBI 편입의 명시적 조건으로 제시하고 있다.9) 한국의 경우 2009년 비거주자 채권 투자에 대한 비과세 조치를 시행한 후 WGBI 관찰대상국으로 지정되었으나, 2011년 1월 비과세 조치를 철회하였고 관찰대상국에서 제외되었다. 2022년 3분기 한국 정부는 외국인 국채 투자 비과세 세법개정안을 국회에 제출하였고, 2022년 12월 30일 국무회의에서 의결되어 2023년 1월 1일부터 적용되었다. 이에 따라 ‘외국인에 대한 차별적 과세 제도’ 이슈는 해소된 것으로 볼 수 있으며, FTSE Russell은 이러한 한국 정부의 시장접근성 개선 노력을 한국 국채의 WGBI 편입 의사결정에 고려할 것으로 설명하고 있다.

2) 글로벌 투자자 예탁결제 편의성

FTSE Russell은 외국인 투자자의 가입(onboarding) 절차의 효율화를 위해 국제예탁결제기구(International Central Securities Depository: ICSD) 연계를 요구한다.10) ICSD는 외국인 투자자들이 단일 플랫폼을 통해 여러 국가의 국채를 매입하고 보유할 수 있게 하여 투자과정의 편의성과 효율성을 높여준다. ICSD를 사용하는 경우 각 국가에 별도로 계좌를 개설할 필요가 없어진다. 주요 ICSD로는 유로클리어(Euroclear)와 클리어스트림(Clearstream)이 있다. 최근 정부는 외국인 국채 투자의 비과세, 외국인 투자자 등록 의무 폐지, 적격외국금융기관(Qualified Foreign Intermediary: QFI) 도입 등 ICSD 연계를 위한 여러 가지 방안들을 발표했다. 이에 따라 2023년 한국예탁결제원은 유로클리어와 ICSD 구축을 위한 계약을 체결하고, 2024년 6월부터 시스템이 운영될 계획이다. FTSE Russell은 이와 같은 ICSD 연계 추진 상황을 주시하고 한국 국채의 WGBI 편입 결정에 이를 고려할 것으로 설명한다.

2. 최근 정부의 시장접근성 개선 방안

가. 시장접근성 개선 방안의 주요 내용

한국 자본시장의 선진시장 격상은 정부11)가 오랜 기간 추진해온 정책과제에 속한다. 2023년에 들어 정부는 MSCI 및 FTSE Russell의 다수 지적 사항에 대응하는 시장접근성 개선 방안을 발표했다. <표 III-7>은 최근 정부가 발표한 주요 시장접근성 개선 방안 및 추진 일정을 보여준다. 발표된 개선 방안은 MSCI 및 FTSE Russell 시장접근성에 공통적으로 적용되는 사항과 개별적으로 적용되는 사항을 포함한다. 일부 개선 방안은 2023년에 이미 시행되었으며, 대부분의 개선 방안은 2024년부터 본격적으로 추진하는 일정을 두고 있다.

1) 외환시장 구조개선

2023년 2월 정부는 ‘글로벌 수준의 시장접근성 제고를 위한 외환시장 구조 개선방안’을 발표했다.12) 외환시장 구조개선에는 3가지 방안들이 포함되어 있다. 첫째, 역내 외환시장의 개장시간 연장이다. 앞선 MSCI의 ‘개선 필요’ 사항에서 살펴봤듯이, 한국 역내 외환시장 개장시간은 증시와 동시에 마감되어 외국인 투자자의 여러 불편함과 오버나이트 리스크의 원인으로 작용해왔다. 금번 개선 방안은 역내 외환거래 마감을 익일 2시까지 대폭 연장하며, 시범운영 기간을 거쳐 2023년 7월부터 정식 적용하는 것으로 발표되었다. 둘째, 인가받은 해외 소재 금융회사(Registered Foreign Institution: RFI)의 역내 외환시장 직접 참여 허용이다. RFI의 외환 취급 범위는 현물환과 더불어 FX 스왑거래도 포함한다. RFI의 역내 외환시장 참여를 통해 외환거래시장 경쟁도가 높아지고 비용 절감과 더불어 상품 및 서비스의 향상이 기대된다. 셋째, 외환거래 업무의 전자거래 고도화다. 여기에는 국내 외국환중개회사 API(Application Programming Interface)를 RFI에게도 제공하고, 전자중개업무(aggregator) 제도를 도입하는 계획이 포함되어 있다. 이러한 시장 인프라 개선 방안들은 외환거래 업무의 편의성과 비용을 낮춰주는 효과를 가져올 것으로 기대된다.

2) 외국인 자본시장 접근성 제고

2023년 1월 정부는 ‘외국인 투자자의 자본시장 접근성 제고방안’을 발표했다.13) 해당 개선 방안에는 4가지 주요 내용이 포함되어 있다. 첫째, 외국인 투자자 등록 의무의 폐지다. 개선 방안에는 IRC를 폐지하고, 금융당국의 등록 의무 없이 외국인 투자자가 거래 증권사에 개인의 경우 여권번호, 법인의 경우 Legal Entity Identifier(LEI)를 부여받고 계좌를 관리할 수 있게 되었다. 다만, 기존에 IRC를 부여받은 투자자는 이를 계속 사용해야 하며, LEI를 새롭게 부여받을 수 없다.

둘째, 외국인 통합계좌, 즉 옴니버스 계좌의 활용도를 높이는 방안이 포함된다. 기존 외국인 투자자 거래내역의 실시간 보고의무를 폐지하고, 대신 국세청이나 금융당국이 필요시 요청하면 최종투자자별로 거래내역을 보고하는 방식으로 완화되었다.

셋째, 외국인 장외거래 범위를 확대하는 내용이 포함되어 있다. 기존 제도하에서는 외국인의 상장증권 거래는 원칙적으로 장내시장에서만 가능하며, 사전심사 후 승인받은 예외적인 경우에만 장외거래가 허용되었다. 발표된 개선 방안에는 사후신고가 가능한 장외거래 범위를 확대하고 신고 부담도 완화하는 조치를 포함하고 있다.

