Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Korean Securities Firms’ Overseas Expansion into Asian Emerging Markets

Publication date Apr. 30, 2024

Summary

Korean securities firms have pursued a strategic shift in their overseas expansion since the 2010s. In the past, their ventures into global markets centered predominantly on developed market countries like the US, UK, and Hong Kong. Despite sustained efforts, however, they experienced limited success in these markets, largely due to the lack of competitive advantage beyond Korean Paper brokerage services. Building upon these experiences, Korean securities firms have redirected their focus towards Asian emerging markets since 2010, adopting a retail brokerage-centric business model.

The strategy of Korean securities firms venturing into Asian emerging markets has yielded some promising results. In Vietnam and Indonesia, where Korean securities firms are concentrated, local subsidiaries have gained significant market share and are ranked among the top 10 brokerages. However, despite increasing top-line growth in these markets, profitability of local subsidiaries still falls short of expectations. While some of the reasons for the lagging profitability are attributable to the rising cost of expanding business operations, it is also due in part to the slower-than-expected pace of capital market development in emerging Asia, including Vietnam and Indonesia. As a result, business in these markets poses substantial risks. Although Asian emerging markets hold high potential, it should be noted that successful overseas expansion into these countries requires a long-term vision and patience.

The strategy of Korean securities firms venturing into Asian emerging markets has yielded some promising results. In Vietnam and Indonesia, where Korean securities firms are concentrated, local subsidiaries have gained significant market share and are ranked among the top 10 brokerages. However, despite increasing top-line growth in these markets, profitability of local subsidiaries still falls short of expectations. While some of the reasons for the lagging profitability are attributable to the rising cost of expanding business operations, it is also due in part to the slower-than-expected pace of capital market development in emerging Asia, including Vietnam and Indonesia. As a result, business in these markets poses substantial risks. Although Asian emerging markets hold high potential, it should be noted that successful overseas expansion into these countries requires a long-term vision and patience.

Despite the long history of Korean securities firms’ overseas expansion, it has yet to yield sufficiently satisfactory results. Korean securities firms’ journey into foreign markets commenced in 1984 when Daewoo Securities, Daishin Securities, and Ssangyong Securities established offices in Tokyo and New York, marking over four decades of involvement. Over time, Korean securities firms have expanded their global footprint, primarily focusing on developed markets such as the US, UK, Hong Kong, and Singapore. As of 2010, 54% of the 93 total overseas operations, and 66% of their 56 local subsidiaries, managed by 20 Korean securities firms were located in developed markets. Despite this outward expansion, overseas endeavors have shown lackluster performance. In 2010, Korean securities firms collectively reported a net loss of $65 million from their overseas operations.1)

Since 2010, Korean securities firms have shifted their focus from developed markets to emerging markets, particularly within the Asian region. The main business model of overseas expansion has also shifted, which used to center on Korean Paper brokerage service, to focus on retail brokerage. Against this backdrop, this article explores the characteristics of Korean securities firms’ overseas expansion since 2010, highlighting performance to date along with challenges going forward.

