OPINION

2024 Jun/11

Fluctuations in USD/KRW Exchange Rate Amid an Extended Period of a Strong Dollar and Relevant Implications

Jun. 11, 2024

PDF

- Summary

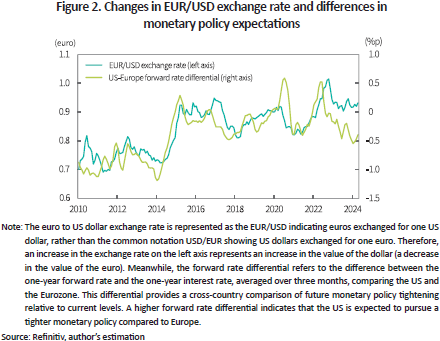

- The volatility of the USD/KRW exchange rate has amplified, with the exchange rate exceeding 1,400 won per dollar during intraday trading last April, causing anxiety in the external sector. An analysis of the USD/KRW exchange rate movement since the global financial crisis reveals that it has soared on two occasions due to the strengthening of the US dollar against the euro and yen, driven by differences in monetary policy paths. Notably, the correlation between the USD/KRW exchange rate and the US Dollar Index (USDX) has been significantly bolstered since the US Fed’s sharp rate hikes in 2022. This has led to the USD/KRW exchange rate hovering above 1,300 won per dollar, despite the expansion of exports, net inflows of foreign capital, and stable international creditworthiness. If a shift in the US monetary policy materializes, the USD/KRW exchange rate may adjust downward to some extent. However, given that the bond market assesses the nominal equilibrium interest rate in the US to be higher than that of the Eurozone or Japan, the structural strength of the USDX is likely to persist for a considerable period. In this context, it is advisable for foreign exchange authorities to mitigate volatility to allow economic agents to gradually adapt to rising exchange rates, rather than rigidly adhering to a specific level.

The US dollar to Korean won (USD/KRW) exchange rate moved sideways in the mid-1,300 won range from the beginning of this year due to weakened expectations of a monetary policy shift in the US. However, in April, the exchange rate rose to the high-1,300 won range amid delayed rate cuts in the US and heightened geopolitical tensions. Notably, on April 16, the intraday USD/KRW exchange rate exceeded 1,400 won per dollar, prompting verbal intervention from the foreign exchange authorities, and dollar-selling intervention was also carried out during April.1) With the exception of the 1997 Asian financial crisis, the 2008 global financial crisis, and the sharp rate hikes by the US Fed in September 2022, the Korean won has never surpassed the 1,400 won per dollar level. This raises questions about what has driven the surge in the USD/KRW exchange rate.

Changes in the USDX and USD/KRW exchange rate in the wake of the global financial crisis

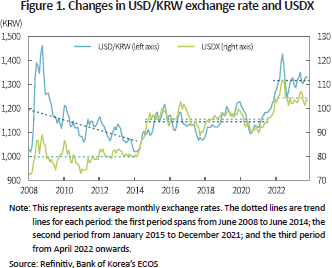

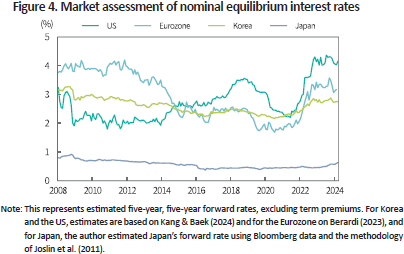

Over a broader time horizon, changes in the USD/KRW exchange rate and the US Dollar Index (USDX) can be categorized into three distinct periods (see Figure 1). The first period spans from 2008 to 2014, the second from 2015 to 2021, and the third from 2022 to the present. In conclusion, the monetary tightening policy in the US, steeper compared to the Eurozone and Japan, has triggered a stronger US dollar and a subsequent gradual increase in the USD/KRW exchange rate.