넷째, 상장기업 영문 공시 제공의 활성화 내용이 담겨 있다. 기업 영문 공시 활성화는 2단계로 나누어 추진되며, 우선 1단계는 2024년부터 자산규모 10조원 이상 또는 외국인 지분율 30% 이상의 코스피 상장사가 대상이다. 2단계는 2026년부터 자산규모 2조원 이상 코스피 상장사로 확대된다.

3) 기업 배당제도 개선

2023년 1월 정부는 ‘글로벌 스탠더드에 부합하는 배당절차 개선방안’을 발표했다. 국내 기업의 배당절차가 글로벌 스탠더드에 부합하지 않다는 지적은 MSCI의 개선 필요 사항에 포함된다. 현재 국내 기업들의 배당제도는 일반적으로 연말에 배당받을 주주를 먼저 확정하고, 이후 주주총회에서 배당금을 확정하고 있으며, 이는 선진시장과 비교해 순서가 뒤바뀌어져 있다. 발표된 제도 개선 방안은 배당액을 선 결정하고, 이후 배당기준일 주주를 확정하는 절차를 도입한다. 다만, 배당절차의 개선은 의무적인 것은 아니며, 기업이 자발적으로 시행할 수 있도록 금융당국이 유권해석을 제공하는 것이다.

4) ICSD 통합계좌 연계

2023년 정부가 도입한 일련의 방안들은 외국인의 국채 투자를 위한 ICSD 연계의 걸림돌을 대부분 제거하였다. 우선 외국인 투자자의 투자 등록 의무가 폐지되었다. 또한, 2023년 시행된 ‘외국인 국채투자 비과세 규정’은 비거주자외국법인이 적격외국금융회사(Qualified Foreign Intermediary: QFI) 등을 통해 취득·보유·양도하는 국채 등으로부터의 이자 및 양도소득을 비과세하는 조치를 포함한다. 이러한 QFI에는 ICSD가 포함되며, 2023년 유로클리어가 한국예탁결제원과 ICSD 연계 시스템 도입을 위한 계약을 체결하고 2024년 6월부터 시스템을 운영할 계획이다.

5) 외국인 원화차입 허용

2024년 정부 발표14)에는 증권결제 목적의 일시적 외국인 원화차입(overdraft)을 허용하는 내용이 포함되어 있다. 외국인 투자자가 주거래은행이 아닌 다른 금융기관과 증권 결제를 위한 환전에서 일시적 원화부족 발생시 실제 원화 거래계약이 있으면 증권 매매 결제 대금을 차입할 수 있도록 하는 방침을 마련하였다.

나. 시장접근성 개선 방안의 기대효과

최근 정부가 발표한 시장접근성 개선 방안은 한국 주식의 MSCI World Index 및 국채의 WGBI 편입을 목적으로 두고 있는 것으로 볼 수 있다. 대부분 개선 방안이 MSCI 및 FTSE Russell의 시장접근성 지적 사항에 대한 직접적인 대응이기 때문이다. 그러나 실제로 이러한 시장접근성 개선 방안이 MSCI 및 FTSE Russell에 의한 한국 자본시장의 선진시장 격상으로 이어질지는 불확실하다. 단정하기는 어렵지만 현재 나와 있는 내용만을 두고 판단할 경우 한국 국채의 WGBI 편입 가능성은 높아 보이며, 한국 주식의 MSCI World Index 편입은 시간이 더 걸릴 수 있을 것으로 예상된다.

최근 정부의 개선 방안은 한국 국채의 WGBI 편입 가능성을 상당히 높여줄 것으로 판단된다. FTSE Russell은 현재 한국을 관찰대상국에 두고 있으며, 선진시장 격상을 위해 검토하고 있는 4개 시장접근성 개선 사항 중 외국인 국채투자 비과세는 이미 실행하고 있다. 또한 예탁결제 편의성과 관련해서도 유로클리어와의 ICSD 연계가 예정되어 있으며, 외국인 투자자 등록 프로세스의 문제점도 ICSD를 활용할 수 있게 되면 해소될 것으로 보인다. 남아 있는 사항은 외환시장 구조이며, 최근 정부의 외환시장 개선 방안이 FTSE Russell의 기준을 얼마나 충족하는가에 따라 WGBI 편입이 결정될 것으로 보인다. 이와 관련하여 한국과 유사하게 부분 교환 통화를 두고 있는 중국 및 말레이시아 국채가 WGBI에 포함되어 있다는 점은 고무적이다.

반면, 한국 주식의 MSCI World Index 편입 가능성은 불확실성이 상대적으로 높아 보인다. MSCI는 선진시장으로 분류되기 위한 구체적 기준은 제공하지 않지만, 현재 선진시장지수에 편입된 국가를 보면 시장접근성의 18개 세부 항목 중 개선 필요 또는 개선 가능으로 평가되는 경우는 합해서 2개 미만이다. 반면, 현재 한국은 MSCI의 관찰대상국에 포함되어 있지 않으며, 시장접근성의 10개 세부 항목에 있어서 개선 필요 또는 개선 가능 등급을 부여받고 있다. 특히 MSCI가 지적하는 시장접근성 사항의 상당수는 제도나 규제적 접근만으로는 개선이 어렵고 절차와 관행 변화가 수반되어야 한다. 이러한 절차와 관행은 단기간에 바꾸기 어려울 수 있으며 보다 장기적인 일정이 필요할 수 있다.