Current landscape of overseas expansion by Korean securities firms

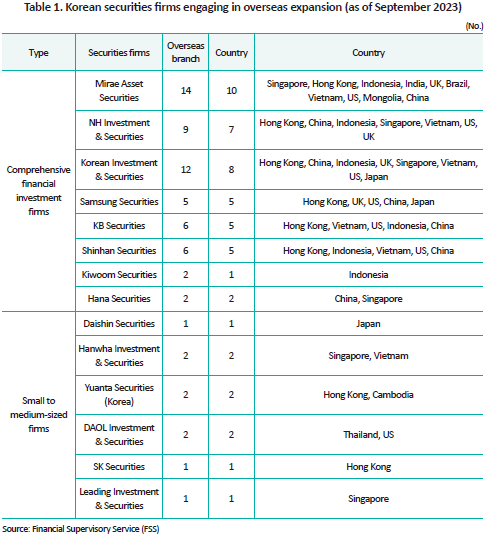

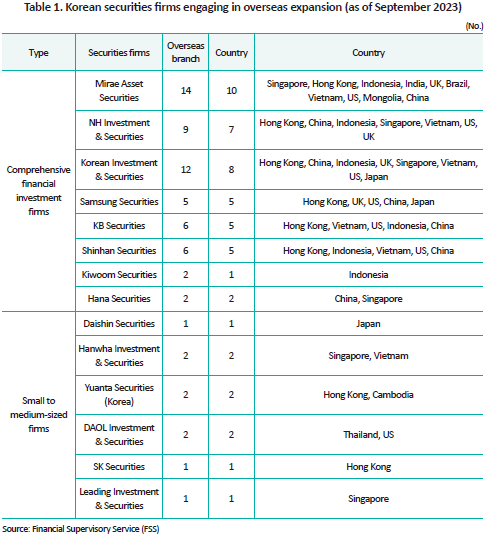

As of September 2023, of the 37 pure domestic Korean securities firms, 14 firms are participating in overseas expansion, meaning almost 40% are operating foreign operations—a significant representation. Their global presence is extensive, spanning a total of 65 overseas operations across 13 countries. In terms of business profiles, a wide range of securities firms have entered global markets, including 8 large firms (“Comprehensive Financial Investment Business Operator”) and 6 small to medium-sized firms. Given the substantial capital required for overseas expansion, the efforts of large firms in this regard are particularly pronounced. As of September 2023, on average, the 8 large firms are operating 7 overseas branches across 5.4 countries, ranging from developed to emerging markets. In contrast, the 6 small to medium firms have an average of 1.5 overseas branches in only 1.5 countries, predominantly concentrated in emerging markets in Asia.

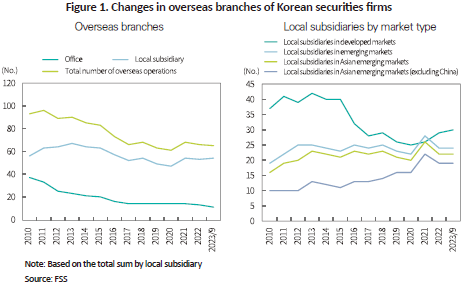

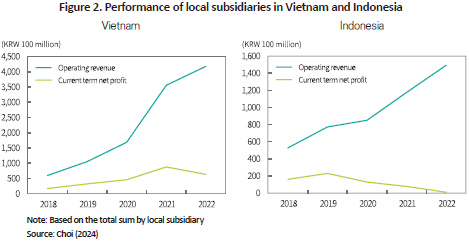

The number of overseas branches operated by Korean securities firms has experienced an overall decline. Figure 1 illustrates changes in their overseas branches from 2010 to September 2023. The number, which stood at 93 in 2010, steadily decreased to 65 in September 2023. This downward trend can be attributed to the deteriorating profitability of Korean securities firms, due to market slumps in the 2010s, prompting them to curtail overseas operations. In particular, reduction of overseas operations came from closure of foreign offices, which declined from 37 in 2010 to 11 in September 2023. Meanwhile, the number of local subsidiaries remained relatively stable, with 54 in September 2023 compared to 56 in 2010.2) However, a closer analysis reveals a major shift in the composition of local subsidiaries, marked by a decrease in subsidiaries in developed markets and an increase in subsidiaries in emerging markets since 2010.