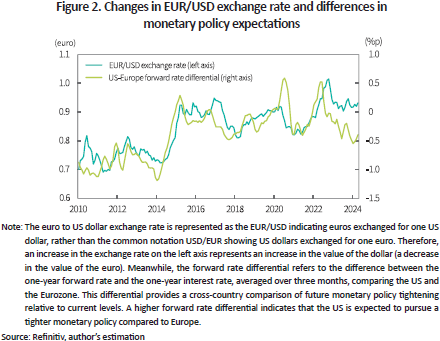

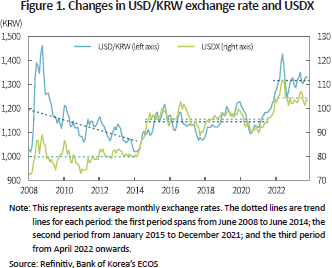

From 2008 to early 2014, the USD/KRW exchange rate spiked during the 2008 financial crisis, and then gradually stabilized downward (the strong won), falling to the low-1,000 won range by June 2014. In contrast, the USDX fluctuated around the 80 level. This trend changed in June 2014, with the USDX soaring to the high-90 level in early 2015. The sharp increase in the USDX can be attributed to the divergence in monetary policy between the US and the Eurozone. While the US Fed began tapering its asset purchases in 2014, the European Central Bank (ECB) adopted a negative interest rate policy starting in June 2014. This disparity resulted in a significant depreciation of the euro, the currency with the largest weight among the six currencies consisting of the USDX.2) Figure 2 shows that the difference between the two regions’ monetary policy paths, as estimated through the forward rate differences in the bond market, has a close correlation with the movement of the euro exchange rate. The USDX averaged around 95 from 2015 to 2021, fluctuating in response to major events such as the 2015 financial instability in China,3) the weakened expectations for US rate hikes in 2017,4) the 2018 US-China trade dispute, and the US Fed’s quantitative easing following the spread of Covid-19 in 2020. During the same period, the USD/KRW exchange rate followed a similar pattern to the USDX, centered around 1,150 won per dollar.

This trend showed signs of change in 2022, when the US Fed significantly raised the benchmark rate in response to a steep rise in inflation following the spread of Covid-19. In the third period, the Japanese yen depreciated the most. When the USDX increased by 14.7% from January to October 2022, the euro depreciated by 13.4% against the dollar, in line with the overall USDX rise, whereas the yen depreciated by 25.1%. From March 2022 to August 2023, the US Fed raised the benchmark rate by 525 basis points, while the Bank of Japan maintained a negative interest rate policy until March 2024. As a result, the yen’s value was primarily tied to the interest rate differential between the US and Japan. Notably, even after its negative interest rate policy ended in March 2024, there was little significant change in market rates in Japan. In contrast, long-term interest rates in the US increased due to the projection of the Fed’s prolonged high rates, which triggered a further depreciation of the yen.

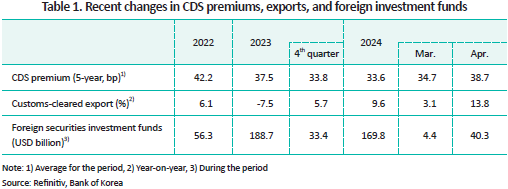

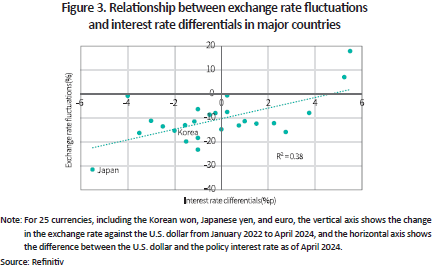

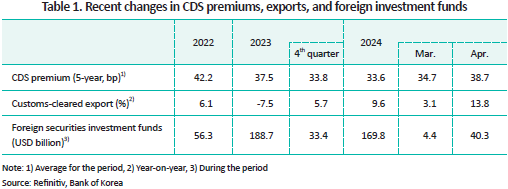

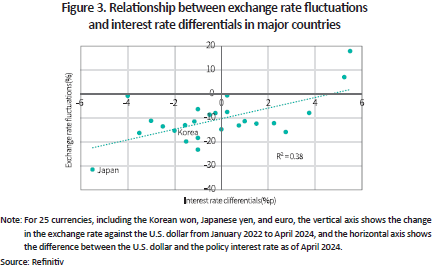

Since 2022, the USD/KRW exchange rate has moved around 1,315 won per dollar, while the USDX has fluctuated at an average level of 105. The most notable feature is that the correlation between the USD/KRW exchange rate and the USDX has strengthened since 2022. Recently, exports have recovered and there are net inflows of foreign funds for securities investment, alongside stable levels of sovereign credit ratings and credit default swaps (CDS). Despite these trends, the recent surge in the USD/KRW exchange rate may be attributed to the strength of the US dollar, rather than internal or external factors (see Table 1). Figure 3 depicts the relationship between exchange rate fluctuations of 25 currencies, including the Korean won, against the US dollar and their benchmark rate difference from that of the US since 2022. Although the Korean won has experienced deeper depreciation than the average of other comparable currencies, it has aligned with sample currencies in terms of the relationship between the exchange rate against the US dollar and interest rate differentials.