IV . 해외 금융기관의 시각

1. 해외 금융기관 시각의 중요성

한국 자본시장의 선진시장 격상을 위해서는 해외 금융기관의 시각에 대한 이해가 필요하다. 이는 무엇보다 MSCI 및 FTSE Russell의 국가 분류 또는 재분류에 있어서 해외 금융기관의 의견을 의사결정에 반영하는 절차를 두고 있기 때문이다. MSCI는 “시장접근성은 특정 시장에서의 해외 기관투자자(international institutional investor)의 경험(experience)을 반영하는 것을 목표로 한다.”고 설명한다. 또한 국가 재분류에 관해서는 “분류 변경이 되돌릴 수 없는(irreversible) 것으로 간주될 경우에만 시장 업그레이드를 고려한다.”는 기준을 두고 있다.15) FTSE Russell은 “국가 재분류는 새로운 규제의 제정이 아닌 해외 투자자(international investors)의 실질 경험(practical experiences)을 기준으로 평가된다. 따라서 국가 재분류의 변경 시기는 규제 개선이 완전히 실행되고 해외 투자자가 예상하는 혜택을 실현하기 위해 필요한 기간에 따라 결정된다.”고 설명한다.16)

이러한 MSCI 및 FTSE Russell의 국가 분류 기준에는 중요한 공통점이 있다. 첫째, 국가 분류의 근거가 되는 시장접근성 평가는 해외 금융기관의 ‘경험’에 기반한 의견을 중요하게 여긴다는 점이다. 둘째, 국가 분류는 규제 변경 자체에 중점을 두는 것이 아니라 해당 규제 변경이 실행되고 나서 해외 투자자에게 어떠한 영향을 미치는지를 확인한 이후 이루어진다는 점이다. 이는 시장접근성 제고를 단순히 규제 변경으로만 접근해서는 안 되고, 규제 변경에 대한 해외 금융기관의 의견을 함께 고려해야 함을 시사한다.

이처럼 해외 금융기관이 한국 자본시장에 대해 가지고 있는 시각은 시장접근성 제고에 중요한 요인으로 작용한다. 문제는 MSCI나 FTSE Russell이 제공하는 자료만을 두고는 해외 금융기관의 의중을 충분히 파악하기 어렵다는 점이다. MSCI 및 FTSE Russell은 각 시장에 대한 해외 금융기관의 의견을 수렴하지만, 그 내용은 핵심 사항 위주로 매우 간략하게만 제공하기 때문이다. MSCI 및 FTSE Russell이 지적하는 한국 시장접근성의 문제점을 자세하게 이해하고, 이에 기반하여 시장접근성 개선 방안의 실효성을 제고하기 위해서는 해외 금융기관의 상세한 설명을 들어볼 필요가 있다.

본 보고서는 해외 금융기관의 시각과 경험을 파악하기 위해 다수 해외 금융기관 관계자와의 인터뷰를 진행하였다. 인터뷰 대상 금융기관은 금융회사 및 금융협회로 구분된다. 인터뷰에 참여한 금융회사에는 글로벌 자산운용사, 상업‧투자은행, 커스터디은행, 증권사, 헤지펀드, 시장조성자 및 시스템트레이더가 포함된다. 인터뷰 대상 금융협회에는 아시아증권산업시장협회(Asian Securities Industry and Financial Markets Association: ASIFMA)17) 및 글로벌금융시장협회(Global Financial Market Association: GFMA)가 포함된다. 인터뷰는 2023년 1월에서 9월 사이에 온라인 및 오프라인 방식으로 이루어졌다. 오프라인 인터뷰는 한국 및 홍콩에서 진행되었다. 인터뷰에 참여한 해외 금융기관 수는 15개에 달하며, 인터뷰 횟수는 온라인 10회 및 오프라인 8회, 인터뷰 참여 관계자 인원수는 45명에 달한다. 다수 글로벌 금융회사는 내부 컴플라이언스 규정에 따라 인터뷰를 익명으로 하는 조건을 두었으며, 이에 따라 본 보고서에서는 인터뷰에 참여한 금융회사명 및 참가자 이름을 제공하지 않는다.

2. 주요 인터뷰 내용

가. 인터뷰 주제

해외 금융기관 인터뷰는 시장접근성에 중점을 두었다. 인터뷰에서는 MSCI 및 FTSE Russell이 지적하는 한국의 시장접근성 사항과 더불어 참가자가 한국 시장에서 활동하면서 경험한 여러 이슈를 포괄적으로 다루었다. 이와 함께 최근 정부가 발표한 각종 시장접근성 개선 방안에 대한 의견도 논의되었다. 인터뷰 이후 내용을 종합해봤을 때 8개의 주요 주제가 도출된다. <그림 IV-1>은 인터뷰에서 다루어졌던 주요 주제를 외국인 투자자의 투자과정에 도표화(mapping)하여 보여준다.

다음으로는 해외 금융기관 인터뷰에서 도출된 8개 주제의 주요 내용을 소개한다.18) 인터뷰의 내용을 살펴보기에 앞서 유의해야 할 점이 있다. 첫째, 소개되는 내용은 인터뷰 당시 참가자가 중요하게 여기는 사항들이다. 이러한 사항 중 일부는 인터뷰 시점에 상황, 특정 이벤트 등이 영향을 미쳤을 가능성이 존재한다. 둘째, 본 보고서의 목적은 해외 금융기관의 입장을 대변하거나 정당성을 부여하는 것이 아니다. 해외 금융기관의 시각을 소개하는 이유는 이러한 의견들이 주관적인 측면이 있을지라도 시장접근성 평가에 중요하게 작용하기 때문이다. 인터뷰 참가자의 의견을 가치판단 없이 있는 그대로 전달하기 위해 본 절의 내용은 인용문 중심으로 구성되어 있다.

1) 한국 자본시장 평가

인터뷰에서는 외국인 투자자의 관점에서 한국 자본시장에 대한 종합적인 시각을 질문하였다. 한국 자본시장이 지니는 매력과 그럼에도 불구하고 신흥시장으로 평가받고 있는 이유에 대해 물어보았다. 대부분 인터뷰 참가자는 한국 자본시장을 실제로는 선진시장으로 봐야 하지만 기대하는 수준의 효율성을 제공하지 못하고 있다고 설명한다.