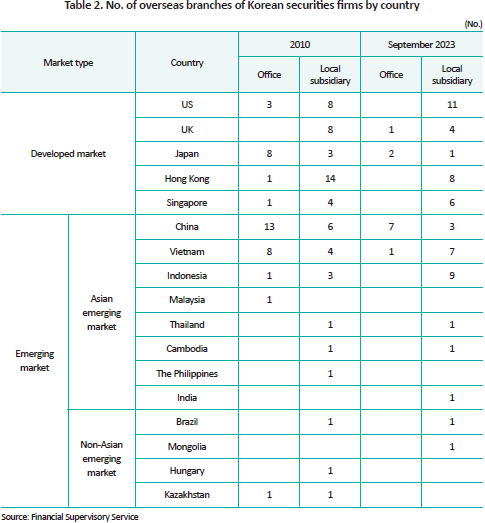

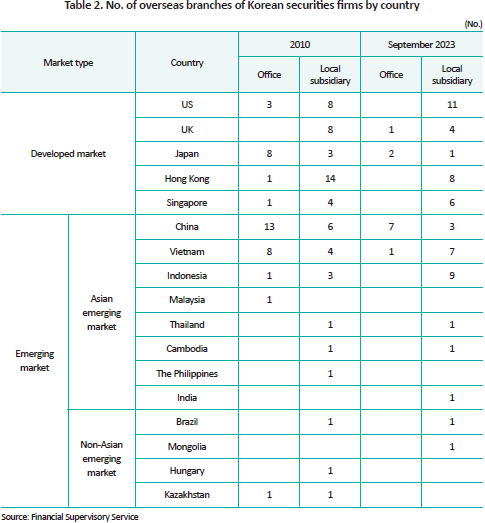

Table 2 shows the number of overseas offices and local subsidiaries operated by Korean securities firms by country as of 2010 and September 2023. In 2010, Korean securities firms maintained 8 local subsidiaries in the UK, along with 1 office and 14 local subsidiaries in Hong Kong. However, by September 2023, these numbers decreased to 4 local subsidiaries in the UK and 8 local subsidiaries in Hong Kong. In Japan, there were 8 offices and 3 local subsidiaries in 2010, yet by September 2023, only 2 offices and 1 local subsidiary survived. Meanwhile, in the US, the number of local subsidiaries rose from 8 in 2010 to 10 in September 2023, primarily due to the US’ pivotal role as the global financial hub and the growing demand from domestic investors to invest in US assets.3) In contrast, Korean securities firms significantly scaled down their operations in China. With high expectations for market liberalization following China’s entry into the World Trade Organization (WTO) in 2001, Korean securities firms rushed to establish offices and local subsidiaries in China. But the number of their offices in China, which reached 13 in 2010, was reduced to 9 in September 2023, with the local subsidiaries decreasing from 6 to 3. This decline stems from the slower-than-expected market liberalization in China and the subsequent closure of branches by many Korean securities firms.

Their expansion into Asian emerging markets, with the exception of China, witnessed sharp growth during the 2010s. The number of newly established local subsidiaries in emerging Asia, excluding China, nearly doubled to 19 by September 2023, from 10 in 2010. In the meantime, the number of offices located in Asian emerging markets, excluding China, declined from 10 in 2010 to 1 in September 2023, which is primarily attributed to the conversion of offices into local subsidiaries. The efforts of Korean securities firms are particularly concentrated in Vietnam and Indonesia. From 2010 to 2023, the number of local subsidiaries in Vietnam surged from 4 to 7, while in Indonesia, it increased from 3 to 9.

The growth of local subsidiaries in Asian emerging markets throughout the 2010s represents a strategic shift in the overseas expansion strategy of Korean securities firms. Historically, their global endeavors primarily focused on developed markets such as the US, UK, Japan, Hong Kong, and Singapore. The primary business model of Korean securities firms in developed markets was Korean Paper brokerage, targeting local institutional investors. However, the Korean Paper brokerage business failed to generate meaningful revenue due to limited investment demand and an increase in foreigners directly investing into the Korean market. Faced with severe competition from global financial institutions in developed markets, Korean securities firms recognized the imperative of securing a competitive edge. Drawing from these experiences, they have turned their attention to Asia and restructured their overseas business model to focus on retail brokerage. In Asian markets, Korean securities firms have sought to establish a strong presence by leveraging their retail brokerage competence, particularly in the field of mobile trading systems (MTS).