Nominal equilibrium interest rates and exchange rates

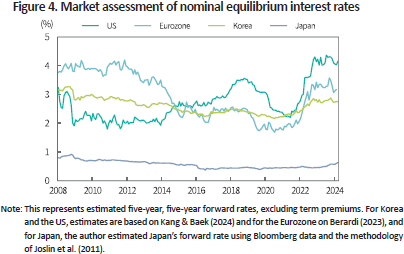

If the rise of the USD/KRW exchange rate is primarily attributable to the strong dollar resulting from the Fed’s high interest rate policy starting from 2022, will a shift in the US monetary policy stabilize the exchange rate downward? Given the stable global economic growth, it is improbable that various countries would implement significant monetary easing policies in response to an economic slowdown. Consequently, the USD/KRW exchange rate is expected to converge toward its equilibrium level. Figure 4 shows estimates of nominal equilibrium interest rate levels,5) as reflected in the government bond yield curves of each respective country. The bond market assesses the equilibrium interest rate level for the US to be close to 4%, while it is estimated to be 3% for the Eurozone, in the mid-2% range for Korea, and below 1% for Japan. If the bond market’s assessment proves accurate, the structurally strong USDX could be sustained with significant interest rate differentials against the euro and yen.6) If a shift in US monetary policy materializes or depending on the outcome of the US presidential election,7) the USD/KRW exchange rate may be adjusted downward to some extent. However, it is unlikely for the Korean won, with its lower benchmark interest rate compared to the US dollar, to deviate significantly from the current trend, where its movement is influenced by the USDX.

Conclusion and implications

As noted by former US Treasury Secretary Larry Summers, the sheer size of the global capital market implies that even a central bank issuing an internationally accepted currency, such as the Bank of Japan, has distinct limitations in influencing exchange rate levels (Bloomberg, 2024). With the USD/KRW exchange rate hovering in the mid-1,300 won range, even a 3-4% change arising from external shocks could bring it close to 1,400 won per dollar. Therefore, foreign exchange authorities in Korea should focus on mitigating abrupt fluctuations in the exchange rate rather than sticking to a specific level. As evidenced by the trend in equilibrium interest rates, elevated exchange rates stemming from differences in underlying economic conditions between the US and other advanced countries are likely to persist for some time. Hence, the goal of foreign exchange policies should be to alleviate exchange rate volatility to ensure that economic agents can gradually adapt to higher exchange rates and increasing foreign financing costs.

1) The Bank of Korea cited efforts to stabilize the market as the reason for the MoM decrease of $6 billion in foreign exchange reserves in the press release titled “foreign exchange reserves as of the end of April 2024”.

2) The current weights of the USDX are as follows: 57.6% for the euro, 13.6% for the Japanese yen, 11.9% for the British pound, 9.1% for the Canadian dollar, 4.2% for the Swedish krona, and 3.6% for the Swiss franc.

3) The Shanghai Composite Index plummeted by 32.1% from June 15, 2015, to its low on July 8 due to concerns over the slowdown of China’s manufacturing industry. Furthermore, the People’s Bank of China changed its calculation method for the benchmark rate on August 11, resulting in a significant depreciation of the yuan. Consequently, as investors became more risk-averse, the value of the safe-haven yen has risen while the USDX has declined.

4) Although inflation in the US picked up in 2016, it remained below the Fed’s target and even slowed down after February 2017, significantly reducing the need for interest rate hikes. The year 2017 marked the start of the Trump administration, which heightened uncertainty over key policy issues such as tax reform, infrastructure investment, and trade policy. As shown in Figure 2, forward rate differentials began to drop in early 2017 and thus, weaker monetary tightening was expected in the US, leading to a stronger euro with a slight time lag.

5) The nominal equilibrium interest rate, reflected in the government bond yield curve, can be seen as the level of short-term rates that could be maintained when the economy enters a stable state after cyclical shocks disappeared (Kang & Baek, 2024). In this regard, this article estimates the average short-term interest rate over a five-year period, starting from five years from now.

6) As recently analyzed by the Congressional Budget Office (CBO, 2024), this reflects the expectation that the US economy will show higher growth compared to other major countries, driven by various factors such as increased immigration.