한국은 사실상 선진시장이다. 한국이 MSCI나 FTSE Russell의 선진시장지수에 편입되는 것이 이득인지 아닌지는 무의미한 질문인 것 같다. 장기적으로 봐야 한다. 이는 큰 파이의 작은 비중과 작은 파이의 큰 비중 중 어느 것이 더 나은지로 생각할 수 있지만, 한국이 신흥시장에서 차지하는 비중은 점차 줄어들 수밖에 없다. 인도, 베트남 등의 경제와 자본시장은 한국보다 빠르게 커지고 있으며, 이에 따라 한국이 신흥시장지수에 머물러 있다면 한국의 비중 감소는 불가피하기 때문이다. (금융협회)

한국 자본시장은 왜 신흥시장으로 간주되는가? 한국의 산업기반, 경상수지, 무역수지 등을 보면 더 이상 신흥국이 아니라 선진국이다. 한국의 자본시장도 선진시장으로 봐야 한다고 생각한다. 일반적으로 선진시장은 안정성이 높고, 신흥시장은 위험성이 높은 시장으로 인식된다. 한국의 주식시장과 채권시장은 선진시장 못지 않은 안정성을 지니고 있다. 다만, 외국인 투자자 입장에서 한국에 투자하는 과정은 편의성과 효율성 측면에서 선진시장에 뒤떨어진다. 외국인 투자자는 현지 투자로 노출된 위험을 헤지 할 수 있어야 하고, 투자자금을 효율적으로 회수할 수 있어야 한다. 그러나 한국은 외환시장 구조, 시장 관행 등의 측면에서 외국인들이 바라는 효율성을 가지지 못하는 것으로 평가되고 있다. 이러한 부분들을 한국의 시장접근성이 떨어지는 것으로 표현한다. (글로벌 증권사)

한국은 외국인 투자자의 관점에서 매우 매력적인 시장이 될 수 있다. 한국은 다양한 산업군을 두고 있으며, IT, 바이오 등 성장성이 높은 산업에 투자할 수 있는 많은 기업들이 있다. 한국 기업들은 적절한 성장성과 안정성을 지니고 있기 때문에 더욱 매력적이다. 외국인의 글로벌 투자 포트폴리오 관점에서 보면 한국은 다른 시장에서 제공하지 못하는 분산의 기회를 제공해준다. 그러나 한국이 홍콩, 싱가포르, 일본, 호주 등의 시장과 같은 수준에서 경쟁하려면 일부 영역에 있어서 선진시장 수준의 관행(best-in-class practices)을 도입해야 한다. (글로벌 헤지펀드)

시장접근성이 얼마나 중요한지는 의견의 차이가 있을 수 있다. 가장 중요한 것은 시장 자체의 매력도다. 이미 한국 시장에 투자를 결정한 투자자는 편의성 때문에 결정을 번복하지는 않는다. 우리와 같은 금융회사의 역할이 고객의 투자 과정을 원활하게 해주는 것이다. 다만, 불편함과 비용이 증가하면 투자가 가능한 수준보다 낮아질 수 있다. 보다 영향을 받는 것은 한국 시장에 대한 투자를 결정하지 않은 고객이다. 이러한 고객은 세계 각국의 자산에 투자하며, 하나의 플랫폼을 사용하고자 한다. 한국에 투자하는 과정에 있어서 별도의 절차나 비용이 발생하면 투자를 하지 않을 수 있다. 어떠한 경우든 한국의 시장접근성이 낮다는 것은 외국인 투자자로부터 받을 수 있는 잠재적 투자의 100%를 얻지 못하고 있음을 의미한다. (글로벌 은행)

최근 미국과 중국 간의 갈등으로 인해 많은 자금이 중국에서 빠져나와 투자처를 찾고 있다. 이중 상당 부분은 아시아 지역 내에서 재투자를 원한다. 한국이 당연히 이러한 투자의 목적지가 되어야 한다. 그러나 한국보다 일본으로 투자가 많이 흘러 들어가고 있다. 이러한 상황은 한국의 시장접근성과 무관하지 않으며, 매우 안타까운 상황이다. (금융협회)

선진시장의 공통적인 특징은 개방된 경쟁과 동등하고 공정하게 적용되는 규칙과 규제다. 홍콩, 싱가포르, 호주, 일본 모두 각각의 방식에는 차이가 있으며 개선할 부분이 있지만, 해외와 국내 금융회사 간 차별을 두지 않는다는 공통점이 있다. 다양한 플레이어들이 참여하고 경쟁하면서 시장의 효율성과 혁신이 증진된다. 그러나 한국 시장은 경쟁이 제한되어 있고, 해외 금융회사에 대한 시장 참여 기회나 규칙의 적용이 동등하지 않게 느껴지는 부분이 있다. (시장조성자)

2) 외국인 투자자 등록 및 계좌 개설

인터뷰에서는 최근 정부의 외국인 투자자 등록 의무 폐지와 IRC를 대체하는 LEI에 대해서도 논의하였다. 인터뷰 참가자 대다수는 외국인 투자자 등록 의무의 폐지를 환영하고, 정부의 노력을 긍정적으로 평가하는 것으로 나타난다. 그러나 IRC 폐지가 시장접근성 향상에 미치는 영향은 예상보다 적을 수 있다고 설명한다. 그 이유는 그간 IRC의 불편함이 투자자 등록 의무화에 있다기 보다 IRC 발급 절차의 일관성 부족과 과도한 증빙서류에 있었기 때문인 것으로 파악된다. 다수 인터뷰 참가자는 근본적인 문제는 투자자 등록 이후의 절차에 있는 것으로 지적하며, 이 부분에 개선의 여지가 많이 남아 있어서 IRC 폐지 자체만의 효과는 크지 않을 수 있다고 설명한다.