Local subsidiaries established by Korean securities firms are predominantly located in Vietnam and Indonesia, among other Asian countries, owing to the allure of the two markets in terms of economic growth, stock market development, demand from retail investors, and mobile penetration. While some Korean securities firms have also ventured into Malaysia, the Philippines, Thailand, and Cambodia, these markets remain largely bank-centric and have yet to fully develop their capital markets or transition from savings to investment.

Performance of overseas expansion into Asian emerging markets

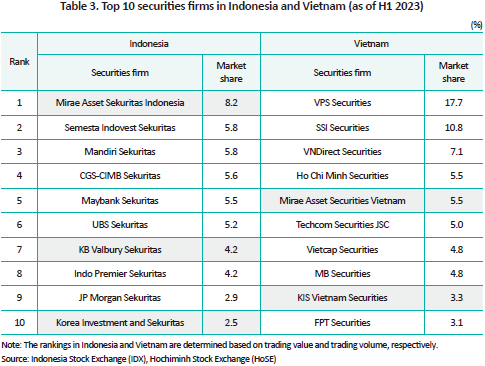

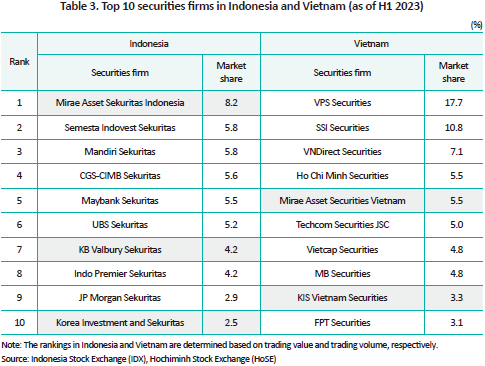

The strategy of Korean securities firms to expand into emerging markets in Asia has yielded visible results. Notably, many of those that have entered the Vietnamese and Indonesian markets have achieved significant shares in the retail brokerage sector. Table 3 shows the top 10 securities firms operating in these two Asian markets as of 2023. In Indonesia, Mirae Asset Sekuritas Indonesia, KB Valbury Sekuritas, and Korea Investment and Sekuritas, local subsidiaries of three major Korean securities firms (Mirae Asset Securities, KB Securities, Korean Investment & Securities), rank 1st, 7th, and 10th, respectively, in terms of the number of shares traded. In Vietnam, Mirae Asset Securities Vietnam and KIS Vietnam Securities hold the 5th and 9th positions, respectively, in terms of trading volume.

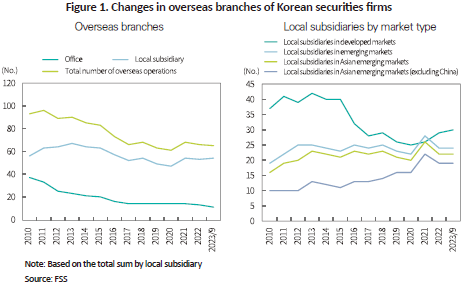

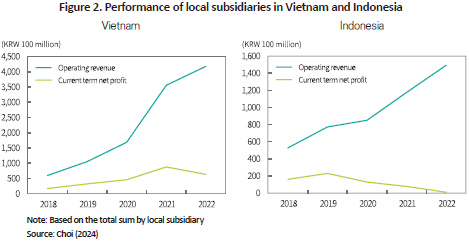

However, the operation of Korean securities firms in Vietnam and Indonesia is not without challenges. Figure 2 illustrates the trends in financial performance of 7 local subsidiaries in Vietnam and 9 local subsidiaries in Indonesia. In terms of top-line growth, from 2018 to 2022, the operating revenue earned by local subsidiaries of Korean securities firms increased sevenfold from KRW 59.8 billion to KRW 417.4 billion in Vietnam, while their Indonesian counterparts saw a 2.8-fold increase in operation revenue from KRW 52.8 billion to KRW 149.2 billion. However, bottom-line growth has not been as rosy. Between 2018 to 2018, net profits of Korean securities firms' local subsidiaries increased only 3.8 times in Vietnam, while declining to 0.1 times in Indonesia.