7) Former President Trump favored a weaker dollar and low interest rates during his tenure, and recently described the strong dollar against the yen as a disaster for the US manufacturing industry.

References

Berardi, A., 2023, Term premia and short-rate expectations in the euro area, Journal of Empirical Finance 74, 101424.

Bloomberg, 2024. 5. 4, Summers says currency interventions fail even at Japan’s scale.

Congressional Budget Office, 2024, The Budget and Economic Outlook: 2024 to 2034.

Joslin, S., Singleton, K.J., Zhu, H., 2011, A new perspective on Gaussian dynamic term structure models, Review of Financial Studies 24(3), 926–970.

[Korean]

Kang, H.J. & Baek, I.S., 2024, Assessment of the possibility of returning to low interest rates following a shift in monetary policy, Korea Capital Market Institute Issue Papers 24-07.

Changes in the USDX and USD/KRW exchange rate in the wake of the global financial crisis

Over a broader time horizon, changes in the USD/KRW exchange rate and the US Dollar Index (USDX) can be categorized into three distinct periods (see Figure 1). The first period spans from 2008 to 2014, the second from 2015 to 2021, and the third from 2022 to the present. In conclusion, the monetary tightening policy in the US, steeper compared to the Eurozone and Japan, has triggered a stronger US dollar and a subsequent gradual increase in the USD/KRW exchange rate.

From 2008 to early 2014, the USD/KRW exchange rate spiked during the 2008 financial crisis, and then gradually stabilized downward (the strong won), falling to the low-1,000 won range by June 2014. In contrast, the USDX fluctuated around the 80 level. This trend changed in June 2014, with the USDX soaring to the high-90 level in early 2015. The sharp increase in the USDX can be attributed to the divergence in monetary policy between the US and the Eurozone. While the US Fed began tapering its asset purchases in 2014, the European Central Bank (ECB) adopted a negative interest rate policy starting in June 2014. This disparity resulted in a significant depreciation of the euro, the currency with the largest weight among the six currencies consisting of the USDX.2) Figure 2 shows that the difference between the two regions’ monetary policy paths, as estimated through the forward rate differences in the bond market, has a close correlation with the movement of the euro exchange rate. The USDX averaged around 95 from 2015 to 2021, fluctuating in response to major events such as the 2015 financial instability in China,3) the weakened expectations for US rate hikes in 2017,4) the 2018 US-China trade dispute, and the US Fed’s quantitative easing following the spread of Covid-19 in 2020. During the same period, the USD/KRW exchange rate followed a similar pattern to the USDX, centered around 1,150 won per dollar.

This trend showed signs of change in 2022, when the US Fed significantly raised the benchmark rate in response to a steep rise in inflation following the spread of Covid-19. In the third period, the Japanese yen depreciated the most. When the USDX increased by 14.7% from January to October 2022, the euro depreciated by 13.4% against the dollar, in line with the overall USDX rise, whereas the yen depreciated by 25.1%. From March 2022 to August 2023, the US Fed raised the benchmark rate by 525 basis points, while the Bank of Japan maintained a negative interest rate policy until March 2024. As a result, the yen’s value was primarily tied to the interest rate differential between the US and Japan. Notably, even after its negative interest rate policy ended in March 2024, there was little significant change in market rates in Japan. In contrast, long-term interest rates in the US increased due to the projection of the Fed’s prolonged high rates, which triggered a further depreciation of the yen.

Since 2022, the USD/KRW exchange rate has moved around 1,315 won per dollar, while the USDX has fluctuated at an average level of 105. The most notable feature is that the correlation between the USD/KRW exchange rate and the USDX has strengthened since 2022. Recently, exports have recovered and there are net inflows of foreign funds for securities investment, alongside stable levels of sovereign credit ratings and credit default swaps (CDS). Despite these trends, the recent surge in the USD/KRW exchange rate may be attributed to the strength of the US dollar, rather than internal or external factors (see Table 1). Figure 3 depicts the relationship between exchange rate fluctuations of 25 currencies, including the Korean won, against the US dollar and their benchmark rate difference from that of the US since 2022. Although the Korean won has experienced deeper depreciation than the average of other comparable currencies, it has aligned with sample currencies in terms of the relationship between the exchange rate against the US dollar and interest rate differentials.