외국인 투자자 등록 의무 폐지는 전반적으로 환영받을 결정이다. 이는 무엇보다 한국 정부가 외국인 투자자의 목소리에 귀를 기울이고 있음을 보여준다. 한국의 외국인 투자자 등록 의무는 주요 선진시장에는 없는 제도로 외국인 투자자가 한국 시장을 접근하는 데 있어서 불필요한 복잡함과 비용을 발생시키는 하나의 요인으로 작용해왔다. IRC를 대체하는 LEI는 훌륭한 기준으로 보인다. 다만 새롭게 도입되는 외국인 투자자 등록 시스템의 실제 효과와 편의성은 세부 내용을 봐야 판단을 할 수 있을 것으로 보인다. 이전에 한국에서 옴니버스 계좌를 도입한다는 발표가 있었을 때, 해외 금융회사는 큰 기대를 하였다. 그러나 세부 내용을 보고는 크게 실망했다. 너무 많은 제약 사항이 있었기 때문이다. 이런 경험으로 인해 외국인 투자자와 해외 금융회사는 현재 보수적인 입장을 취하고 있다. (글로벌 자산운용사)

그동안 IRC의 불편함은 투자자 등록 자체에도 있었지만, 그 과정에 따른 불확실성이 어쩌면 더 큰 문제가 되어 왔다. 예를 들어 두 건의 IRC 신청에 있어서 동일 종류의 증빙자료를 제출했는데, 한 건은 승인되고 다른 한 건은 추가 증빙자료를 요구하는 경우가 있다. 또한, IRC가 승인 되는 기간도 예측하기 어려우며, 어떤 경우 며칠이 걸리고 다른 경우 몇 주가 걸린다. 이러한 일관성 부족은 업무 프로세스의 문제라고 생각한다. 외국인 투자자 등록을 심사하고 승인하는 담당자가 1~2명에 불과한 것으로 알고 있으며, 신청 건수가 많으면 승인이 지연된다. 또한 담당자도 자주 교체되어서 담당자에 따라 요구하는 증빙서류의 편차가 발생하기도 한다. 이 때문에 투자자 입장에서 언제 투자를 개시할 수 있는지 불확실해지고 이러한 부분들이 한국 시장의 매력도를 떨어트리는 요인이 된다. 선진시장의 경우 신규 투자자 가입, 즉 온보딩(onboarding) 절차가 간소화 및 표준화되어 있으며, 한국에 비해 신속하고 일관되게 이루어진다. (글로벌 자산운용사)

한국 정부가 IRC를 폐지하고 LEI로 대체할 것으로 알고 있다. 하지만 외국인 투자자는 이미 IRC에 어느 정도 익숙해져 있다. 그동안의 문제는 IRC 자체보다는 발급받는 절차에 있었다. 외국인 투자자에게 어려움은 IRC 발급을 위해 요구되는 증빙자료와 이러한 증빙자료를 인쇄본(hard copy)으로 제출해야 한다는 것이다. 이러한 점은 계좌 개설에서 더욱 문제가 된다. 외국인 계좌 개설을 위해서는 많은 증빙서류가 요구된다. 선진시장에서 통용되는 증빙서류가 한국에서는 인정되지 않거나, 추가 증빙서류를 요구하는 경우가 많다. 여기에 외국인은 한국 시장에 투자하기 위해 현지 증권사, 수탁은행 등 모든 금융기관에 각각 증빙서류를 제출해야 한다. 이 부분이 가장 큰 불편함을 느끼는 점이다. (글로벌 은행)

IRC 폐지 소식은 환영할 일이지만, 한국 내 계좌 개설 절차의 불확실성은 여전히 외국인 투자자에게 중요한 고려 사항이다. 현재로서는 LEI에 대한 세부적인 내용이 아직 발표되지 않아 파악하기 어려운 부분이 많다. 예를 들어 기존 IRC 발급에 필요했던 절차와 서류, 특히 고객알기제도(Know Your Customer: KYC) 및 자금세탁방지(Anti Money Laundering: AML) 등을 위한 고객 실사(due dilligence)가 전적으로 없어지는 것인지, 아니면 다른 형태의 규제로 대체되어 계좌 개설 과정으로 이전된 것인지 아직 불명확하다. 따라서 외국인 투자자 등록 의무 폐지가 실질적인 편의성 개선으로 이어지려면, 계좌 개설 과정에서의 요구 사항과 절차를 명확히 하고, 가능한 한 간소화하는 방향으로 정책이 구체화 되어야 할 것이다. (글로벌 커스터디은행)

인터뷰 관계자들은 IRC 폐지의 효과를 낮게 평가하는 주요 이유로 외국인 투자자 등록 이후의 과정에 있어서는 큰 변화가 없기 때문이라고 설명한다. 계좌 개설에서 청산결제까지 여전히 외국인 투자자의 입장에서는 여러 가지 불편함과 비효율성이 존재한다고 지적한다.

IRC 폐지는 한국 정부가 올바른 방향으로 나가고 있음을 보여준다. 그러나 운영상에서 거래 주문이나 결제가 처리되는 방식은 변함이 없다. 한국에서는 틀린 계좌로 주문을 내는 경우 이를 수정하는 게 매우 어렵다. 이러한 리스크는 여전히 존재한다. 그래서 해외 금융회사는 한국에서 주문 오류에 대해서 걱정을 많이 한다. 한 주의 주문 오차가 엄청난 골칫거리가 되고 경고까지 받을 수 있다. 이는 바이사이드(buy side)가 더 고민하지만 셀사이드(sell side)도 공감하는 부분이다. 다른 선진시장에서는 주문 오류를 좀 더 유연하게 대처할 수 있도록 해준다. IRC 폐지는 한 편으로는 투자 개시를 쉽게 하는 데 도움이 되지만 실질적으로 플랫폼에서 업무를 간소화하고 최대한 효율적으로 만들기 위해서는 해야 할 일이 아직 많이 남아 있다. (글로벌 커스터디은행)

외국인 투자자 등록은 폐지되었지만, 계좌 개설 이후의 프로세스(down stream process)는 여전히 변한 게 없다. 이는 해외 금융회사들이 정보를 공유하는 포럼 등에서 널리 알려진 한국 시장의 문제점이다. 한국에서 흘러나오는 정보를 보면 이러한 점들이 명확하게 인지되지 못하는 것 같다. 한국에서는 마치 이러한 문제들이 대부분 해결된 것으로 간주하는 것으로 보인다. 그러나 한국 시장에 실제 참여하고 있는 해외 금융회사 관계자들의 피드백을 들어보면 문제는 여전히 존재하고 있다. 이 부분이 해결된다면 한국 시장에는 매우 큰 도움이 될 것으로 생각한다. (해외 증권사)

일부 인터뷰 참가자는 IRC와 LEI의 공존으로 계좌 관리가 복잡해질 수 있다는 우려를 제기한다. 기존 IRC 발급자는 LEI를 발급받지 못하기 때문에, 글로벌 금융회사는 두 가지 유형의 계좌를 관리해야 하기 때문이다.