The relatively lower profitability in Vietnam, and especially in Indonesia, despite impressive top-line growth, can be partly attributed to increasing operational costs related to staff additions and branch expansion. However, another important contributing factor is the slower-than-expected pace of capital market development of Asia’s emerging countries, including Vietnam and Indonesia. In particular, these markets have much more room for improvement in areas such as corporate governance, disclosure transparency, and credit rating reliability. This is especially critical, as a substantial part of Korean securities firms' local subsidiary revenues is based on the margin-lending business. The risks associated with margin lending in a less transparent market, along with underdevelopment of derivatives markets that limit risk hedging, poses significant dangers to doing business in these markets.

Challenges for overseas expansion into emerging Asia

In the past decade, Korean securities firms have redirected their overseas expansion focus from developed to emerging markets, particularly in Asia. Unlike their previous ventures into developed markets, which lacked a competitive advantage, Korean securities firms are now leveraging their expertise in retail brokerage to penetrate emerging markets in Asia. Many Korean securities firms have secured substantial market share in Vietnam and Indonesia. And they are positioned competitively versus local rivals in terms of scale and size as well. It is also the strategy of Korean securities firms to leverage the customer base, networks and market information gained through retail brokerage to expand into other business areas such as investment banking and trading. However, implementing such a strategy is not without its own challenges.

While countries like Vietnam and Indonesia boast high economic growth rates, their capital markets have not advanced as rapidly as anticipated by Korean securities firms. As a result, Korean securities firms must undertake some restructuring of their overseas operations in these markets. In the short term, they should prioritize reinforcing their presence in retail brokerage, which includes efforts to enhance risk management systems. On the other hand, the hoped-for expansion of business scope may require more time, in pace with the advancement of local capital markets, and may need to be approached from a more medium to long term perspective. To succeed in emerging Asia, what is most required is a long-term vision and patience.

1) Financial Supervisory Service (July 13, 2011).

2) For convenience, this paper collectively refers to both branches and local subsidiaries as local subsidiaries.

3) Choi (2024)

References

Financial Supervisory Service, July 14, 2011, Operating performance of overseas branches of Korean securities firms in FY 2010, press release.

Choi, S.Y., 2024, Enhancing competitiveness in the securities industry (3): Current state and challenges of overseas expansion by Korean securities firms, Korea Capital Market Institute Issue Paper 24-04.

Since 2010, Korean securities firms have shifted their focus from developed markets to emerging markets, particularly within the Asian region. The main business model of overseas expansion has also shifted, which used to center on Korean Paper brokerage service, to focus on retail brokerage. Against this backdrop, this article explores the characteristics of Korean securities firms’ overseas expansion since 2010, highlighting performance to date along with challenges going forward.

Current landscape of overseas expansion by Korean securities firms

As of September 2023, of the 37 pure domestic Korean securities firms, 14 firms are participating in overseas expansion, meaning almost 40% are operating foreign operations—a significant representation. Their global presence is extensive, spanning a total of 65 overseas operations across 13 countries. In terms of business profiles, a wide range of securities firms have entered global markets, including 8 large firms (“Comprehensive Financial Investment Business Operator”) and 6 small to medium-sized firms. Given the substantial capital required for overseas expansion, the efforts of large firms in this regard are particularly pronounced. As of September 2023, on average, the 8 large firms are operating 7 overseas branches across 5.4 countries, ranging from developed to emerging markets. In contrast, the 6 small to medium firms have an average of 1.5 overseas branches in only 1.5 countries, predominantly concentrated in emerging markets in Asia.