Nominal equilibrium interest rates and exchange rates

If the rise of the USD/KRW exchange rate is primarily attributable to the strong dollar resulting from the Fed’s high interest rate policy starting from 2022, will a shift in the US monetary policy stabilize the exchange rate downward? Given the stable global economic growth, it is improbable that various countries would implement significant monetary easing policies in response to an economic slowdown. Consequently, the USD/KRW exchange rate is expected to converge toward its equilibrium level. Figure 4 shows estimates of nominal equilibrium interest rate levels,5) as reflected in the government bond yield curves of each respective country. The bond market assesses the equilibrium interest rate level for the US to be close to 4%, while it is estimated to be 3% for the Eurozone, in the mid-2% range for Korea, and below 1% for Japan. If the bond market’s assessment proves accurate, the structurally strong USDX could be sustained with significant interest rate differentials against the euro and yen.6) If a shift in US monetary policy materializes or depending on the outcome of the US presidential election,7) the USD/KRW exchange rate may be adjusted downward to some extent. However, it is unlikely for the Korean won, with its lower benchmark interest rate compared to the US dollar, to deviate significantly from the current trend, where its movement is influenced by the USDX.

Conclusion and implications

As noted by former US Treasury Secretary Larry Summers, the sheer size of the global capital market implies that even a central bank issuing an internationally accepted currency, such as the Bank of Japan, has distinct limitations in influencing exchange rate levels (Bloomberg, 2024). With the USD/KRW exchange rate hovering in the mid-1,300 won range, even a 3-4% change arising from external shocks could bring it close to 1,400 won per dollar. Therefore, foreign exchange authorities in Korea should focus on mitigating abrupt fluctuations in the exchange rate rather than sticking to a specific level. As evidenced by the trend in equilibrium interest rates, elevated exchange rates stemming from differences in underlying economic conditions between the US and other advanced countries are likely to persist for some time. Hence, the goal of foreign exchange policies should be to alleviate exchange rate volatility to ensure that economic agents can gradually adapt to higher exchange rates and increasing foreign financing costs.

1) The Bank of Korea cited efforts to stabilize the market as the reason for the MoM decrease of $6 billion in foreign exchange reserves in the press release titled “foreign exchange reserves as of the end of April 2024”.

2) The current weights of the USDX are as follows: 57.6% for the euro, 13.6% for the Japanese yen, 11.9% for the British pound, 9.1% for the Canadian dollar, 4.2% for the Swedish krona, and 3.6% for the Swiss franc.

3) The Shanghai Composite Index plummeted by 32.1% from June 15, 2015, to its low on July 8 due to concerns over the slowdown of China’s manufacturing industry. Furthermore, the People’s Bank of China changed its calculation method for the benchmark rate on August 11, resulting in a significant depreciation of the yuan. Consequently, as investors became more risk-averse, the value of the safe-haven yen has risen while the USDX has declined.

4) Although inflation in the US picked up in 2016, it remained below the Fed’s target and even slowed down after February 2017, significantly reducing the need for interest rate hikes. The year 2017 marked the start of the Trump administration, which heightened uncertainty over key policy issues such as tax reform, infrastructure investment, and trade policy. As shown in Figure 2, forward rate differentials began to drop in early 2017 and thus, weaker monetary tightening was expected in the US, leading to a stronger euro with a slight time lag.

5) The nominal equilibrium interest rate, reflected in the government bond yield curve, can be seen as the level of short-term rates that could be maintained when the economy enters a stable state after cyclical shocks disappeared (Kang & Baek, 2024). In this regard, this article estimates the average short-term interest rate over a five-year period, starting from five years from now.

6) As recently analyzed by the Congressional Budget Office (CBO, 2024), this reflects the expectation that the US economy will show higher growth compared to other major countries, driven by various factors such as increased immigration.

7) Former President Trump favored a weaker dollar and low interest rates during his tenure, and recently described the strong dollar against the yen as a disaster for the US manufacturing industry.

References

Berardi, A., 2023, Term premia and short-rate expectations in the euro area, Journal of Empirical Finance 74, 101424.

Bloomberg, 2024. 5. 4, Summers says currency interventions fail even at Japan’s scale.

Congressional Budget Office, 2024, The Budget and Economic Outlook: 2024 to 2034.

Joslin, S., Singleton, K.J., Zhu, H., 2011, A new perspective on Gaussian dynamic term structure models, Review of Financial Studies 24(3), 926–970.

[Korean]

Kang, H.J. & Baek, I.S., 2024, Assessment of the possibility of returning to low interest rates following a shift in monetary policy, Korea Capital Market Institute Issue Papers 24-07.