한국 정부의 발표에 따르면 기존 고객은 IRC를 유지하고 신규 고객만 LEI를 사용할 수 있다. 그러나 IRC와 LEI의 공존은 향후 계좌 관리의 복잡성을 야기할 수 있다. 글로벌 자산운용사 등은 한국에 투자하는 수백, 수 천 개의 외국인 고객 계좌를 보유하고 있는데, 이중 대부분은 IRC이지만 일부는 LEI가 될 것이다. 그리고 LEI의 비중은 점차 늘어나기 마련이다. IRC와 LEI 두 유형의 계좌를 관리하는 것은 복잡해질 수 있으며, 지금은 예측하지 못하는 문제가 발생할 수도 있다. (글로벌 자산운용사)

3) 외국인 투자자 계좌(옴니버스 계좌)

외국인 투자자 계좌 관리 문제는 다수 인터뷰에서 지적된 사항이다. 가장 큰 문제점은 한국에서는 진정한 외국인 통합계좌, 즉 옴니버스 계좌가 제공되지 않고 있다는 것이다. 그 이유는 현재 한국의 옴니버스 계좌로는 통합 매매주문이 가능하지만, 통합 청산결제는 가능하지 않기 때문이라고 설명한다. 이로 인해 글로벌 자산운용사, 은행 등이 선진시장에서 사용하는 옴니버스 계좌를 한국에서는 사용하기 어렵다고 지적한다.19)

근본적인 문제는 한국은 여전히 외국인 투자자를 식별하는 ‘ID 시스템’을 유지하고 있다는 점이다. IRC 폐지 등 최근 정부가 발표한 다양한 방안들은 한국 시장에 대한 외국인 투자자의 편의성을 높일 것으로 기대된다. 그러나 여전히 외국인의 계좌 관리는 최종투자자 단위로 이루어져야 할 필요가 있어서 개선할 여지가 남아 있다. (글로벌 은행)

통합계좌에는 ‘명의자 모델’과 ‘옴니버스 모델’의 두 가지 유형이 있다.20) 선진시장에서 글로벌 자산운용사, 증권사, 수탁은행 등이 사용하는 것은 옴니버스 모델이다. 반면, 이들이 한국 시장에서 사용하는 것은 명의자 모델에 가깝다. 명의자 모델은 소수 고액자산가 고객을 관리하는 프라이빗뱅킹(private banking)에서는 사용할지 몰라도, 글로벌 자산운용사들은 더 이상 사용하지 않는 모델이다. 한국의 외국인 통합계좌에는 옴니버스 트레이딩(omnibus trading) 기능이 제공되지만, 아직 옴니버스 청산결제(omnibus settlement and clearing)는 제공되지 않는다. 해외 금융회사는 한국 금융당국이 그간 외국인 투자자의 편의성을 높이기 위한 통합계좌 개선 방안에 감사함을 느낀다. 예를 들어 IRC가 준비되지 않은 상황에서도 투자를 개시할 수 있고, 주문 정정(cancel correct)도 기존 T+1에서 T+2로, 즉 결제 이전까지 허용해줄 것으로 알고 있다. 이러한 추가적인 유연성은 자산운용사 등 해외 금융회사에게 매우 유용하다. 정부가 최근 발표한 거래내역 보고 요건 면제나 보고 간소화 조치 등도 많은 도움이 될 것으로 생각한다. 하지만, 한국의 통합계좌로는 청산결제까지 일괄적으로 이루어지지 못하기 때문에 시장에는 여전히 비효율성이 존재한다. (금융협회)

정부가 최근 발표한 통합계좌 개선 방안은 자산운용사, 증권사 등의 금융회사에는 의미 있는 것으로 생각한다. 또한, ICSD와 관련해서는 별도의 옴니버스 계좌 방안이 도입되는 것으로 알고 있다. 하지만, 현재 우리와 같은 글로벌 커스터디은행의 경우 옴니버스 계좌의 사용이 사실상 가능하지 않다. 글로벌 커스터디은행의 경우 한국에서는 여전히 IRC 단위로 고객 계좌를 개별 관리해야 한다. 글로벌 커스터디언을 사용하는 고객이 궁극적으로 원하는 것은 여러 나라의 자산에 투자하는 데 있어서 하나의 플랫폼을 사용해서 높은 수준의 편의성과 효율성을 얻는 것이다. 이를 위해서는 각국의 외국인 투자자 계좌 관리 방식이 호환성을 지녀야 한다. (글로벌 커스터디은행)

한국에서는 거래 포지션이 펀드매니저 수준이 아닌 펀드 수준에서 정확해야 한다. 이는 상당한 관리의 복잡성과 위험을 수반한다. 만약 운영상의 실수로 잘못된 계좌에서 매도를 하게 되면, 이는 무차입 공매도(naked short-selling) 혐의를 받을 수 있다. 한국에서는 이러한 거래 실수에 대한 벌금이 현재 매우 크다는 것을 모두가 알고 있다. (금융협회)

브로커들의 경험에 따르면, 한국에서 여러 계좌를 운영하는 것은 매우 복잡하며, 실수를 수정할 수 있는 유연성은 거의 없다는 불만을 토한다. 옴니버스 거래는 나머지 운영 절차가 잘 작동할 때 도움이 되며, 특히 결제 전에 계좌를 수정할 수 있는 유연성이 필요하다. 선진시장에서는 이러한 유연성을 제공한다. 그러나 현재 한국에서는 이러한 유연성이 사실상 없다. 한국에서는 이로 인한 어려움을 충분히 이해하지 못하고 있는 것 같다. (글로벌 헤지펀드)

4) 거래 가이드라인

인터뷰에서 가장 많이 거론된 사항은 한국의 거래 가이드라인 투명성이다. 다수 인터뷰 참가자는 해당 이슈를 한국의 시장접근성 제고를 위해 풀어야 할 최우선 과제로 손꼽았다.21) 특히 이상거래(abnormal trading)에 대한 명확한 기준이 공개되지 않는다는 점을 문제로 삼았다. 또한 이상거래 관련 경고나 제재에 있어서 사전 및 사후적 규명 절차가 불투명하다고 지적한다.