The number of overseas branches operated by Korean securities firms has experienced an overall decline. Figure 1 illustrates changes in their overseas branches from 2010 to September 2023. The number, which stood at 93 in 2010, steadily decreased to 65 in September 2023. This downward trend can be attributed to the deteriorating profitability of Korean securities firms, due to market slumps in the 2010s, prompting them to curtail overseas operations. In particular, reduction of overseas operations came from closure of foreign offices, which declined from 37 in 2010 to 11 in September 2023. Meanwhile, the number of local subsidiaries remained relatively stable, with 54 in September 2023 compared to 56 in 2010.2) However, a closer analysis reveals a major shift in the composition of local subsidiaries, marked by a decrease in subsidiaries in developed markets and an increase in subsidiaries in emerging markets since 2010.

Table 2 shows the number of overseas offices and local subsidiaries operated by Korean securities firms by country as of 2010 and September 2023. In 2010, Korean securities firms maintained 8 local subsidiaries in the UK, along with 1 office and 14 local subsidiaries in Hong Kong. However, by September 2023, these numbers decreased to 4 local subsidiaries in the UK and 8 local subsidiaries in Hong Kong. In Japan, there were 8 offices and 3 local subsidiaries in 2010, yet by September 2023, only 2 offices and 1 local subsidiary survived. Meanwhile, in the US, the number of local subsidiaries rose from 8 in 2010 to 10 in September 2023, primarily due to the US’ pivotal role as the global financial hub and the growing demand from domestic investors to invest in US assets.3) In contrast, Korean securities firms significantly scaled down their operations in China. With high expectations for market liberalization following China’s entry into the World Trade Organization (WTO) in 2001, Korean securities firms rushed to establish offices and local subsidiaries in China. But the number of their offices in China, which reached 13 in 2010, was reduced to 9 in September 2023, with the local subsidiaries decreasing from 6 to 3. This decline stems from the slower-than-expected market liberalization in China and the subsequent closure of branches by many Korean securities firms.

Their expansion into Asian emerging markets, with the exception of China, witnessed sharp growth during the 2010s. The number of newly established local subsidiaries in emerging Asia, excluding China, nearly doubled to 19 by September 2023, from 10 in 2010. In the meantime, the number of offices located in Asian emerging markets, excluding China, declined from 10 in 2010 to 1 in September 2023, which is primarily attributed to the conversion of offices into local subsidiaries. The efforts of Korean securities firms are particularly concentrated in Vietnam and Indonesia. From 2010 to 2023, the number of local subsidiaries in Vietnam surged from 4 to 7, while in Indonesia, it increased from 3 to 9.

The growth of local subsidiaries in Asian emerging markets throughout the 2010s represents a strategic shift in the overseas expansion strategy of Korean securities firms. Historically, their global endeavors primarily focused on developed markets such as the US, UK, Japan, Hong Kong, and Singapore. The primary business model of Korean securities firms in developed markets was Korean Paper brokerage, targeting local institutional investors. However, the Korean Paper brokerage business failed to generate meaningful revenue due to limited investment demand and an increase in foreigners directly investing into the Korean market. Faced with severe competition from global financial institutions in developed markets, Korean securities firms recognized the imperative of securing a competitive edge. Drawing from these experiences, they have turned their attention to Asia and restructured their overseas business model to focus on retail brokerage. In Asian markets, Korean securities firms have sought to establish a strong presence by leveraging their retail brokerage competence, particularly in the field of mobile trading systems (MTS).

Local subsidiaries established by Korean securities firms are predominantly located in Vietnam and Indonesia, among other Asian countries, owing to the allure of the two markets in terms of economic growth, stock market development, demand from retail investors, and mobile penetration. While some Korean securities firms have also ventured into Malaysia, the Philippines, Thailand, and Cambodia, these markets remain largely bank-centric and have yet to fully develop their capital markets or transition from savings to investment.