선진시장의 공통된 두 가지 특징은 투명한 거래 가이드라인과 경쟁적인 시장환경이다. 이상거래 관련 지침의 투명성 제고는 한국이 선진국 시장으로 격상되기 위해서 우선적으로 다루어야 할 문제다. 이는 근본적으로 시장 감시체계에 관한 이슈이며, 해외 투자자의 관점에서 한국은 선진시장에 비해 이부분에 있어서 유연성이 상당히 부족한 것으로 느낀다. (글로벌 증권사)

한국 시장에서 가장 중요한 이슈는 명확한 거래 지침이다. 예를 들어 종가 경매와 관련하여 허용되는 움직임의 범위다. 선진시장에서는 시장 마감 시점에 투자자들이 어떻게 행동하는지, 특정 지수 이벤트(index event)일이 일반 거래일과 어떻게 다른지, 이유가 무엇인지 등에 대해 시장참여자와 거래소 간에 많은 논의가 이루어진다. 그리고 이러한 점들을 감안하여 시장감시에 대한 기대치를 조정한다. 심지어 중국의 경우에도 이러한 부분은 잘되어 있다. 한국에서도 종가에 대한 제한선(red line) 등을 보다 명확하게 하는 등 의미 있는 대화가 이루어지고 있는 것으로 알고 있다. 그럼에도 불구하고 거래 지침은 여전히 문제가 되고 있다. 커뮤니케이션이 투명하지 않기 때문에 해외 금융회사는 과거 자신들이 암묵적으로 이해하는 제한선에서 벗어나는 것을 꺼린다. 이는 특히 지수 변경이 원활하게 이루어지기 어렵다는 것을 의미한다. 우리는 글로벌 자산운용사 등의 포트폴리오 리밸런싱(rebalancing)을 지원하기 위한 유동성을 공급한다. 이 과정에 우리는 증권을 매입하는 측으로 리스크를 이전하는 활동에 있어서 자신감을 가지고 싶어한다. 가격 변동 제한 및 거래량 변동 제한을 두고 있는 한국의 경우 이러한 리스크 이전이 매우 어렵고 불균형적으로 이루어질 수 있다. 이 문제는 모든 지수제공자들 사이에 논의되고 있는 사항이며, 한국이 선진시장으로 격상되기 위해 해결해야 할 사항이다. (시장조성자)

선진시장의 경우 경매시 가격 변동에 대한 민감성의 제약은 있지만 한국과 같이 거래량도 제한하는 경우는 없다. 거래량 제한은 시장의 완만한 조정을 방해한다. 예를 들어 지수 변경일에는 거래량이 평소 경매의 10배에 달할 수 있지만, 이를 예측하기는 매우 어렵다. 이처럼 이상거래 지침의 불투명성은 완만한 인덱스 조정을 어렵게 만들며, 이 경우 시장의 효율적 위험 배분이 이루어지지 못한다. 이는 인덱스 상품 제공자 입장에서는 매우 어려운 상황이다. 한국과 비교할 때 미국, 영국, 홍콩, 싱가포르 등 선진시장의 경우 포지션 조정에 대한 유연성이 상대적으로 높다. 우리는 이 이슈에 관해 많은 전문가를 동원할 수 있고, 여러 시장참여자와의 대화를 환영한다. 이를 통해 올바른 거래 규칙이 마련되고, 안심할 수 있는 거래 환경이 형성될 수 있도록 돕고자 한다. (글로벌 자산운용사)

지금은 모든 트레이딩이 알고리즘으로 자동화되어 있다. 특정 국가에서의 트레이딩 알고리즘에는 시장 요소뿐만 아니라 규제, 규정, 지침 등의 거래 요소도 모두 프로그램에 포함되어 있다. 그러나 한국 시장에서는 거래 규정이나 지침이 홍콩, 싱가포르 등 선진시장에 비해 투명하지 못하다. 심지어 중국에 비해서도 한국의 거래 지침 투명성은 뒤떨어지는 것으로 평가된다. 중국의 경우 시장참여 및 취급 가능 거래 상품은 상대적으로 제한되어 있지만, 거래가 허용되는 금융상품에 있어서는 거래 가이드라인이 명확하다. 그러나 한국 시장은 수수께끼 같은 부분이 많으며, 특히 시스템 트레이더에게는 공정한 경쟁 시장이 아니라는 느낌을 가지게 된다. 어쩌면 이는 책임소재를 명확하게 하지 않기 위해서일 수도 있다는 생각을 갖게 된다. (시스템 트레이더)

인터뷰 참가자는 이상거래 관련 심의과정(adjudication process)도 개선되어야 한다고 지적한다. 특히 이상거래 경고 등에 대한 설명이 명확하게 제공되지 않고, 사전 및 사후적으로 해외 금융회사의 입장을 소명할 수 있는 기회가 충분하게 주어지지 않는다고 설명한다.