Performance of overseas expansion into Asian emerging markets

The strategy of Korean securities firms to expand into emerging markets in Asia has yielded visible results. Notably, many of those that have entered the Vietnamese and Indonesian markets have achieved significant shares in the retail brokerage sector. Table 3 shows the top 10 securities firms operating in these two Asian markets as of 2023. In Indonesia, Mirae Asset Sekuritas Indonesia, KB Valbury Sekuritas, and Korea Investment and Sekuritas, local subsidiaries of three major Korean securities firms (Mirae Asset Securities, KB Securities, Korean Investment & Securities), rank 1st, 7th, and 10th, respectively, in terms of the number of shares traded. In Vietnam, Mirae Asset Securities Vietnam and KIS Vietnam Securities hold the 5th and 9th positions, respectively, in terms of trading volume.

However, the operation of Korean securities firms in Vietnam and Indonesia is not without challenges. Figure 2 illustrates the trends in financial performance of 7 local subsidiaries in Vietnam and 9 local subsidiaries in Indonesia. In terms of top-line growth, from 2018 to 2022, the operating revenue earned by local subsidiaries of Korean securities firms increased sevenfold from KRW 59.8 billion to KRW 417.4 billion in Vietnam, while their Indonesian counterparts saw a 2.8-fold increase in operation revenue from KRW 52.8 billion to KRW 149.2 billion. However, bottom-line growth has not been as rosy. Between 2018 to 2018, net profits of Korean securities firms' local subsidiaries increased only 3.8 times in Vietnam, while declining to 0.1 times in Indonesia.

The relatively lower profitability in Vietnam, and especially in Indonesia, despite impressive top-line growth, can be partly attributed to increasing operational costs related to staff additions and branch expansion. However, another important contributing factor is the slower-than-expected pace of capital market development of Asia’s emerging countries, including Vietnam and Indonesia. In particular, these markets have much more room for improvement in areas such as corporate governance, disclosure transparency, and credit rating reliability. This is especially critical, as a substantial part of Korean securities firms' local subsidiary revenues is based on the margin-lending business. The risks associated with margin lending in a less transparent market, along with underdevelopment of derivatives markets that limit risk hedging, poses significant dangers to doing business in these markets.

Challenges for overseas expansion into emerging Asia

In the past decade, Korean securities firms have redirected their overseas expansion focus from developed to emerging markets, particularly in Asia. Unlike their previous ventures into developed markets, which lacked a competitive advantage, Korean securities firms are now leveraging their expertise in retail brokerage to penetrate emerging markets in Asia. Many Korean securities firms have secured substantial market share in Vietnam and Indonesia. And they are positioned competitively versus local rivals in terms of scale and size as well. It is also the strategy of Korean securities firms to leverage the customer base, networks and market information gained through retail brokerage to expand into other business areas such as investment banking and trading. However, implementing such a strategy is not without its own challenges.

While countries like Vietnam and Indonesia boast high economic growth rates, their capital markets have not advanced as rapidly as anticipated by Korean securities firms. As a result, Korean securities firms must undertake some restructuring of their overseas operations in these markets. In the short term, they should prioritize reinforcing their presence in retail brokerage, which includes efforts to enhance risk management systems. On the other hand, the hoped-for expansion of business scope may require more time, in pace with the advancement of local capital markets, and may need to be approached from a more medium to long term perspective. To succeed in emerging Asia, what is most required is a long-term vision and patience.

1) Financial Supervisory Service (July 13, 2011).

2) For convenience, this paper collectively refers to both branches and local subsidiaries as local subsidiaries.

3) Choi (2024)

References

Financial Supervisory Service, July 14, 2011, Operating performance of overseas branches of Korean securities firms in FY 2010, press release.

Choi, S.Y., 2024, Enhancing competitiveness in the securities industry (3): Current state and challenges of overseas expansion by Korean securities firms, Korea Capital Market Institute Issue Paper 24-04.