해외 금융회사는 현지 규정을 준수하면서 거래하고자 한다. 다만 그 규정이 무엇이고, 특히 위반 사항이 무엇인지 정확하게 알 수 있어야 한다. 이러한 정보는 해외 금융회사에게 직접 전달되지 않고, 사용하는 로컬 브로커(증권사)에게만 제공된다. 그러나 문제가 발생할 경우 로컬 브로커마다 각각 다른 설명을 해주기 때문에 정확한 상황 파악이 어렵다. 우리는 거래소와 직접 소통하기를 바란다. 하지만, 거래소와의 직접 의사소통이 어려운 경우가 많다. 특히, 이상거래 관련 가이드라인은 공개 자료가 아니고 거래소가 회원사인 로컬 브로커에게만 제공하며, 로컬 브로커들은 이 내용을 고객이나 해외 계열사와도 공유하지 못하게 하는 것으로 해외 금융회사들은 알고 있다. (글로벌 헤지펀드)

해외 금융회사는 여러 로컬 브로커들을 사용한다. 이상거래 경고를 받을 경우 그 이유를 물어보면 브로커마다 설명이 다르다. 또 하나의 문제는 로컬 브로커가 어떤 고객에게 경고의 원인을 파악하여 설명해주지만, 다른 고객에게는 그렇게 해주지 않는 경우가 있다. 예를 들어 대형 금융회사에는 정보를 제공해주지만, 작은 규모 고객을 위해서는 노력하지 않는 것이다. 이로 인해 해외 금융회사 간에도 차별이 생기며, 정보에 있어서 경쟁력의 격차가 발생한다. 이는 한국이 공정하지 않은 시장환경을 조성하는 결과를 초래할 수 있으며, 일부 해외 금융회사는 이러한 부분을 차별적 대우로 간주한다. (시장조성자)

한국에서는 업계의 경고 조치 관련 심의 프로세스는 조금 더 투명하고 공식적인 체계를 적용할 필요가 있다. 경고를 취하기 이전에 가급적 고객과 적극적으로 접촉해서 전후 상황에 대해 설명해주고 고객이 소명할 수 있는 기회를 제공할 필요가 있다. 선진시장에서는 이러한 과정을 거친 후 최종적으로 경고 조치가 결정되는 것이 관행이다. 예를 들어 일본의 경우 조사가 필요한 거래 패턴이 포착되면, 결론 도출 또는 시정 조치 확정 이전에 거래소 회원사와 일련의 질의응답 및 사실확인을 위한 논의와 의견 청취 과정을 거치는 것이 일반적인 관행이다. 홍콩거래소 또한 경고 조치를 취하기 이전에 시장참여자들과 적극적인 논의를 통해 해당 행위의 배경을 확인하는 과정을 두고 있다. 충분한 정보가 공유되는 논의 및 심리 절차의 구축은 이상거래 방지에도 도움이 될 것으로 생각된다. (글로벌 은행)

일부 인터뷰 참가자는 한국에서 받은 경고나 제재가 경미한 수준이라도 글로벌 금융회사 입장에서는 큰 영향을 미칠 수 있다고 설명한다.

글로벌 금융회사의 경우 다국적 사업을 하기 때문에 어느 한 국가에서의 제재는 그룹 전체에 영향을 미칠 수 있다. 우선 특정 국가에서의 경고 발생은 내부 컴플라이언스 측면에서 문제가 될 수 있으며, 경고가 누적되면 해당 국가의 영업 활동을 위축시킬 수 있다. 또한, 한국에서의 경고가 글로벌 금융회사의 다른 지역 사업에도 영향을 미칠 수 있다. 예를 들어 한국에서 경고를 받은 특정 글로벌 금융회사가 아시아 내 다른 국가에서 신규 라이선스를 신청할 경우 해당 국가의 금융당국은 그 금융회사가 다른 국가에서 받은 경고나 벌금에 대한 정보를 요구할 수 있다. 따라서 한국 시장에서의 경고 또는 경미한 제재도 글로벌 금융회사에는 큰 영향을 미칠 수 있다. 이는 글로벌 금융회사가 한국시장에서 거래하는 데 있어서 소극적이거나 투자 규모를 제한하는 요인으로 작용할 수 있다. (글로벌 은행)

5) 공매도

한국 공매도 제도의 개선은 대부분 인터뷰 참가자가 지적한 사항이다. 이는 공매도가 단순히 트레이딩 전략 구현을 위한 수단이 아니라 시장의 효율성 및 경쟁도 차원에서 중요하기 때문이라고 강조한다. 일부 인터뷰 참가자는 공매도 제도 개선을 한국이 선진시장으로 격상되기 위해 풀어야 할 주요 과제로 손꼽는다.

한국이 선진시장으로 격상되기를 원한다면 두 가지 요건을 만족해야 한다. 첫 번째는 거래 지침의 투명성이다. 두 번째는 시장의 탄력성이다. 그리고 시장 탄력성의 핵심 요소는 공매도다. 공매도는 시장의 효율적 가격 형성을 가능하게 하며, 이와 더불어 다양한 플레이어들이 참여할 수 있는 기반을 마련해준다. 현재 한국에서는 어느 종목을 공매도할 수 있는지 제약이 있고, 또한 어떻게 공매도를 할 수 있는지에 대한 지침이 불명확하여 비효율성이 발생한다. 우리는 한국 규제당국의 공매도 지침에 대해 궁금해한다. 문제의 원인이 무엇이며, 달성하고자 하는 목적이 무엇인지를 알고 싶어 한다. 만약 가격 하락에 대한 우려라면, 더 나은 서킷 브레이커(circuit breaker)를 도입할 수 있다. 이는 공매도를 제한하거나 할당량을 두는 것보다 효과적인 방법이라고 생각한다. 우리는 선진시장의 경험을 바탕으로 금융당국이 원하는 목적을 달성하는 데 도움이 되고 싶다. (글로벌 은행)

공매도는 단순히 특정 금융회사 또는 사업에 국한된 이슈가 아니다. 공매도의 필요성과 중요성에 대해서는 모두의 의견이 일치한다. 이는 헤지펀드 등 공매도를 집중적으로 하는 특정 섹터에 국한된 이슈가 아니다. 그 이유는 공매도가 시장의 전체적 유동성 공급과 가격 발견에 있어서 중요한 역할을 하기 때문이다. 글로벌 자산운용사의 경우에도 공매도를 집중적으로 하지는 않지만, 다양한 유동성 공급자들이 시장에 참여하여 거래 비용을 낮추고 원하는 투자 포트폴리오를 효율적으로 구성할 수 있기를 바란다. 공매도를 제약하는 것은 시장의 다양성과 경쟁도를 낮추는 결과를 가져다준다. (글로벌 자산운용사)